Key points

- Aging infrastructure, unrealized plans, and high costs continue to limit nuclear’s role in swift decarbonization, while solar and wind power are expanding rapidly and outpacing nuclear in new capacity and generation.

- Nearly 40% of all nuclear power ever proposed has been cancelled: 566 gigawatts (GW) of nuclear capacity has been cancelled worldwide, more than what is currently operational (401 GW) or retired (116 GW) combined.

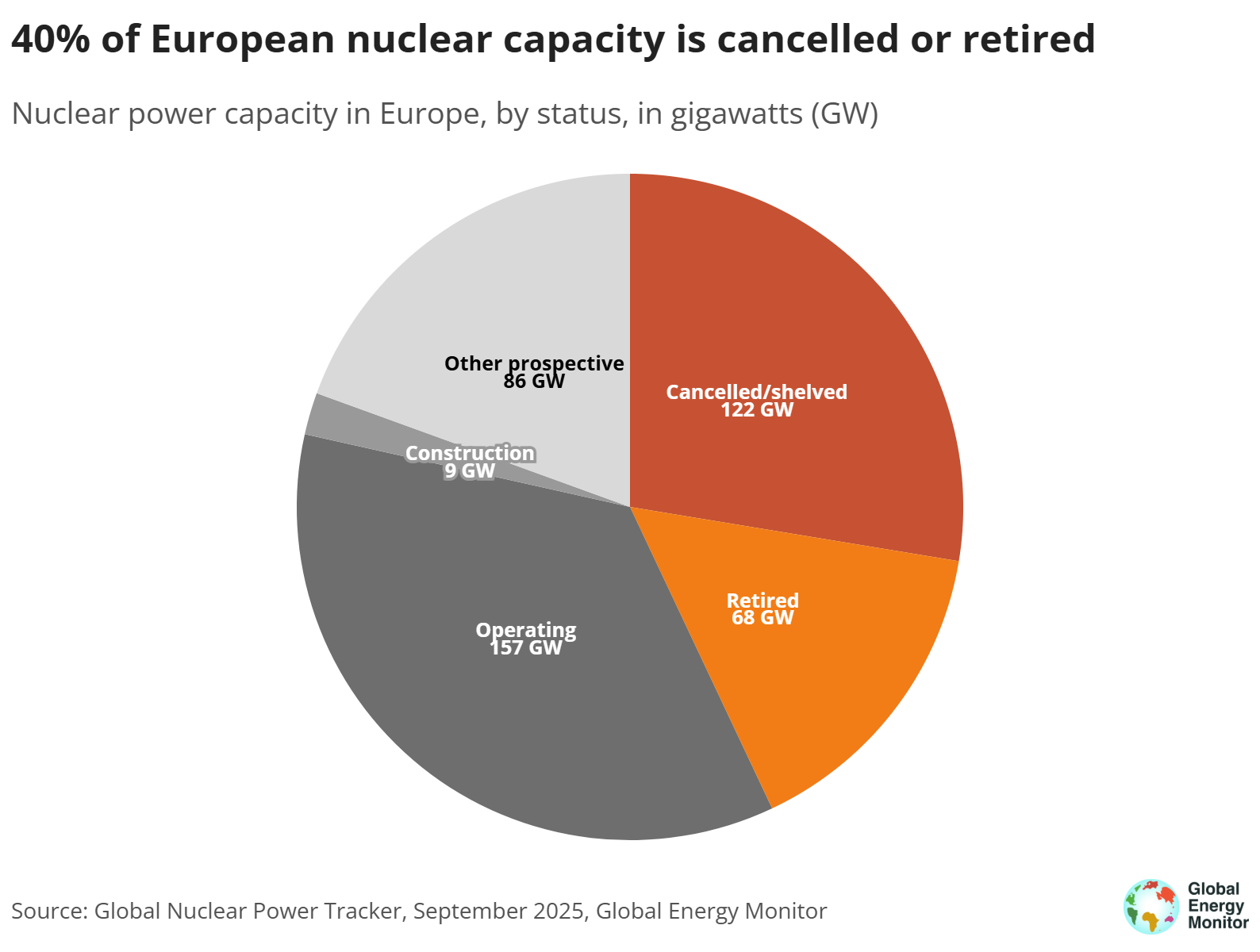

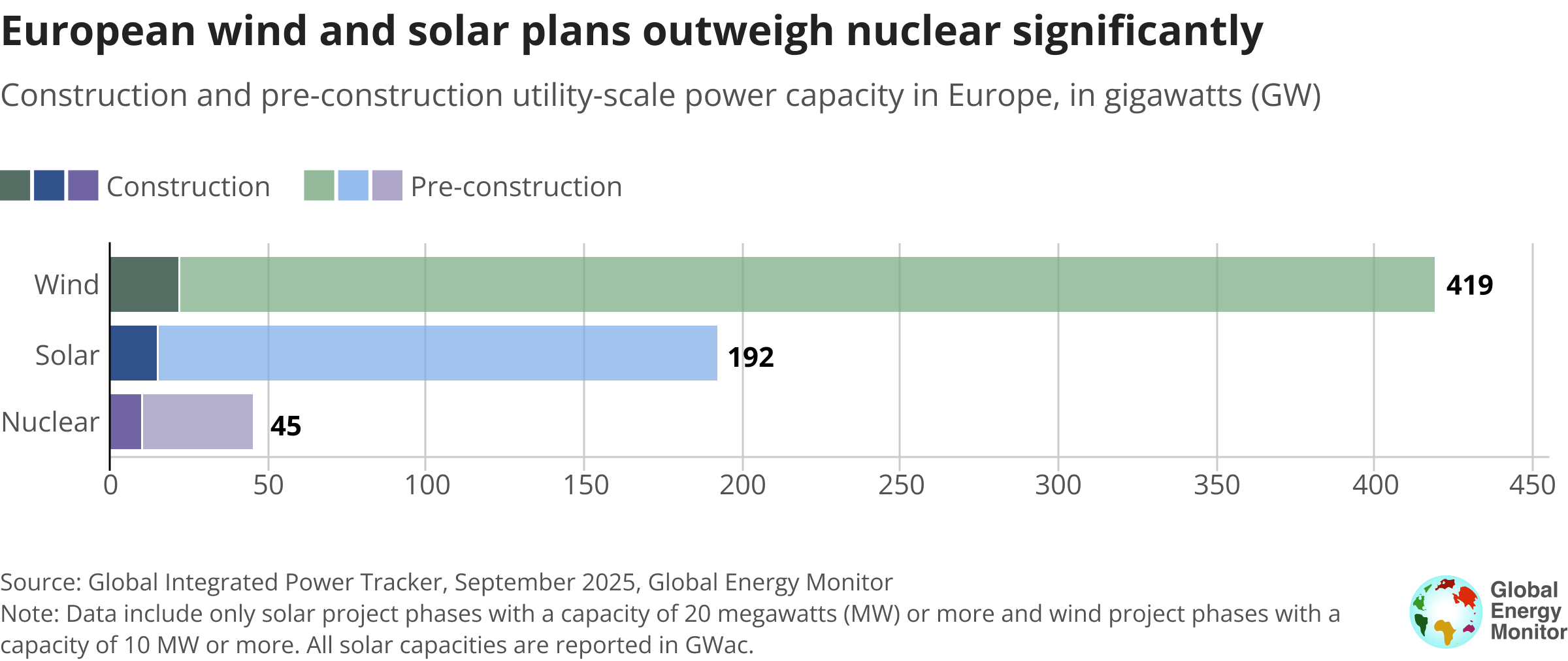

- Europe’s nuclear sector has lost 122 GW of planned capacity to cancellations, more than the operating nuclear fleet of any single country worldwide. An additional 68 GW has been retired, and 90% of the remaining reactors are more than 35 years old. In contrast, European wind and utility-scale solar capacity under construction or in pre-construction outweighs nuclear by a factor of more than 13 to 1.

- Australia’s moratorium on nuclear, lengthy projected development timelines, high costs, lack of expertise, and strong public and policy preference for renewables mean nuclear is unlikely to play a significant role in filling the gap left by the country’s planned coal phaseout by 2038.

Limiting warming to 1.5°C is the internationally recognized target of the Paris Agreement, as reaffirmed at recent UN climate summits. However, scientific assessments indicate that this threshold is likely to be surpassed within the next three years, underscoring the urgent need for rapid decarbonization. In this context, the approaching target breach is driving a broad shift away from fossil fuels, and nuclear energy has been reassessed as a potential low-carbon power option. Nuclear power, although not classified as renewable, has seen increased policy support and investment in recent years. COP28 and COP29 formally recognized its potential role, and 31 countries pledged to triple global nuclear capacity by 2050.

The comprehensive, citation-based data in GEM’s Global Nuclear Power Tracker (GNPT) monitors not only operational nuclear plants but also uniquely maps the full development pipeline, including cancelled projects. Often overlooked in other datasets, nuclear project cancellations account for 38% of all capacity ever proposed — about 566 GW, equivalent to nearly 120% of India’s entire power generation capacity from all sources. This briefing focuses on Europe, where nuclear infrastructure is extensive but aging, and Australia, where nuclear power has been discussed, but not yet deployed. In both jurisdictions, the GNPT indicates that new nuclear deployment is not a viable approach to meet climate targets.

Europe: wind and solar plans outpacing nuclear fourteen to one

Nuclear energy’s role in European decarbonization is limited by aging infrastructure, extended construction timelines, escalating costs, and strong competition from renewables. Of all nuclear capacity ever planned for Europe, two-fifths of it has either been cancelled (25%) or retired (15%), while only 2% is currently under construction. European cancellations alone total 112 GW of capacity, exceeding the operating nuclear capacity of any single country worldwide. GNPT data reveal that nuclear projects consistently face high risks of delay, cost overruns, and abandonment. For example, unit 3 of Finland's Olkiluoto project required 17 years to complete, while unit 4 was cancelled in 2015. Most projects now under development are not expected to begin operation until the next decade, negating their potential contribution to the 1.5°C climate target. In contrast, solar and wind power have already demonstrated rapid scalable deployment and measurable emissions reductions, offering near-term climate benefits.

Figure 1

GEM's GNPT shows that as of September 2025, Europe operates 157 gigawatts (GW) of nuclear capacity, over 90% of which comes from reactors more than 35 years old. Retirements are steadily reducing total operating capacity. In France, the continent’s largest nuclear operator, generation has declined due to maintenance challenges and unplanned outages, including a record heatwave in July 2025 that disrupted reactor cooling. Compared to 2005, French nuclear output was 16% lower in 2024, even after the addition of its first new unit in nearly two decades. EU-wide, nuclear’s share of electricity generation fell from 25% in 2005 to under 20% in 2024. Of the 9.3 GW of new European nuclear capacity under construction, GEM data show that most is intended to replace retiring units rather than expand total capacity.

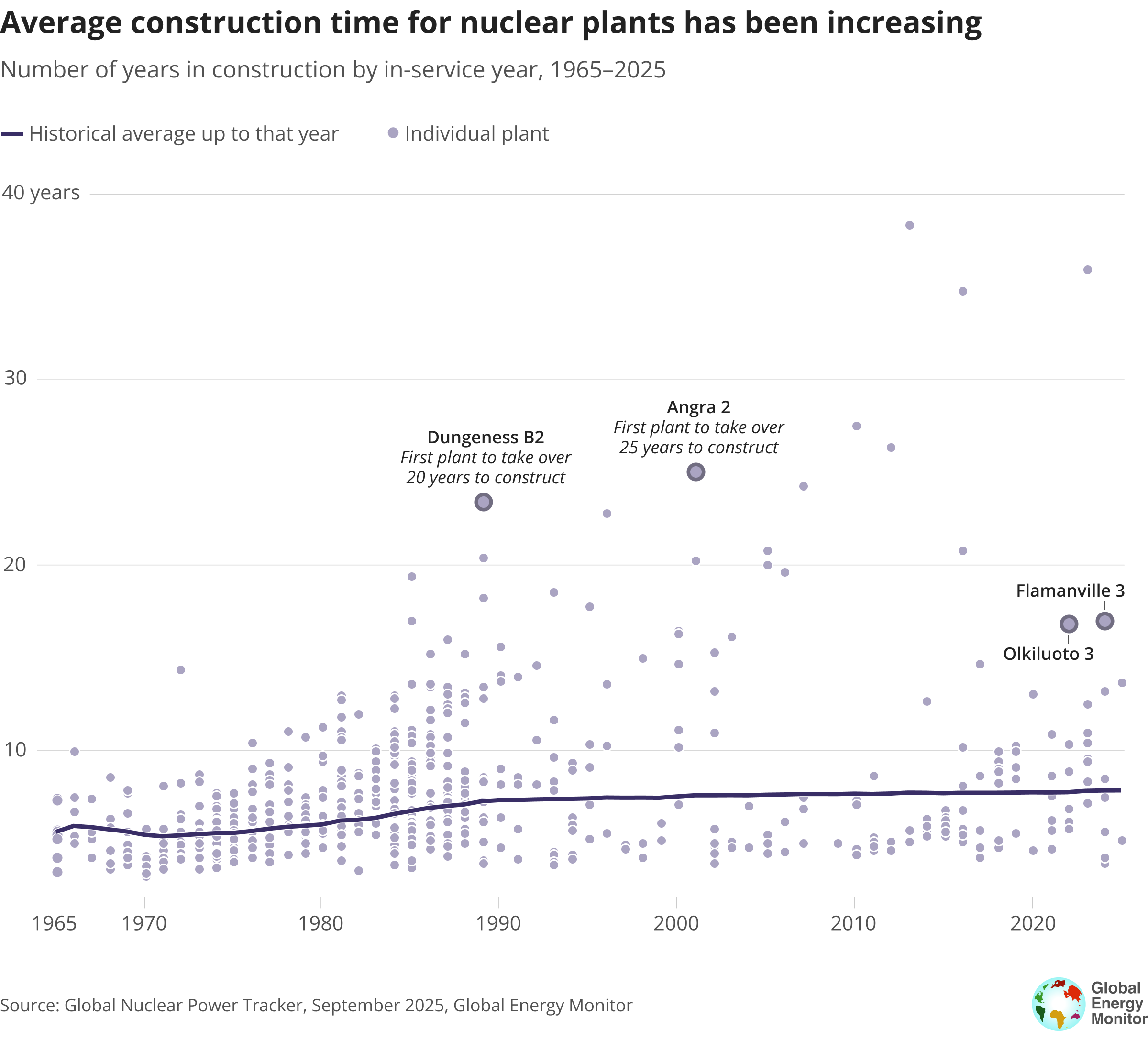

Recent European reactor projects such as Finland’s Olkiluoto 3, France's Flamanville 3, and the UK's Hinkley Point C have experienced delays exceeding ten years and steep cost overruns. All employ the European Pressurized Reactor (EPR) design, whose first-of-a-kind complexity and lack of standardized construction methods have led to inefficient implementation. Efforts to develop SMRs are underway in multiple European countries including the UK and France, but no commercial SMRs are yet in operation and first deployments are unlikely before the early 2030s due to regulatory, cost, and public acceptance barriers.

In contrast, renewable deployment continues at scale. GEM’s Global Integrated Power Tracker indicates that over 600 GW of wind and utility-scale solar capacity is in pre-construction or construction across Europe, which together is over fourteen times that of nuclear. Even when accounting for the higher capacity factors of nuclear generation, planned wind and solar additions are expected to provide a substantially greater contribution to decarbonization. Much of this renewable capacity is expected to be operational well before new nuclear projects, due to renewable project lead times typically ranging from one to four years, compared to a decade or more for nuclear. Within the EU specifically, in mid-2025, total solar generation (22.1%) has already surpassed nuclear (21.8%) for the first time. Battery storage, driven by declining costs, is on track to expand from 22 GWh in 2024 to about 120 GWh by 2029, supporting deeper renewables integration. At the same time, pumped-storage hydropower remains a cornerstone of large-scale energy storage capacity.

Figure 2

Australia’s coal phaseout by 2038 makes nuclear timeline infeasible

Australia is another major economy where nuclear power is unlikely to contribute to emissions reduction goals in the next one to two decades despite recent calls by some political stakeholders to revisit nuclear plans. The country’s longstanding moratorium on nuclear energy, reflected in GEM’s GNPT as a total absence of operational or prospective facilities, underscores nuclear’s limited potential as a near-term decarbonization option, especially when contrasted with the country’s robust expansion of wind and solar capacity.

Australia plans to retire its entire coal-fired power fleet — which currently supplies around half of the country’s electricity — by 2038. This transition will necessitate the deployment of fast, reliable, and cost-effective replacement energy sources within the next thirteen years. GEM data show that new nuclear reactors have historically averaged just under eight years from the start of construction to completion since the mid-1960s, excluding pre-construction periods and cancelled projects. The Commonwealth Scientific and Industrial Research Organisation (CSIRO) estimates that construction timelines for nuclear plants in Australia are likely to be at least five years longer than the global average, resulting in an expected construction period of approximately thirteen years from groundbreaking to commissioning.

Figure 3

To achieve operational status by 2038, new nuclear projects would therefore need to begin construction before the end of this year. When factoring in the extensive pre-construction phases, which often span multiple years, the feasibility of introducing new nuclear capacity in Australia within the required timeframe to replace retiring coal-fired power plants becomes extremely unlikely.

Nuclear also remains one of the highest-cost forms of electricity generation per megawatt-hour, with delays and cancellations often transferring financial risk to taxpayers. Compounding these problems are Australia’s lack of a nuclear-trained workforce and absence of regulatory frameworks for safe and timely project delivery. Public sentiment and policy further challenge nuclear’s prospects. Most Australians supportmaintaining the current moratorium, as reaffirmed in recent parliamentary inquiries, and national energy policy prioritizes wind, solar, and storage. In the last ten years, Australia has added over 21 GW of new wind and utility-scale solar capacity, and the government target of 43% emissions reduction by 2030 is widely considered achievable through sustained deployment of wind, solar, and storage, which remain less expensive and faster to scale than nuclear.

Conclusion

The high costs and long timelines of new nuclear power plants severely limit any impact on near-term decarbonization goals. Wind and solar are achieving rapid scale and greater cost-effectiveness, making them central to immediate emissions reductions required for the 1.5°C pathway. SMRs remain commercially unproven, and current risks and deployment rates for nuclear overall are insufficient for 2030 climate targets. Robust decarbonization and successful action toward reaching emissions reductions will require technology-neutral, system-level planning, including a realistic evaluation of nuclear’s proposed role.

About the Global Nuclear Power Tracker

The Global Nuclear Power Tracker (GNPT) is a worldwide dataset of nuclear power facilities. The GNPT catalogs every nuclear power plant unit of any capacity and of any status, including operating, announced, pre-construction, under construction, shelved, cancelled, mothballed, or retired.

Media Contact

Joe Bernardi

Project Manager, Global Nuclear Power Tracker