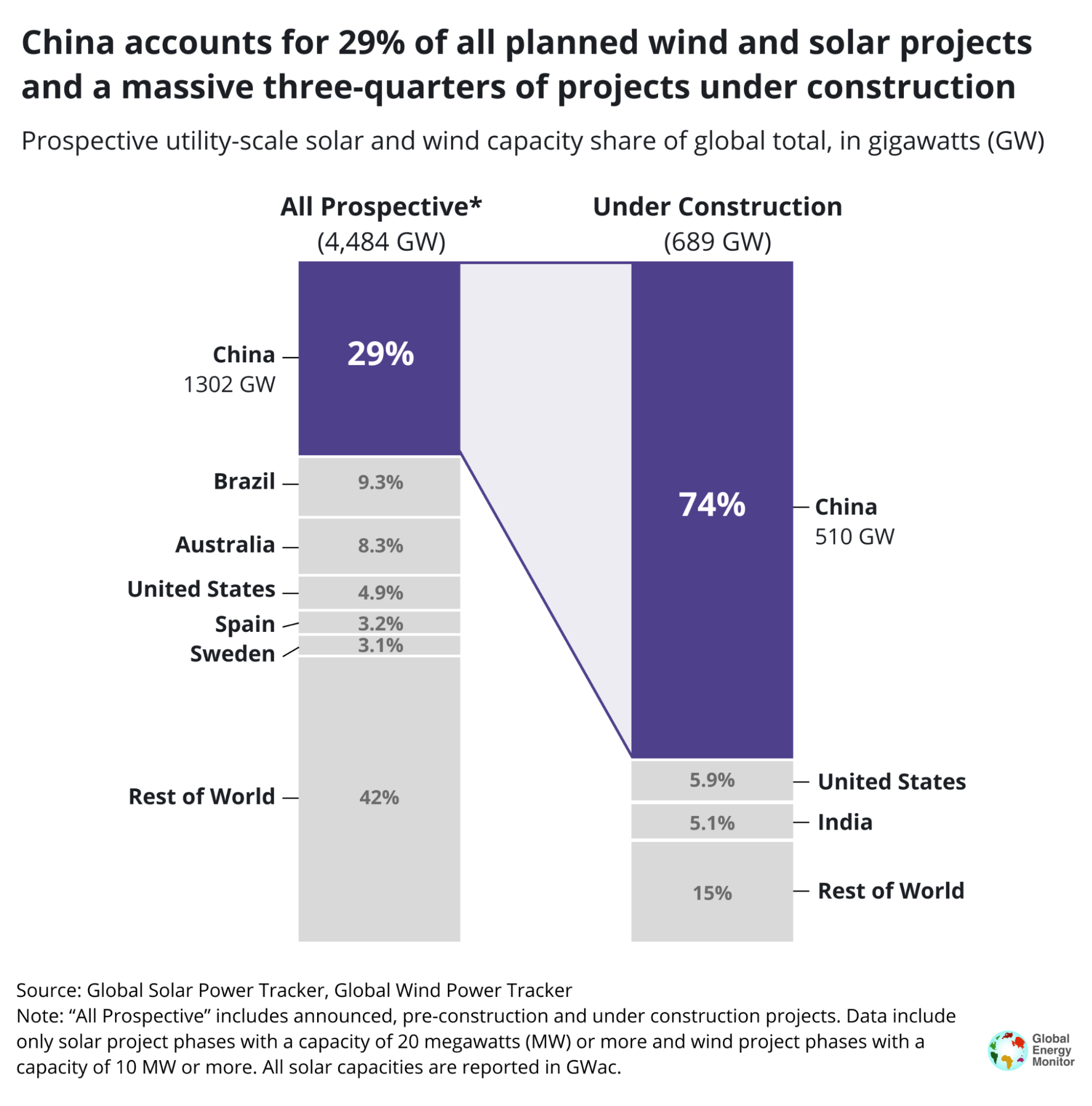

China is advancing a nearly 1.3 terawatt (TW) pipeline of utility-scale solar and wind capacity, leading the global effort in renewable energy buildout. This is in addition to China’s already operating 1.4 TW of solar and wind capacity, nearly 10% of which (141 gigawatts (GW)) came online in 2024. Though only a small portion of China’s overall renewable capacity, China’s offshore wind fleet contributes over 50% of the overall offshore wind capacity in construction worldwide. However, China is not immune to the challenges of this new market, as development of offshore wind in China has slowed in recent years. In order for this technology to advance, China has an opportunity to move from its provincial development approach to one that provides stable and market-specific national policies.

- China is fast-tracking a 1.3 TW pipeline of utility-scale solar and wind projects. Of this, 510 GW is already under construction, primed to be added to China’s 1.4 TW solar and wind capacity already in operation.

- As of March 2025, China has emerged as the world’s offshore wind powerhouse — growing from under 5 GW in 2018 to 42.7 GW in 2025 (50% of global capacity).

- Offshore wind could play a role in decarbonizing China’s coastal provinces, but fossil fuels stand in the way.

- China’s offshore wind fleet shows promising expansion as technology and development progress, but international policies can provide valuable insights for national strategies to ensure market stabilization.

China has over 1.3 TW of planned solar and wind capacity

China leads global utility-scale solar capacity for projects in announced, pre-construction, and construction phases. According to Global Energy Monitor’s Global Solar Power Tracker, China has over 709 GW1 of prospective solar capacity, representing over one-third of planned solar capacity worldwide in 2025. These projects could generate approximately 1,100 terawatt hours (TWh) of electricity per year — equivalent to roughly 122% of Japan’s 2023 electricity consumption (909 TWh). About 161 GW (23%) of prospective capacity is in announced phases, while 261 GW (37%) is in pre-construction phases. China's construction capacity exceeds 40%, as 287 GW has broken ground. This is roughly four times the global average for capacity under construction (9%).

Figure 1

China’s wind capacity follows a similar rate of growth as solar, according to Global Energy Monitor’s Global Wind Power Tracker, with over 590 GW in prospective phases — nearly 530 GW of onshore capacity and 63 GW of offshore capacity. As of July 2025, 223 GW (37%) of this prospective capacity is under construction, almost four times the combined under-construction capacity of the rest of the world. If these projects become operational, they could generate roughly 1,260 TWh of electricity per year, enough to power about 120 million United States households. Ultimately, China’s prospective capacity accounts for about one-third of total global wind capacity in development.

Geographically, Xinjiang and Inner Mongolia host 40% (523 GW) of China’s prospective capacity. Of this, nearly 212 GW — 31% of global utility-scale solar and wind under construction — is found in these autonomous regions. This rapid buildout underscores China’s drive to accelerate its renewable energy development, with at least 205 GW of new capacity slated to come online in China by this year’s end, though the total capacity is expected to be even higher.

Figure 2

China’s 1.4 TW operating solar and wind outstrips thermal power

In Q1 2025, China’s wind and solar capacity surpassed its thermal (coal and gas) capacity for the first time, supplying nearly 23% of the country’s total electricity consumed, up from roughly 18% in Q1 of 2024, according to the National Energy Administration (NEA). Increased output from solar, wind, and other non-fossil energy also met China’s additional electricity demands in Q1 2025. China’s solar and wind operating capacity has soared to 1.4 TW and now accounts for 44% of the world’s operating utility-scale solar and wind capacity, more than the combined total of the European Union, United States, and India.

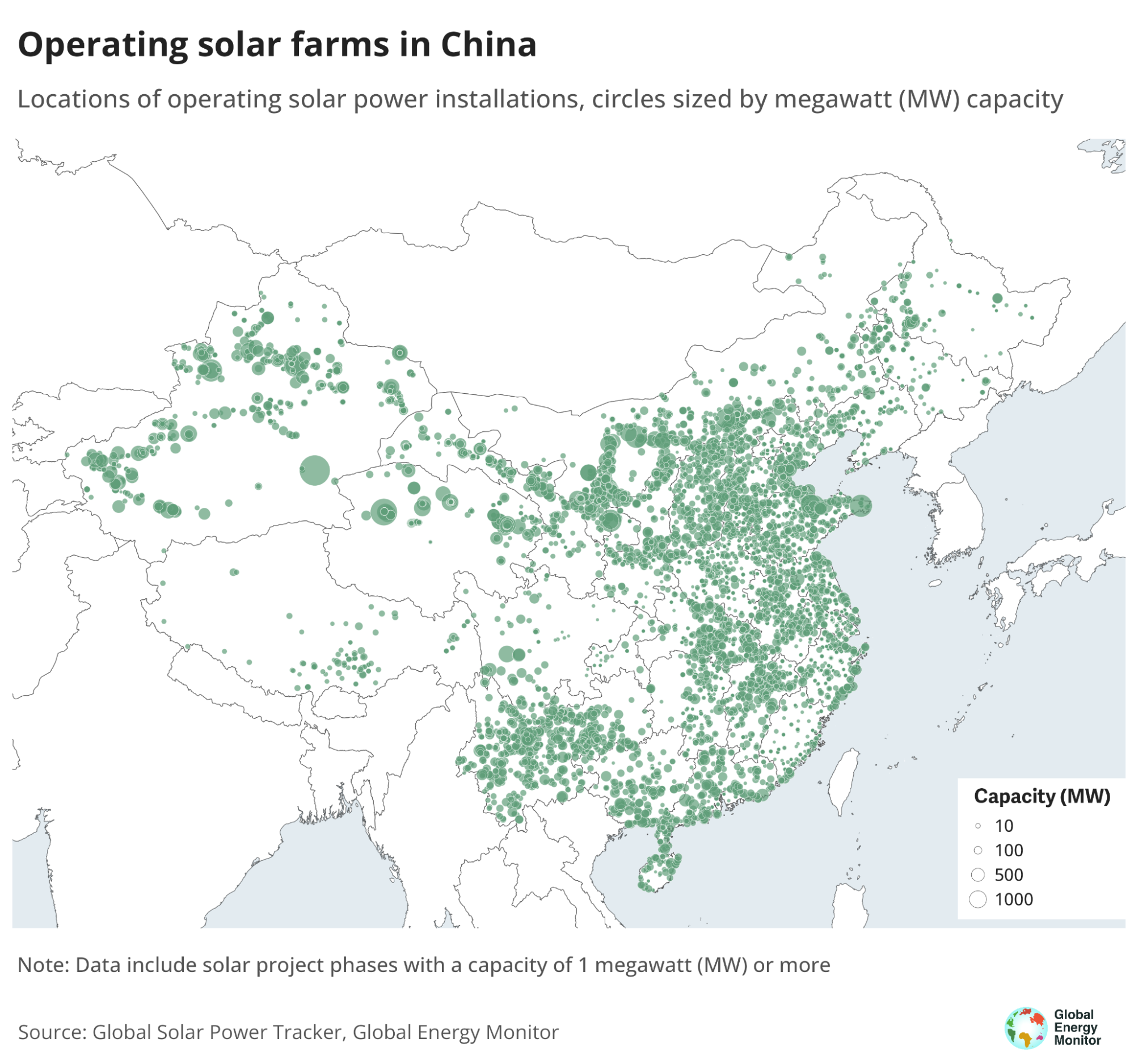

As of May 2025, China has installed 1,080 GW of solar capacity, with May seeing China’s largest monthly increase in operating capacity. China’s annual solar additions jumped from 55 GW in 2021 to 88 GW in 2022 (+60%), surged to 216 GW in 2023 (+145%), and then reached 278 GW in 2024 (+29%). Of the 278 GW added capacity, 57% (159 GW) came from centralized installations and 43% (118 GW) came from distributed systems. Included in 2024 additions is the world’s largest single-site photovoltaic plant — the 3.5 GW Midong Solar Farm, located in Xinjiang Autonomous Region — which was connected to the grid in June 2024. Once fully operational, the solar project Midong is expected to generate nearly 6.1 TWh per year, nearly matching the annual electricity demand of Luxembourg in 2023.

Figure 3

Wind power has followed a similarly rapid trajectory. As of May 2025, China added 46 GW of new wind capacity for the year, bringing the total to 570 GW of operating capacity. A notable project is the Omattingga Wind Farm in Tibet, a 100 megawatt (MW) installation that is the world’s highest-altitude wind farm. At 4,650 meters high, it produces about 200 gigawatt hours (GWh) annually.

Figure 4

Offshore wind development ramping up in China

China’s coastal provinces2 are home to many of China’s major megacities and industrial hubs, and while they contribute 25% and 30% of the nation’s solar and wind capacity, respectively, they consume nearly half of the nation's electricity. Though offshore wind represents only about 9% of China’s total wind power capacity, it is gaining traction as these provinces pursue ambitious decarbonization targets. China has already begun tapping into this potential, but further progress will require a strategic and coordinated nationwide approach to fully scale offshore wind as a pillar of coastal decarbonization.

Figure 5

Figure 6

China has established itself as the global leader in offshore wind through rapid and large-scale development. In 2024, China added 4.4 GW of offshore wind capacity, accounting for nearly 55% of all global additions that year. China’s offshore wind capacity grew from less than 5 GW in 2018 to 42.7 GW by March 2025. This represents a sustained compound annual growth rate of 41% over the past five years, two times the global average. Among China’s iconic projects is the 1.7 GW Yangjiang Shaba III complex in the South China Sea, China's largest deep-sea wind farm. This project alone accounts for nearly 10% of Guangdong Province’s total operational offshore wind capacity.

This growth is enabled by the country's vast offshore wind potential (estimated at 1,400 GW), its proximity to eastern coastal demand centers, and advances in domestic offshore wind technologies. As of February 2025, China had 67 GW of offshore wind projects in the development pipeline, 41% (28 GW) of which is under construction — a stark comparison to the global average of 2% under construction outside of China.

Figure 7

If China grows its offshore wind capacity, the technology could help displace coal and cut carbon emissions. Guangdong province's 11.4 GW offshore wind fleet has the potential to avoid roughly 23 million tonnes of CO₂ each year if fully operational — equivalent to burning 8.7 million tonnes of standard coal. Yet offshore wind’s rollout must compete against continued development of gas and coal, which remains prominent in the region, as 13.5 GW of gas power capacity and 23 GW of coal are planned for commissioning by 2027 in Guangdong province alone. Guangdong is not the only coastal province with offshore wind development running in parallel with its fossil fuel capacity. While offshore wind’s capacity to deliver stable electricity makes it particularly well-suited for decarbonizing China’s heavy industries, such as steel and petrochemical manufacturing concentrated along the east coast Bohai Rim, Yangtze River Delta, and Pearl River Delta, it continues to face challenges as coal and gas are still on the rise across China.

China's coastal provinces collectively outlined a total offshore wind capacity target of 52 GW during the 14th Five-Year Plan period (2021–2025). As of February 2025, China’s operational offshore wind fleet totaled 41 GW — meeting nearly 80% of China’s combined provincial goal. Nearly 10 GW of the 11 GW needed to bridge the gap is expected to become operational by the end of 2025.

In striving to meet their 14th Five-Year Plan offshore wind targets, each coastal province has pursued its own development pathway. Among them, Jiangsu and Guangdong stand out as national leaders, with 12.6 GW and 11.4 GW of installed offshore wind capacity respectively, accounting for 55% of the country’s total offshore capacity.

Jiangsu was one of the earliest provinces to scale up offshore wind capacity, thanks to favorable shallow-water conditions in the Yellow Sea and early development of intertidal and nearshore zones dedicated to offshore wind development. These conditions made way for the growth of the country’s largest offshore wind supply chain hub, with Yancheng City alone hosting over 47 wind equipment manufacturers. Today, Jiangsu’s newest fleet of offshore wind projects is being pushed into deeper waters as the result of already established offshore wind projects in shallow waters.

Guangdong has emerged as China’s fastest-growing offshore wind market. The province is also home to Mingyang’s OceanX, the world’s largest-capacity floating platform. Unlike Jiangsu’s shallow seabed, Guangdong’s deep waters require jacket foundations or floating structures capable of withstanding frequent typhoons that ultimately raise engineering demands, as turbines need reinforced, storm-resistant designs. China’s floating wind sector has been proactively addressing these challenges, with the development of typhoon-ready designs to face extreme weather conditions. To tame high costs, Guangdong approved large-scale projects (500–800 MW) to capture economies of scale and encourage turbine upscaling, with local original equipment manufacturers like Mingyang rolling out 10–18 MW models to boost energy yield per foundation.

China is rapidly advancing floating wind technology to tap deepwater resources. As of Q1 2025, almost 40 MW is operational across five pilot projects. The first phase (200 MW) of a 1,000 MW Hainan Wanning floating offshore wind farm is scheduled for completion by the end of 2025. China also leads in developing flagship offshore turbines. In June 2024, Goldwind became the first company to commercialize a 16 MW unit at Zhangpu-Liuao Phase 2. Later that year, Dongfang Electric unveiled a 26 MW design with a 310-meter rotor.

China’s coastal provinces are pioneering ways to decarbonize heavy industry and energy systems powered by offshore wind. One major decarbonization pathway is producing green hydrogen from offshore wind. Pilot projects are underway in Fujian, Guangdong, and Shandong, with robust central policy support. Offshore wind is also being utilized for direct electrification of energy‐intensive industries. In Guangdong, for example, a 500 MW offshore wind farm in the South China Sea, slated to connect in late 2025, will deliver 100% renewable power to Germany-based company BASF’s Zhanjiang Verbund chemical complex. In June 2025, Shanghai Lingang announced the world’s first commercial underwater data center powered by offshore wind, sourcing over 90% of its energy from sea-based turbines.

While China remains committed to innovation in offshore wind, the sector faces a key domestic challenge following the phaseout of national subsidies in 2021. At the end of 2021, China phased out its national feed-in tariffs (FiTs), which had guaranteed developers premium rates and supported an Internal Rate of Return (IRR) of roughly 10%. In the rush to meet the subsidy deadline, China installed a record 16.6 GW in 2021, only to see additions drop to about 6.5 GW in 2022. To soften the blow, provinces such as Guangdong, Shandong, and Zhejiang introduced modest local incentives in 2022, including both capacity-based subsidies and tariff-based subsidies.

China’s offshore wind future — Strategic anchors & policy blueprint

China’s offshore wind sector is entering a critical phase of development, requiring a coordinated policy framework that balances industrial scaling, environmental sustainability, and technological advancement. Drawing from international markets, China has the opportunity to refine its approach to offshore wind development and enhance the technology’s long-term competitiveness with fossil fuels. By combining global best practices with domestic policy needs, China can create a stable and coordinated approach to fully scale offshore wind as a pillar of coastal decarbonization.

Adjustments to the project bidding structure could support sustainable sector growth. A hybrid auction mechanism that incorporates both price and technical criteria, such as ecological impact mitigation (e.g., sediment stabilization, noise-reducing foundations), grid integration readiness, and technology advancement (e.g., hydrogen generation, black-start capabilities) can incentivize innovation. Such an approach strengthens the market signals for high-quality projects while reinforcing the long-term resilience and sustainability of the sector. International models like the Netherlands’ zero-subsidy auction system, which prioritizes technological ingenuity through non-price criteria and the United Kingdom's Contract for Difference (CfD) mechanism, which guarantees long-term price stability by indexing payments to wholesale electricity prices, offer complementary lessons. The Dutch model drives down levelized costs by fostering competition in efficiency gains, and the CfD system mitigates financing risks through 15-year revenue certainty, which can be critical for China’s capital-intensive deepwater projects. China could structure auction criteria to reflect regional priorities, allocating greater emphasis to technical merits in ecologically sensitive zones and prioritizing price competitiveness in mature industrial clusters. This dynamic calibration would reward projects that align with national decarbonization targets while maintaining market-driven efficiency.

Robust spatial planning and ecological safeguards are essential to balancing offshore wind expansion with marine conservation. In December 2024, China announced depth and distance requirements, as well as ecological regulations for new offshore wind projects. Centralized marine spatial planning can play a pivotal role in this transition by identifying suitable development zones based on wind resource availability, ecological sensitivity, and proximity to grid infrastructure. Linking project development to habitat restoration efforts, similar to Germany’s biodiversity compensation models, can align offshore wind expansion with marine conservation goals. This integrated approach helps to ensure that site selection and project development are both environmentally responsible and strategically aligned with national priorities.

Support for industrial-academic collaboration may accelerate technology development, particularly in areas such as typhoon-resilient floating platforms and AI-powered predictive maintenance. Partnerships involving major developers and research institutions, such as state-owned enterprises China Three Gorges Corporation and State Power Investment Corporation, and private wind turbine manufacturer MingYang Smart Energy, have the potential to strengthen innovation ecosystems. These collaborations can help bridge research and commercialization, positioning China at the forefront of offshore wind innovation globally.

About the Solar and Wind Trackers

The Global Solar Power Tracker is a worldwide dataset of utility-scale solar photovoltaic (PV) and solar thermal facilities. It covers all operating solar farm phases with capacities of 1 megawatt (MW) or more and all announced, pre-construction, construction, and shelved projects with capacities greater than 20 MW. The Global Wind Power Tracker is a worldwide dataset of utility-scale, on- and offshore wind facilities. It includes wind farm phases with capacities of 10 megawatts (MW) or more.

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape and creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Follow us at www.globalenergymonitor.org, on Twitter/X @GlobalEnergyMon, and Bluesky @globalenergymon.bsky.social.

Media Contact

Mengqi Zhang

Researcher