In 2024, newly-opened coal mines added a total of 105 million tonnes per annum (Mtpa) of production capacity to the global coal mining industry — a 46% decline from 2023 (193 Mtpa) and the smallest production capacity increase in a decade. This decline suggests that it is indeed possible to rein in coal expansion. Yet, while the rollout of new coal operations has recently slowed, this decline still falls short of what is necessary to align with the Paris Agreement and the International Energy Agency’s (IEA) Net Zero scenario. Aligning with these climate and emissions reduction models requires not only a slowdown, but a complete halt to new coal development.

Despite this reality, an estimated 2,270 Mtpa of new coal mining capacity remains under development. If brought online, this capacity, which represents a quarter of 2024 global production (8,770 Mtpa), could emit an estimated 15.7 million tonnes of methane per year, or around 1.3 billion tonnes of carbon dioxide equivalent (CO₂e) using a 20-year Global Warming Potential (GWP). This would surpass the total annual greenhouse gas emissions of Japan, one of the world’s top ten emitters, which stood at 1.18 billion tonnes in 2022.

Based on Global Energy Monitor’s (GEM) global survey of active coal mine proposals, key 2024 trends in new coal mine planning include:

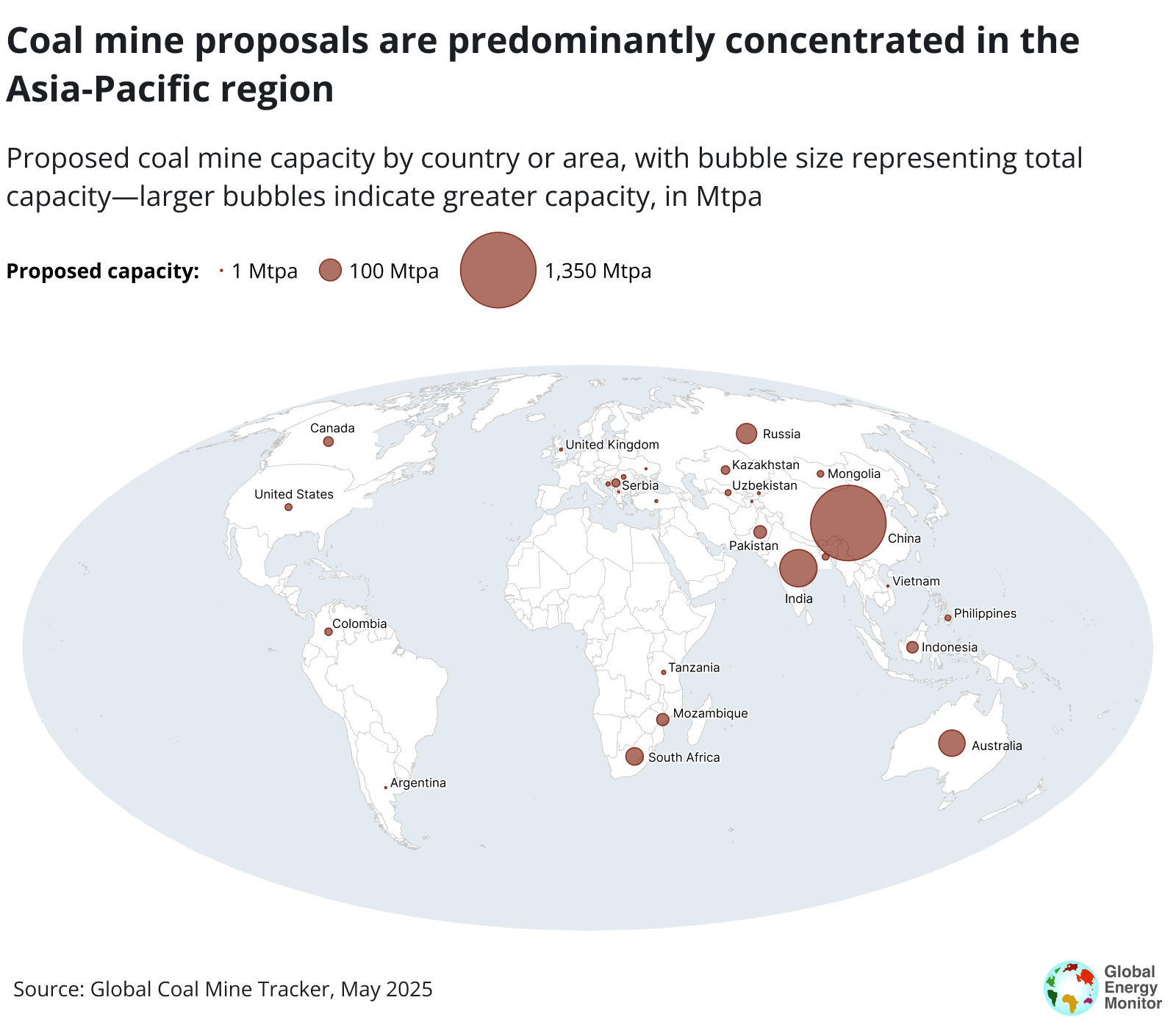

- Over 850 new mine plans, mine expansions, and mine extension projects1 are currently announced or under development worldwide, amounting to 2,270 Mtpa of new capacity. Nearly half of this amount (1,113 Mtpa) is in the early stages of planning and is therefore vulnerable to cancellation. 744 Mtpa is already under construction or in test operation,2 while the remaining 414 Mtpa has been approved.

- China, India, Australia, and Russia comprise nearly 90% (1,942 Mtpa) of all proposed mine developments. China alone has 1,350 Mtpa in development — more than all other countries combined.

- In 2024, China saw relatively low levels of both newly-approved coal capacity (57 Mtpa) and new operational capacity coming online (87 Mtpa). However, China still has 1,350 Mtpa of proposed coal capacity at various stages of development. Of this amount, 39% is already under construction or in test operation, 14% has been approved, and the remaining 47% is in early planning, awaiting approval.

- Thermal coal operation plans still dominate, accounting for 75% (1,690 Mtpa) of global proposed mine capacity. However, the opposite is true when zooming in to North America, where metallurgical coal for steelmaking accounts for over 70% of proposed capacity.

- Three-quarters of mine proposals are “greenfield” developments (1,696 Mtpa), signaling the coal industry’s willingness to break ground on new mines that tend to lock in more long-term production. New mines also lock in more future emissions than existing “brownfield” mines, as well as a higher risk of stranded assets.

- If fully developed, proposed coal mines would emit an estimated 15.7 million tonnes (Mt) of methane annually. Of this, 744 Mtpa of late-stage projects already under construction and in test operation would account for 6 Mt of methane emissions that are effectively locked in. Without strong mitigation measures, proposed coal mining capacity would keep methane emissions well above net-zero targets.

- Underground mines account for half of all proposed capacity (1,153 Mtpa), but nearly 80% of projected methane emissions. Proposed underground mines are expected to emit 13 Mt/yr, compared to 2.6 Mt/yr from surface mines.

Global overview

Although the rapid expansion of renewable energy over the past decade has helped reduce coal dependence in some countries, it has not kept pace with the surging electricity demand in several major coal-producing nations, such as China, India, and Indonesia, especially in the post-COVID-19 years when global coal production reached record highs.

During the power shortages of 2021, coal became the immediate fallback solution due to its ease of extraction and stockpiling. This also contributed to the rebound in coal mine operations that year, following two years of slowdown largely triggered by pandemic-related lockdowns and temporary mine closures.

However, in 2024, the amount of production capacity that came online at newly-operating mines hit its lowest level since at least 2015, the year the Paris Agreement was adopted. The 105 Mtpa of added production capacity was over 100 Mtpa below the annual average (206.5 Mtpa) for the 2015 to 2024 period. This decline is largely attributed to top coal-producing countries India and China, however, it doesn’t necessarily signal a sustained downward trend in both countries’ coal expansion plans. Rather, the slowdown likely reflects delays in expansion approvals, the inherently lengthy nature of coal mine development phases, and a potential easing of supply-demand pressure following the pandemic-fueled surge in capacity additions over the previous two years.

Figure 1

Given the substantial amount of proposed capacity still under development, the current downward trend may be at risk of reversing in the coming year.

According to GEM’s latest coal mine data, global coal production capacity has reached at least 8.9 billion tonnes, sufficient to support the record-high output of 8.77 billion tonnes in 2024. Nevertheless, at least 2,270 Mtpa of additional coal mining capacity remains under various stages of development, with a strong focus on the Asia-Pacific region. Developers are pursuing 850 new mines, mine expansions, and mine recommission projects across 30 countries. In addition, 35 mine extension projects are also under consideration.

Figure 2

Nearly 90% of this proposed capacity is located within just a few countries. China leads by a wide margin, accounting for 1,350 Mtpa of proposed capacity, with most projects concentrated in the country’s north and northwest. India follows with 329 Mtpa, nearly half of which is being developed by state-owned Coal India. Australia ranks third with 165 Mtpa, while Russia and South Africa also host significant developments, at approximately 98 Mtpa and 73 Mtpa, respectively.

Map 1

Figure 3

North America has 45 coal mine projects in development, totaling 32 Mtpa, with Canada accounting for two-thirds of this amount, and the U.S. for the remaining one third (11 Mtpa). In the U.S., the current administration’s promotion of so-called “beautiful, clean coal" adds uncertainty to the region’s trajectory toward phasing out coal in the coming years.

Europe has 28 Mtpa of proposed coal mining capacity, with most new coal developments (26 Mtpa) concentrated in Central and Eastern Europe, particularly in non-EU countries like Serbia and Bosnia-Herzegovina.

Indonesia leads Southeast Asia’s coal expansion with 31 Mtpa of new capacity under development, driven by rising domestic demand and thermal coal exports. In South Asia, Pakistan and Bangladesh are advancing coal projects tied to power generation. Beyond Asia, coal development is modest in Central Asia and Latin America, with Kazakhstan leading in Central Asia and Colombia home to all active coal projects in Latin America.

Among the proposed projects, approximately three-fourths — representing around 1,696 Mtpa of capacity — are “greenfield” or brand new developments. This highlights the coal industry's continued push to open new mines. Once developed, greenfield projects tend to lock in long-term future emissions, with an average reported mine life of approximately 54 years longer than that of brownfield projects (31 years), according to GEM’s latest coal mine data. These new developments also carry a higher risk of becoming stranded assets if coal demand declines or prices fall, potentially rendering them uneconomical and leading to idling or abandonment.

Country / Regional analysis

China

As of April 2025, China maintained a total of 1,350 Mtpa of proposed coal mine projects (including expansions), accounting for 60% of the global proposed capacity. This amount surpasses the combined operating coal capacity of Indonesia and Australia, the world’s third- and fourth-largest coal producers.

Over one-third (39%) of China’s proposed capacity is already under construction or in test operation, while 14% has been approved, and nearly half (47%) remains in the early stages of planning or development.

Proposed projects are primarily concentrated in five provinces and autonomous regions — Inner Mongolia, Shaanxi, Xinjiang, Guizhou, and Shanxi — accounting for 89% of the total proposed capacity. Inner Mongolia stands out as the leading province in proposed coal mine development, with approximately 41% of its total project capacity already under construction or in test operation.

Figure 4

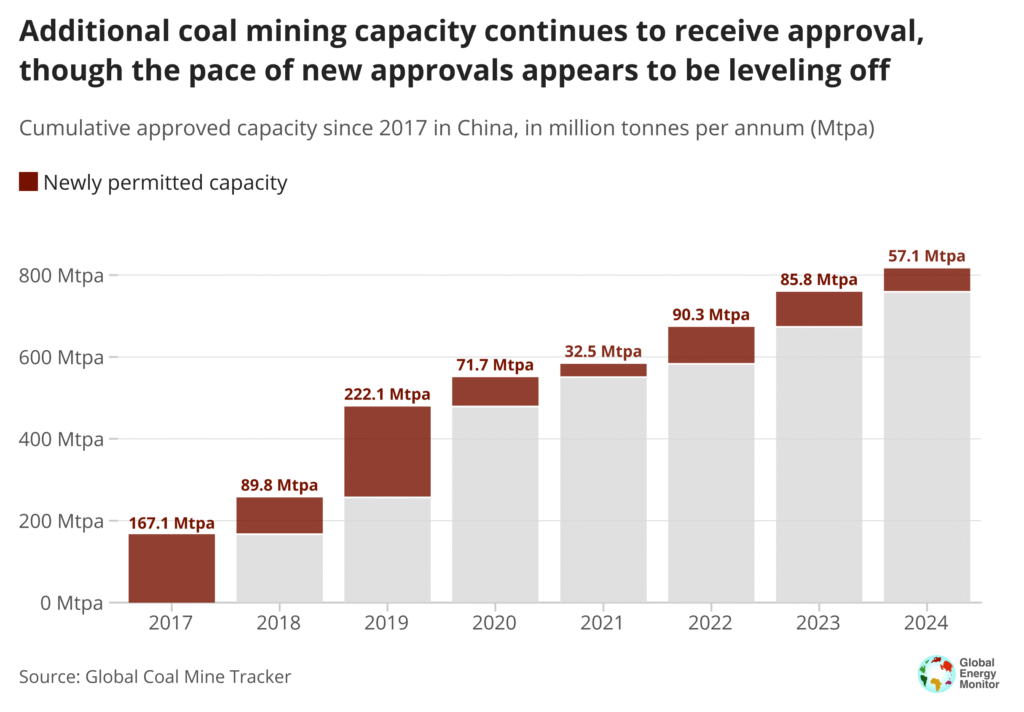

China's coal mine capacity approvals peaked in 2019 after the 2016 launch of its de-capacity policy, then declined sharply through 2020–2021, hitting a multi-year low of 32 Mtpa in 2021. However, following the power shortage crisis in the second half of 2021, China responded by rapidly expanding existing production capacity and accelerating approvals of new and expanded mines. As a result, approvals surged in 2022, reaching 90 Mtpa of capacity — nearly triple that of 2021. However, as coal supply shortages eased, this rapid expansion gradually lost momentum, with the total approved capacity dropping to 57 Mtpa in 2024, a 33% decline from 2023 and the lowest in three years. In 2024, China commissioned 87 Mtpa of new coal mine capacity, representing a 38% year-on-year decline and marking the lowest level in the past decade.

While this may suggest a downward trend in new operational capacity, it remains too early to confirm such a shift. Given that coal mine construction typically takes 3–5 years, the 2024 decline may instead reflect the lagging effect of fewer approvals in 2020 and 2021. By this same respect, the large volume of projects (233 Mtpa) approved during 2022–2024 is likely to be commissioned in the coming years, potentially contributing to a new wave of capacity growth.

Figure 5

More crucially, the development of proposed projects continues to receive policy support in China. China unveiled a plan in 2024 to establish a coal capacity reserve system by 2027, which aims to enhance energy security by ensuring more flexible coal supply. This indicates that additional capacity will likely be brought under development, since the plan involves approving a batch of coal mines specifically designated for reserve purposes. By 2030, the country aims to establish approximately 300 Mtpa of dispatchable reserve capacity.3

For these reserve coal mines, 60% or more of their new capacity is exempt from the standard capacity replacement requirement (coal enterprises must retire outdated or inefficient coal production capacity before gaining approval to develop new, more advanced coal mines) established in 2016 for capacity reduction. According to some estimates, the net increase in newly-built capacity by 2030 is expected to reach up to 1.3 billion tons, or the equivalent of roughly one-quarter of China’s 2024 total coal output, because of this policy support.

The National Energy Administration's 2025 Energy Work Guidance calls for approval of a new batch of large-scale, modern coal mines and acceleration of construction for already approved projects.

For example, Inner Mongolia, which leads in renewable energy development, also holds the largest volume of proposed coal mining capacity and has reportedly accelerated coal mine construction in 2025. Approximately 31.5 Mt of capacity is currently in the test operation phase, while another 8.6 Mt is expected to complete construction by the end of the year. Additionally, eight projects that fall under the coal capacity reserve system category have been approved, with a total production capacity of 92 Mtpa, including a reserve capacity of 16.4 Mtpa.

China's coal production has grown for four consecutive years since the 2021 power crisis. In 2024, domestic coal output reached 4,780 Mt, up 1.2% year-on-year, while coal imports rose 14.4% to 542.7 Mt. The combination of robust domestic production and growing imports has shifted China's coal supply from tight to relatively abundant.

Although coal consumption reached 4,890 Mt in 2024 — a 1.7% increase — the growth rate has slowed over the past three years, and data from the first quarter of 2025 also indicates an overall downward trend.

Among China’s four major coal-consuming industries (power generation, steel production, construction materials manufacturing, and chemicals manufacturing), the power sector consumed 2,870 Mt of coal in 2024, marking a 1.2% year-on-year increase. However, with the rapid expansion of renewable energy, demand for coal in this sector is expected to decline gradually in the future. The production of steel and cement faces overcapacity and declining demand in 2024. However, coal consumption in the coal-to-chemicals sector reached 319 Mt in 2024, representing a 7% year-over-year increase. Although its share remains insignificant relative to other key sectors of coal demand, future annual growth is projected to stay in the 5%–10% range, making it the only sector among the four major coal-consuming industries expected to continue growing.

Among the proposed projects, 47% (635 Mt) remained unapproved and is still in the planning or early project stages. If these plans are not significantly rolled back in the forthcoming 15th Five-Year Plan4 (2026–2030), China could see a new wave of coal capacity coming online, potentially leading to another round of overcapacity similar to that experienced during 2012–2015.

India

India ranks a distant second globally in proposed coal mining capacity, with 329 Mtpa currently under development. Of this, 163 Mtpa remains in the early planning stage, approximately 90 Mtpa has been permitted, and 75 Mtpa is already under construction. The pipeline is geographically concentrated in four states, with Jharkhand (106 Mtpa), Odisha (92 Mtpa), Chhattisgarh (50 Mtpa), and Madhya Pradesh (44 Mtpa) accounting for nearly 90% of the total proposed capacity of the country.

Figure 6

India’s coal sector is dominated by state-owned enterprises (SOEs), which are responsible for approximately 72% (238 Mtpa) of the proposed mining capacity. Coal India alone accounts for 139 Mtpa, making it the leading player in India’s coal expansion. Other SOEs include Singareni Collieries (16 Mtpa) and lignite-focused NLC India Ltd (26 Mtpa).

Private developers are also playing a significant role, planning 92 Mtpa of additional proposed capacity. The Adani Group, India’s largest privately-owned coal developer and the country’s leading mine developer and operator (MDO), holds 28 Mtpa. Vedanta Ltd follows with 18 Mtpa, making it the second-largest private coal mining company with proposed capacity in development within the country.

Coal production in India has risen steadily, reaching a record 1,048 Mt in FY 2024–25. This growth is expected to continue as the government pushes to boost domestic output, aiming to reduce import reliance and allegedly improve energy security. The government targets 1.3 billion tonnes of coal production by FY 2027 and 1.5 billion tonnes by 2030. To support this goal, India plans to open 100 new coal mines, adding 500 Mtpa in capacity by 2030. Over 80 Mtpa is expected to come online in FY 2025–26, suggesting that already permitted or under-construction projects could be fast-tracked.

Coal continues to be a cornerstone of India’s economy, powering critical sectors such as electricity, steel, and cement. However, domestic reserves of metallurgical or coking coal and high-grade thermal coal are limited, making imports, especially for steelmaking, essential. At present, metallurgical coal accounts for only about 3% of the country’s proposed coal mining capacity.

To address this gap, the Ministry of Coal has launched Mission Coking Coal, aiming to increase domestic coking coal production to 149 Mt by FY 2029–30. This is expected to spur a wave of new metallurgical coal projects in the future.

Meanwhile, underground mining, which currently makes up less than 10% of India’s coal production, is also a focus area. The government has set a target to produce 100 Mt from underground mines by 2030 to boost overall domestic coal supply. Yet, current proposals only include about 20 Mtpa (6% of the pipeline), indicating that additional underground projects could be added to the pipeline in the future.

The government’s latest Action Plan also highlights “unlocking the value of discontinued mines” as a key strategy for meeting short-term goals. In June 2024, Coal India announced plans to reopen over 30 previously uneconomic mines, 27 of which have already been awarded through tenders. This initiative is expected to contribute significantly to near-term production increases.

Australia and New Zealand

Australia ranks third after China and India in terms of proposed coal mining capacity under development, accounting for roughly 7% of global proposals, with a total of 165 Mtpa in various stages. Of this total, 96 Mtpa has already received approval and is under construction, while the remaining 70 Mtpa is still in the early planning phase. As with its current coal production, the bulk of proposed capacity is concentrated in Queensland and New South Wales, two major coal-producing states in Australia which host approximately 124 Mtpa and 41 Mtpa of proposed capacity, respectively.

Australia is the world’s leading exporter of metallurgical coal, with about 89% of its metallurgical coal product exported in 2022–2023. The country now accounts for roughly one-third (58 Mtpa) of the world’s proposed metallurgical coal mining capacity, most of which is clustered in Queensland. China, once a top buyer of Australian coal, lifted its import restrictions in early 2023. However, Mongolia emerged as China’s second-largest source of metallurgical coal in 2024, reducing China’s reliance on Australian exports. Although Australia still supplies over half of India’s metallurgical or coking coal imports, India plans to ramp up domestic production and acquire overseas assets as part of its “Mission Coking Coal,” potentially diminishing future demand for Australian imports. This creates a risk that early-stage metallurgical coal projects in Australia may be shelved or cancelled due to declining international demand.

On the domestic front, coal use in power generation — which accounts for about 88% of Australia’s total coal consumption — has been declining in recent years. Nonetheless, significant thermal coal capacity remains in the pipeline, with 85 Mtpa in proposed thermal coal projects and an additional 15 Mtpa in mixed thermal-metallurgical projects. This comes despite Australia signing a call for no new coal plants in national climate plans at COP29 and appearing on track to significantly reduce coal use. The country already has sufficient existing thermal capacity of 230 Mtpa, while coal consumption in 2023 totaled only 1.5 exajoules (approximately 62.5 Mt), a figure that reflects the ongoing shift away from coal in electricity generation, largely driven by a rapid increase in solar energy production. In light of these factors, many of the proposed thermal coal projects may face a risk of becoming stranded assets.

Although New Zealand has no new coal mining capacity proposed, coal development has not come to a halt. Instead, there are around six proposals to extend the lifespan of existing operations, all submitted by the country’s leading coal producer, Bathurst Resources. This includes the Stockton Coal Mine, New Zealand’s largest mine, which is set to expire in March 2027 but could continue producing coking coal for another 25 years if the extension is approved.

Russia

Russia has approximately 98 Mtpa of proposed coal mining capacity, ranking fourth globally. This includes 30 Mtpa already under construction and another 15 Mtpa undergoing test operations prior to entering full commercial production. An additional 23 Mtpa has received permits and risks advancing to the construction phase, while the remaining 30 Mtpa is still in early planning.

Geographically, nearly half of this proposed capacity is concentrated in three key federal subjects — Kemerovo, Sakha (Yakutia), and Krasnoyarsk — which align with Russia’s major coal basins. The Amur and Novosibirsk regions each account for around 10 Mtpa of proposed development.

Around half of Russia’s coal production is exported, now primarily to eastern markets, following the European Union’s ban on Russian coal imports in response to the 2022 invasion of Ukraine. Although Russian coal exports have declined in recent years, driven by sanctions and efforts among key buyers to diversify supply and strengthen domestic production, there is little indication that Russia is slowing its coal mine development. On the contrary, the country’s coal sector is aiming to boost annual production to over 600 Mt by 2050, up from the current 440 Mt, and to secure a quarter of the global coal market by increasing coal exports to 350 Mt by 2050. This is a significant increase from the export levels of less than 200 Mt in 2024, as outlined in the Russian Federation’s Energy Strategy to 2050. Achieving these ambitions will largely depend on the exploration and expansion of new coal mining clusters.

South Africa and the African continent

Africa is home to 5% (121 Mtpa) of the world’s proposed coal mine capacity. Nearly two-thirds (73 Mtpa) of this amount is concentrated in South Africa, with the remaining planned capacity located in Mozambique (34 Mtpa), Botswana (9 Mtpa), Tanzania (4 Mtpa), and Niger (1 Mtpa).

South Africa has 35 proposed coal mines with a projected output of 73 Mtpa, ranking fifth globally, just behind Russia, in proposed coal capacity. Of these 35 projects, 21 are planned for the Mpumalanga province, which is already responsible for 83% of South Africa’s coal production. Six of the remaining fourteen projects are located in KwaZulu-Natal; five are in Limpopo; two are in Gautang; and one is planned for the Free State. Nearly 80% of South Africa’s proposals are for thermal coal, which is largely used for domestic power generation.

Mozambique’s 34 Mtpa of proposed coal capacity is roughly triple its actual 2023 coal production (11 Mt). If all of this capacity were to come online, it would represent one of the largest percent shifts in national output worldwide. The bulk of this capacity consists of the 12-Mtpa multi-phase expansion of the Benga coal mine and the 8-Mtpa expansion of its Chirodzi coal mine, both owned by India-based Jindal Steel. In recent years, Mozambique — whose primary export is coal — has strived to attract foreign investment to develop its vast natural resources, including coal, in the hopes that the move will facilitate the country’s economic independence.

All of Botswana’s 9 Mtpa of coal capacity is currently under construction with plans to come online in the next 1–2 years.

The planned coal mining capacity in Tanzania is for two coal projects, one of which is a joint venture project between the Tanzanian government and China’s Sichuan Hongda to supply coal to the Mchuchuma power station. In Niger, the 1 Mtpa Salkadamna coal mine is planned as a companion mine to the proposed Salkadamna coal plant, whose plans have stalled for over a decade.

While GEM is also tracking a few planned coal mining projects in Eswatini, Madagascar, and Zimbabwe, the details of each, including coal capacity, are at present unclear.

North America

North America has 45 mine projects in development, amounting to 32 Mtpa of proposed new capacity. Two-thirds of this proposed capacity (21 Mtpa) is concentrated in Canada. While Australia is the world’s leading producer of metallurgical coal, North America is leading the shift from thermal to met coal production, as evidenced by the fact that met proposals in the U.S. and Canada now outweigh those for thermal operations by 68% and 77%, respectively.

In 2024, U.S. coal production continued its decades-long decline, falling to 512 million short tonnes as competition from gas and renewables in the electric power generation arena has increased. U.S. coal prices have been declining too, falling to 2021 levels at the close of the year. As a result, many coal producers are hesitant about scaling up too quickly. This is reflected by the fact that only 11 Mtpa of coal capacity is planned, with most located in West Virginia.

In addition to being modest with their mine proposals, another way U.S. coal companies are attempting to weather this coal slump is by lowering costs. For example, through their recent merger, Arch Resources and CONSOL Energy aim to shave off as much as US$140 million in annual operational costs.

It’s still too early to tell how the second term of the Trump administration will impact U.S. coal’s downward trend. The U.S. government has declared a national energy emergency and intends to boost America’s fossil fuel production. In an effort to push this new “pro-coal” sentiment, the U.S. government has made several goodwill gestures to coal companies, including approving the decades-long proposed expansions of the Spring Creek mine and Bull Mountains mine in Montana, and expediting the environmental permitting process of new coal projects. However, as of May 20255, few coal producers have made public-facing changes to their 2025 strategic plans. This suggests a lingering hesitancy about continued poor market conditions and economic uncertainty caused by the Trump administration’s shifting tariff and trade policies, which could prove detrimental to the coal export market.

Meanwhile, U.S. producers attempt to continue protecting themselves by increasing investments in new metallurgical mines. All but two proposed mines are planned by top metallurgical coal companies Ramaco Resources, Coronado, Alpha Metallurgical, and Warrior Met. This trend is expected to continue in 2025, especially given the recent designation of metallurgical coal as a “critical material” by the U.S. Energy Department.

Similarly, Canadian operators have readily embraced a supposed revival of metallurgical production, which is not affected by shifts in power generation. As of 2024, 77% (17 Mtpa) of Canada’s proposed coal mines are metallurgical projects, most located in British Columbia where the coal fields are rich in coking coal.

While some companies are turning to metallurgical coal during the clean energy shift, others are taking the opportunity to divest from coal altogether. In 2024, Vancouver-based Teck Resources, which was once the largest metallurgical coal producer in North America, finalized the sale of its metallurgical coal assets to Glencore. This comes despite Glencore’s renewed pledge to its 2050 net-zero emissions goal.

Europe

Europe’s combined 28 Mtpa of proposed coal capacity ranks it among the regions with the most modest proposed coal mining capacity globally. Coal production continued to plummet in Europe, with several countries, including the UK and Slovakia, completing their coal phaseout plans, and mine operators facing declining demand from power companies due to competition from wind, solar, and gas.

As of October 2024, the UK has successfully phased out coal power generation, becoming the world’s first major economy, and the sixth country, to eliminate coal from its power grid. Despite no longer using coal for power generation, the UK still has three mine proposals in consideration whose coal would be used for steelworks — the under 1 Mtpa expansion of the Aberpergwm Coal Mine, the 1.2 Mtpa Lochinvar coal mine, and Energy Recovery Investments’ controversial project to extract so-called “reclaimed” coal from coal tips at the retired Bedwas Colliery.

Elsewhere across Europe, coal has proven more difficult to dislodge. As of 2024, the Western Balkans has ten coal mine projects, amounting to 20 Mtpa of new mine capacity, with half in early phase developments and the other half under construction. Serbia, which has five new mine proposals amounting to 15 Mtpa, leads the coal expansion. It is followed by Bosnia-Herzgovina (3.5 Mtpa) and North Macedonia (1 Mtpa), which have two new mine proposals each, and Montenegro (under 1 Mtpa). Romania (5 Mtpa) is the only country within the European Union proposing new coal. And in Ukraine, the 1 Mtpa Novovolynskaya No 10 coal mine, whose construction began decades ago, remains planned but stalled.

Neither Germany nor Poland have any coal mining capacity in the pipeline, which aligns with each country’s 2038 and 2049 respective coal phaseout targets (though both timelines are widely seen as needing to be brought forward to meet climate commitments).

Other Asian countries

Outside of China and India, approximately 135 Mt of proposed coal mining capacity is in the pipeline across twelve Asian countries, with Pakistan and Indonesia together accounting for more than half of this total.

Figure 7

Southeast Asia’s coal development pipeline is led by Indonesia, which currently has 15 Mtpa of coal mining capacity under construction and an additional 16 Mtpa in early-stage planning. Indonesia’s coal production has grown steadily in recent years, rising from 564 Mt in 2020 to 836 Mt in 2024. This increase has been driven by expanding domestic power demand and surging imports from countries like China, India, and other regional buyers. At present, Indonesia is developing at least 31 Mtpa of new coal mining capacity, 94% of which is thermal coal aimed at supplying both domestic power generation and international markets. Additionally, more than 40 proposed coal mine projects remain at very early stages and lack reported capacity data.

The country’s coal resources are heavily concentrated on Kalimantan Island, particularly across the provinces of South, East, Central, West, and North Kalimantan. This region accounts for over 80% of Indonesia’s coal output and hosts more than half of the proposed capacity (approximately 20 Mtpa), with South and East Kalimantan leading in project scale.

Roughly 84% of Indonesia’s known coal reserves are low- to medium-grade thermal coal primarily used for power generation, making the country the leading thermal coal exporter in the world. However, the country is also a metallurgical coal importer, sourcing coking coal mainly from Russia, Australia, and China. While nearly all proposed mining capacity is focused on thermal coal, the Indonesian government has recently ramped up exploration efforts to identify new coking coal deposits and reduce its reliance on imports.

With China and India purchasing nearly two-thirds of Indonesia’s coal exports in 2023, the country’s coal mining sector faces significant exposure to the risk of uneconomic and stranded assets. This vulnerability became apparent in early 2025, when Indonesia’s thermal coal exports fell to a three-year low between January and April, driven by reduced demand from both countries as they’ve taken efforts to boost domestic production to lower import dependence.

Beyond Indonesia, the Philippines holds 8 Mtpa of proposed coal mining capacity in Southeast Asia, all of which remains in early-stage development without permits.

Pakistan ranks second in South Asia, after India, with approximately 38 Mtpa of coal mining capacity under development. Most of these proposed projects are tied to coal demand from the power sector. For example, the Thar Block VI open-pit project is planned in two phases: Phase 1 includes the development of 7.9 Mtpa of capacity alongside a 1,320 megawatt (MW) mine-mouth power plant, while Phase 2 involves expanding the mine by an additional 8.1 Mtpa to support a coal gasification and coal-to-liquid facility operating in parallel with the power plant. At Thar Block II, Phase III is in the pipeline, targeting an additional 3.8 Mtpa to supplement the existing 7.6 Mtpa of operational capacity. This expansion has already been permitted. In a 2024 interview, the company of Thar Block II has confirmed that Phase IV is under planning, with the long-term goal of increasing total production at Thar Block II to approximately 30 Mtpa.

Bangladesh currently has a very small coal production capacity, less than 1 Mtpa, yet it ranks third in South Asia in terms of proposed coal mining capacity, with around 10 Mtpa under development. Coal plays a relatively minor role in the country's energy mix compared with other energy sources like gas, oil, and biofuels, accounting for just 5.5% of total energy supply. At present, only one coal mine, the Barapukuria Coal Mine, is operational, with a production capacity of 0.9 Mtpa.

Since 2020, Bangladesh has begun importing coal to fuel the Payra power station, and coal consumption is projected to rise through 2030 in the government’s 2023 Integrated Energy and Power Master Plan. Developing new domestic coal mines is seen as a strategy to reduce reliance on imported coal and ensure a stable local supply. Additionally, as the country transitions away from traditional biomass — still a major energy source — toward fossil fuels like coal, this may further justify plans for expanding mining capacity.

However, all currently proposed coal mines remain in the early planning phase. Bangladesh pledged at COP26 in 2021 to aim for up to 40% clean energy in its power generation mix by 2041. If this target is reached ahead of schedule, national coal demand could peak and begin to decline earlier than expected, potentially rendering much of the proposed mining capacity unnecessary.

Coal development is also active in Central Asia, with Kazakhstan leading the region at approximately 17 Mt of proposed coal mining capacity, nearly 60% of which is nearing completion. As one of the top ten countries with the largest proven coal reserves, Kazakhstan is proposing new coal-fired power plant construction which would boost domestic demand for coal. At the same time, it is seeking to diversify coal exports abroad; currently, about one-third of Kazakhstan’s coal is exported, primarily to Russia, the EU, and Asian markets.

Meanwhile, Uzbekistan, Kyrgyzstan, and Tajikistan collectively have 11 Mt of proposed capacity, though most projects remain in early, unpermitted stages.

Latin America

Latin America accounts for a mere 0.5% (12 Mtpa) of proposed global coal mining capacity. Only one country, Colombia, is home to all coal mine projects currently under development.

Colombia’s three largest coal mine projects currently under consideration include the San Juan mine (with an estimated average annual production of up to 10.5 Mtpa), the Cañaverales Coal mine (up to 0.8 Mtpa), and the Papayal mine (up to 0.9 Mtpa) — all owned by Turkish multinational firm, Yildirim, through its Colombian subsidiary Best Coal Company. While transparency issues continue to surround Yildirim’s plans for the mines, their coal is expected to be imported to Türkiye for power generation.

2024 marked the second anniversary since Brazil’s proposed Guaíba mine was shelved. Had the 5 Mtpa mine been approved and built by private coal mining company Copelmi Mineração, it would have been inundated by over 28 inches (700 mm) of rain which fell across the Porto Alegre region during the 2024 Southern Brazil floods. This near miss is a stark reminder of coal’s cascading environmental impacts beyond the release of heat-trapping greenhouse gases.

Mine proposals: Lock in of future coal mine methane emissions

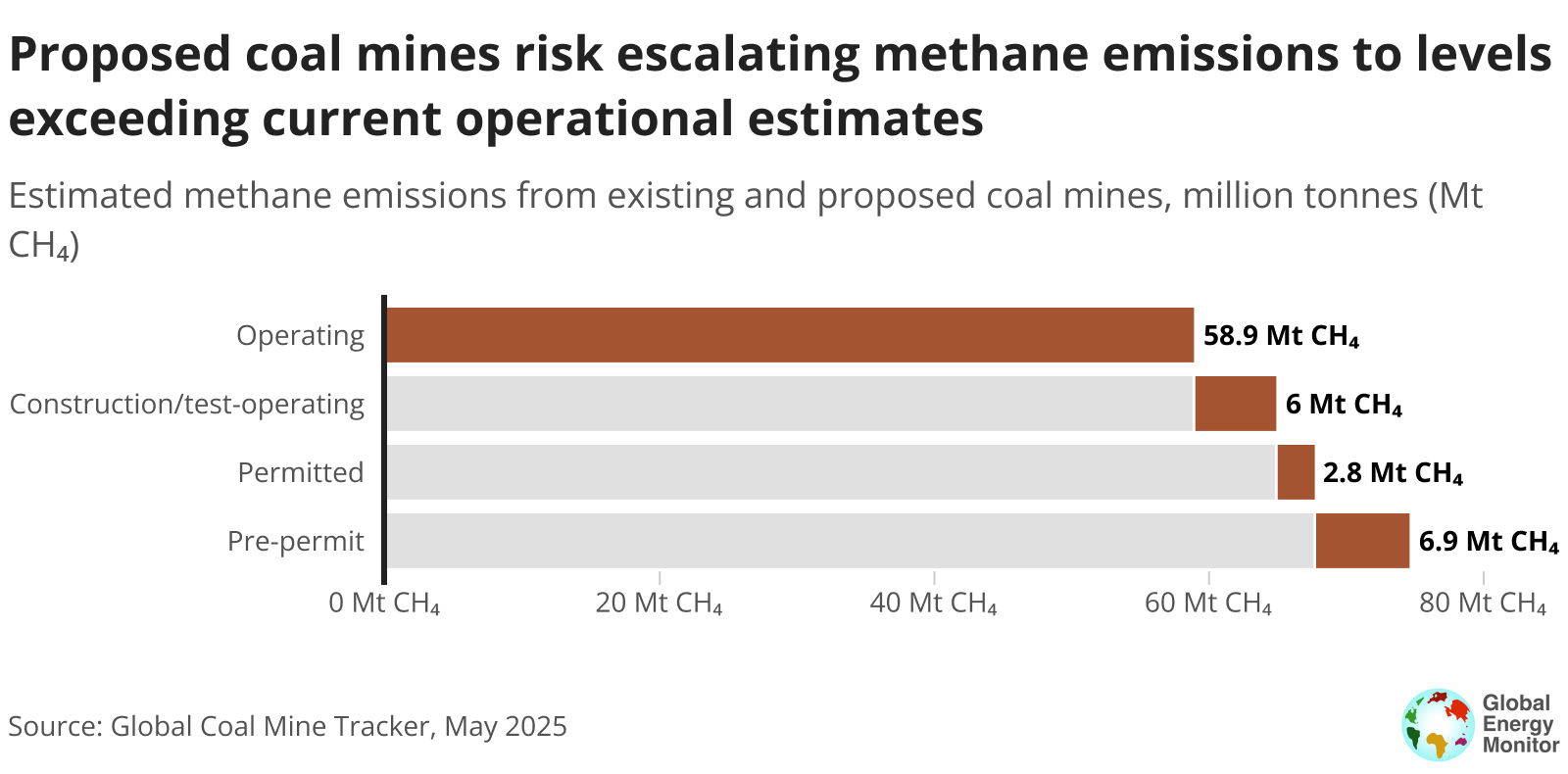

A projected 15.7 Mt of methane emissions per year could be released if all globally proposed coal mining projects are developed.6 This is equivalent to roughly 1.3 billion tonnes of CO₂e using a 20-year Global Warming Potential — exceeding Japan’s total annual greenhouse gas emissions, which stood at 1.18 billion tonnes in 2022. Should all this capacity become operational, global coal mine methane emissions could rise by approximately 39% over the IEA’s latest estimate of 40.3 Mt, and by approximately 26% compared to GEM’s latest estimate of 58.9 Mt from currently operating mines — an estimate that does not account for any mitigation measures.

Without robust abatement, emissions from new coal mines would compound the already significant methane emissions from existing mines. Altogether, these emissions would add up to over 6 billion tonnes of CO₂e (20-year GWP), comparable to the annual greenhouse gas emissions of the United States, the world’s second-largest emitter at 6.02 billion tonnes in 2022.

Figure 8

Currently, over 850 new coal mines or mine expansions of varying capacities are under development worldwide. Of these, 296 projects are under construction and expected to become operational within the next few years, while 28 mines are in the test operation phase and likely to start full production within a year. Together, these late-stage developments represent a total of 744 Mtpa in new capacity and are projected to emit around 6 Mt of methane annually, once operational.

An additional 186 projects, representing approximately 414 Mtpa of coal mining capacity, have already received permits. These permitted projects, currently in the interim phase of development, are expected to generate 2.9 Mt of methane annually unless halted or abandoned.

The remaining 1,113 Mtpa of coal mining capacity, linked to estimated methane emissions of at least 6.9 Mt/yr, remains in early development stages, including announcement, exploration, and pre-permitting. These projects are particularly susceptible to delays, or may ultimately be shelved or canceled altogether, depending on shifts in coal demand as well as economic, environmental, social, and climate risks across different countries.

Figure 9

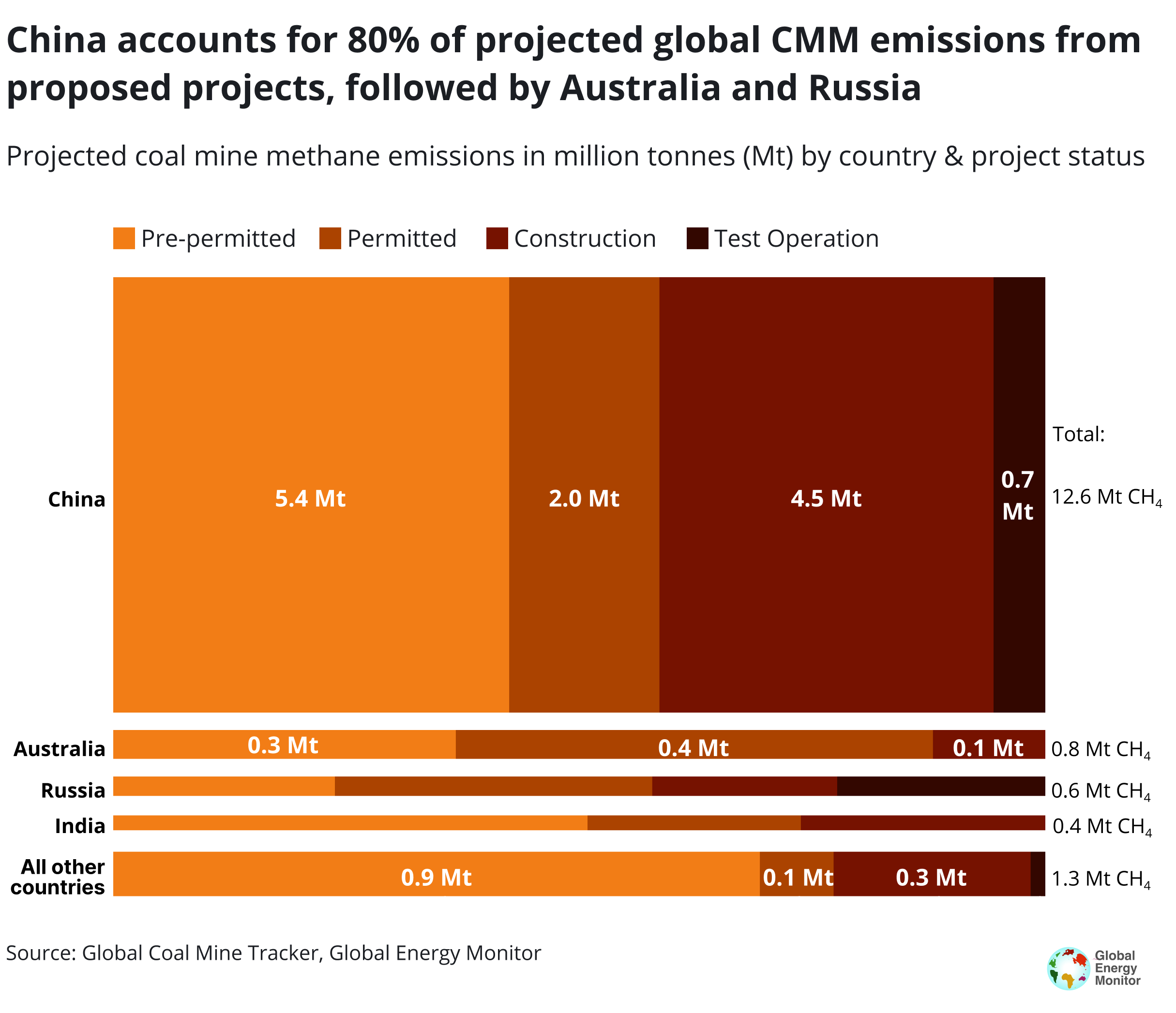

China is the source of the largest projected increase in global coal mine methane emissions, accounting for 80% of estimated emissions from proposed projects worldwide. The country has 456 proposed coal mines under development, totaling approximately 1,350 Mtpa in planned capacity. If fully realized, these projects could emit an additional 12.6 Mt of methane annually, according to GEM estimates. With nearly 40% of this capacity already under construction or in test operation, about 5 Mt of new emissions per year may be effectively locked in.

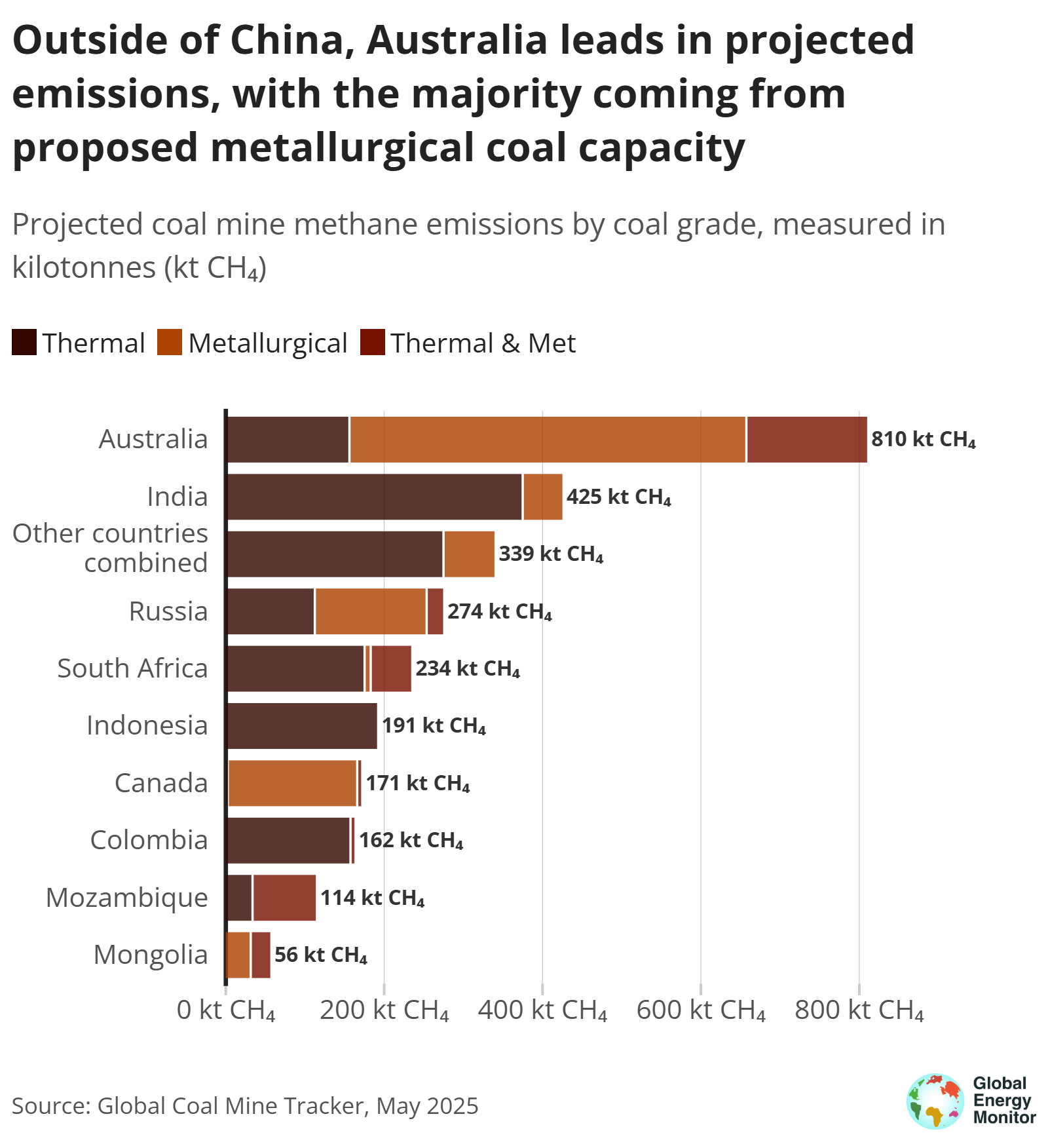

Australia follows, with 58 proposed projects, totaling 165 Mtpa, that could add up to 0.8 Mt of methane per year. Of this amount, 14 Mtpa is currently under construction, locking in an estimated 0.1 Mt/yr, while another 82 Mtpa has been permitted and could contribute 0.4 Mt annually, if developed.

Russia ranks third, with 36 proposed coal mines totaling 98 Mtpa and the potential to release 0.6 Mt of methane annually. Projects already in advanced stages account for 0.2 Mt/yr, with an additional 0.2 Mt/yr likely from 23 Mtpa of permitted capacity. Combined, China, Australia, and Russia account for nearly 90% of the projected methane emissions from proposed coal mine developments worldwide.

India ranks fourth in projected methane emissions from proposed coal mining capacity, with an estimated 0.43 Mt of methane emitted annually, nearly 90% of which comes from identified thermal coal projects. With the government aiming for a significant expansion of domestic coal production, particularly from underground and metallurgical coal mines by 2030, methane emissions are likely to increase further in the absence of effective abatement measures.

From a coal grade perspective, proposed thermal coal mines, primarily intended for power generation, are projected to release approximately 11.5 Mt of methane annually. In contrast, proposed metallurgical coal mines, which serve steelmaking and other industrial processes, are expected to emit around 1.7 Mt, based on GEM’s analysis of proposals with identified coal grade information. While the overall emissions from metallurgical projects appear smaller due to a much smaller number of mines and total capacity, they tend to be significantly more methane-intensive on a per mine basis. On average, metallurgical coal mines emit 2.5 times more methane than thermal mines of comparable size. This is largely because metallurgical projects are often deep underground operations targeting higher-rank coal types such as bituminous and anthracite, where methane concentrations increase with depth.

Figure 10

China, without doubt, dominates emissions across all coal grades, largely due to its unmatched volume of proposed coal mining capacity across various coal ranks. Outside of China, Australia is the second-largest emitter from proposed coal projects, with over two-thirds of its projected emissions coming from metallurgical coal capacity. Russia and Canada follow as the next largest emitters from metallurgical coal proposals.

From a coal mine type perspective, underground mines are typically more methane-intensive than surface mines. Proposed underground coal mine projects are projected to emit approximately 13 Mt of methane annually, compared to 2.6 Mt/yr from surface mine projects. China hosts the largest share of proposed underground coal mining capacity, accounting for 88%. While Australia has a much smaller share compared with China, it still ranks second with 4% of total projected emissions from underground proposals.

Although projected emissions from proposed surface mines are generally lower than those from underground mines, this does not make them any less significant. GEM’s analysis finds that several proposed surface mines with large production capacities could emit more methane annually than many underground mines. A notable example includes the Changtan Surface Coal Mine in China. If developed, this project could emit between 5.3–14.6 Mt CO₂e (based on 100-year and 20-year GWPs) per year, placing it among the largest methane-emitting coal mines in the world.

Emissions from surface or open-pit coal mining have often been overlooked due to their comparatively smaller share. However, aircraft-based measurements have shown that methane emissions from a major open-pit coal mine in Australia were three to eight times higher than reported. Without sufficient attention and more direct measurement data, methane emissions from surface mines risk becoming the overlooked “elephant in the room” in global coal mine methane accounting.

How proposals impact global emissions targets

Greenhouse gas emissions have reached an all-time high, making the scale of required reductions even more daunting. With a substantial volume of coal mining capacity still in the development pipeline, moving forward with these projects would only move progress further away from achieving global climate targets.

According to the United Nations Environment Programme’s (UNEP’s) Production Gap Report 2023, achieving the 1.5°C target under the low demand (IMP-LD) scenario requires a massive 75% reduction in coal production by 2030 compared to 2020, meaning global output would need to drop from about 7,607 Mt in 2020 to just 1,902 Mt — or roughly 571 Mt per year — by 2030. However, with global coal production having reached 8,770 Mt in 2024, the required cuts have doubled to about 1,144 Mt per year in order to remain aligned with the 1.5°C target (see Figure 11, dark-green line).

In comparison, the IEA Net Zero Emissions (NZE) scenario offers a more gradual approach, projecting a 39% reduction in coal production from 2020 levels, down to roughly 4,640 Mt by 2030. Yet even this slower pathway, which originally required an average reduction of about 297 Mt per year, now demands cuts of 688 Mt per year (Figure 11, light-green line).

However, if all 2,270 Mtpa of proposed coal mining capacity (Figure 11, dark-red bars) is developed and brought online at a steady rate through 2030 (averaging 378 Mtpa annually) — even after accounting for production at mines slated for closure or expected to deplete their recoverable reserves before 2030 (totaling 837 Mtpa) — the gap between current production trends and what’s required to achieve climate targets will widen further. This scenario would necessitate even more aggressive cuts, requiring annual retirements of coal mining capacity to not only match but exceed the pace of new additions in order to stay on track for the 1.5°C target under both the UNEP and IEA NZE scenarios.

Figure 11

From an emissions perspective, the IEA’s NZE scenario calls for methane emissions from coal production to be cut by around 75% from today’s levels by 2030 — dropping from 40.3 Mt in 2024 to just 10 Mt by 2030. This requires an average annual reduction of approximately 5 Mt, totaling about 30 Mt over the next five years to stay on track for the NZE target. With annual methane emissions still showing no downward trend, and the time frame narrowing, the path to achieving this goal is becoming increasingly precarious.

If all 2,270 Mtpa of proposed coal mining capacity is developed and brought online at a steady rate through 2030, over 15 Mt of additional methane emissions are projected each year (see Figure 12, dark-red bars). Without strong mitigation measures, these new projects would further jeopardize progress toward net zero.

Figure 12

The IEA’s updated Net Zero Roadmap, which charts a path to limiting global warming to 1.5°C by 2050, calls for no new coal mines or mine extensions under the NZE scenario. Developing new greenfield coal projects risks not only creating stranded assets, but also locking in costly, long-term emissions. Rather than expanding production capacity or extending the lifespan of existing (“brownfield”) mines, these sites should be evaluated for potential conversion to renewable energy use, such as solar power projects.

Out of the 30 countries with coal mining capacity still under development, 21 are signatories to the Global Methane Pledge. Together, these countries’ proposed projects are expected to emit nearly 2 Mt of methane annually. Yet, to date, only a limited number of countries and regions have submitted detailed methane action plans. If countries are truly committed to meeting their climate targets, the solution is not to pursue further coal mine development with uncertain mitigation measures but to halt new projects entirely. The most effective strategy forward remains clear: Leave coal in the ground.

1 Extension projects refer to existing mines seeking to prolong their lifespan by mining new areas without increasing current production rates.

2In China, “test operation” denotes the phase prior to commercial launch in which the mine completes construction, commissions equipment, conducts safety and operational checks, and initiates limited production to ensure readiness for full-scale output. This process is also observed in Russia and Kazakhstan.

3Coal production reserve mines adopt a "base + reserve" dual-capacity system, with reserve capacity accounting for 20%–30% of total output. Under normal conditions, only base capacity operates, while reserve capacity can be quickly activated during emergencies.

4China’s Five-Year Plan is a national economic and development blueprint released every five years outlining major policy goals and priorities.

5The May version of the GCMT dataset was updated in July, featuring major revisions to the "Parent Company" column, which now reflects GEM's latest ownership format and includes associated Entity IDs for parent companies (excluding Chinese companies), along with other minor changes. Please visit the download page for the updated version.

6For further detail on estimating methane emissions from coal mines, visit GEM’s methodological wiki page.

About the Global Coal Mine Tracker

The Global Coal Mine Tracker is a worldwide dataset of coal mines and proposed projects. The tracker provides asset-level details on ownership structure, development stage and status, coal type, capacity, production, workforce size, reserves and resources, methane emissions, geolocation, and over 30 other categories.

The most recent release of this data in May 2025 includes operating mines producing 1 million tonnes per annum (Mtpa) or more, with smaller mines included at discretion. The tracker also includes proposed coal mines and mine expansions with various designed capacities.

Media Contact

Dorothy Mei

Project Manager, Global Coal Mine Tracker