Solar’s opportunity to reclaim coal’s footprint

Coal was once billed as the “buried sunshine” of a prehistoric past. But the world has now entered an age of solar energy — a time when harnessing the sun has become more accessible, affordable, and environmentally sustainable than digging it up in fossil fuels. In 2024, the world installed a record-breaking 599 gigawatts (GW) of solar capacity, and currently has more than 2,000 GW of utility-scale solar projects in development. But that requires widespread land use, and today's developers often struggle to secure prime locations that aren’t already in use, or off limits.

What looks ideal on a solar map can prove impractical on the ground. But vast tracts of scarred landscapes already sit idle in much of the world waiting for a second act — abandoned coal mines.

Global Energy Monitor (GEM) conducted a worldwide survey of surface coal mines closed in the last five years (since 2020) and those forecasted to close over the next five (by the end of 2030). The first-time analysis shows that over 300 surface coal mines recently out of commission could house around 103 GW of photovoltaic (PV) solar capacity, and upcoming closures of large operations could host an additional 185 GW of solar across 127 sites (see Methodology). These abandoned coal mines are predisposed to renewables siting with grid-adjacent and even pre-cleared acreage.

If these potential solar projects came to fruition, the world could build almost 300 GW of solar capacity on mined out lands by the end of 2030. Uptake on that scale is equal to 15% of the solar that has already been built globally and would add enough solar capacity to inch the world one step closer to tripling renewables before the end of the decade.

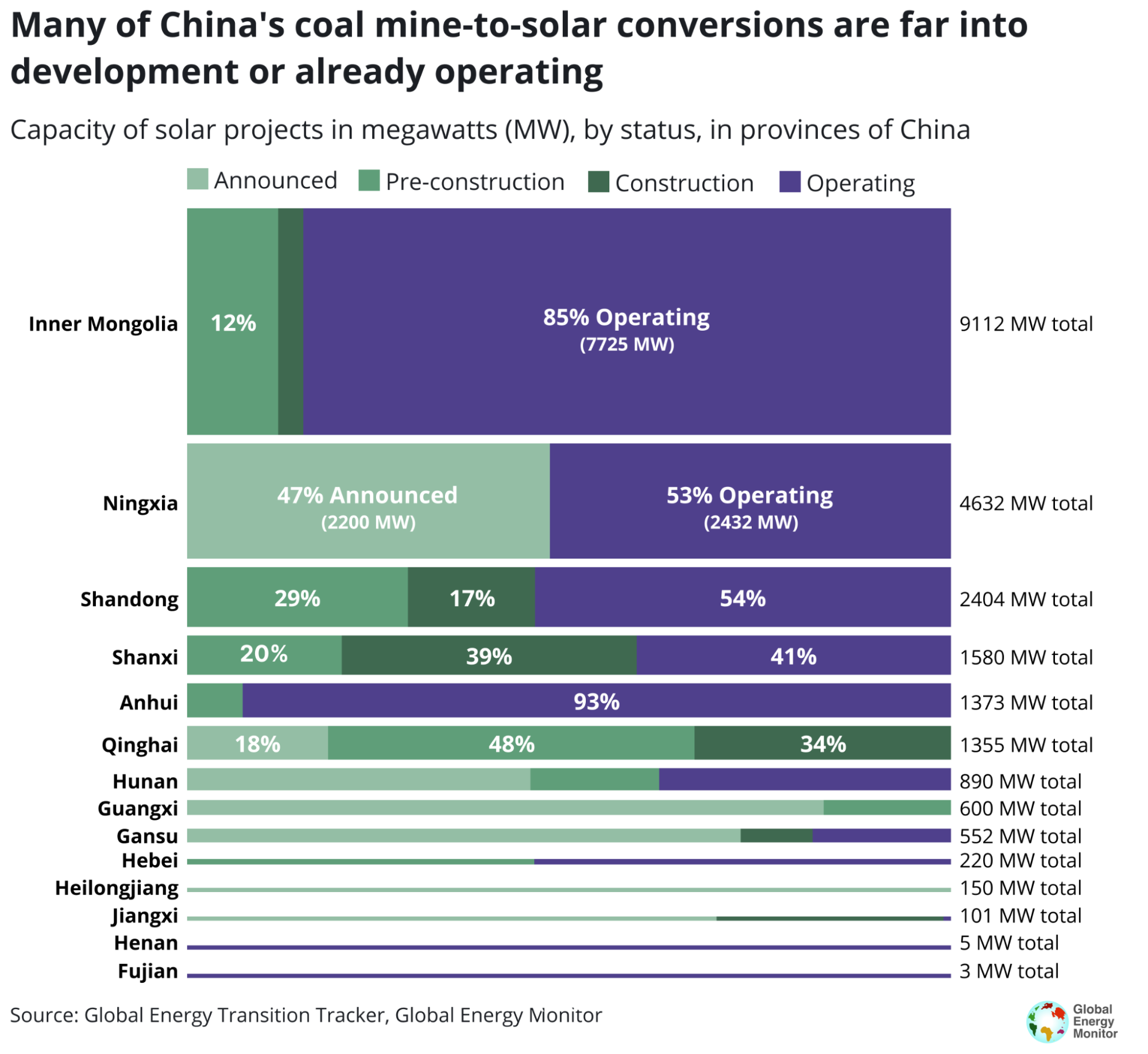

Some of these projects are already underway. GEM’s new data on coal-to-solar projects show that China has 90 operational coal mine-to-solar conversions, with a capacity of 14 GW, and 46 more projects, with 9 GW, in planning.

The coal-to-solar transition offers a rare chance to repair the environmental hazards and eyesores of open pits and generate an estimated 259,700 permanent jobs in the solar industry — five times more than the current coal mining workforce of the United States. During construction, these projects would also create even more temporary construction jobs (317,500), which together is more than the number of workers that the coal industry is expected to shed globally by 2035. Constructing solar on upheaved lands isn’t just land reclamation — it’s a chance to align land restoration, clean energy goals, and local job creation.

And that’s just the beginning of possibility. While recent closures are the likeliest candidates for new development, plenty of other closed mines may still be in suitable condition. The world has closed over 6,000 coal mines since 2010, most of them in China during the coal industry’s restructuring and in the U.S. where economic headwinds forced operators to slash their 1 billion tonne industry in half. The earlier closures happened, the harder it is for developers to trace ownership tenures and infrastructural changes that could impede future repurposing, though it is still possible to scrutinize project viability on a site-by-site basis.

Key findings

- A nation’s worth of solar potential: Developers could build almost 300 GW of photovoltaic solar capacity on open pit coal mines that closed over the past five years (since 2020) and those expected to close over the next five (by the end of 2030) — roughly what it takes to meet the annual electricity consumption needs of a country like Germany, and the projects currently operational or in development represent only a small fraction of this vast potential

- Grid-ready sites: Nearly all abandoned coal mines and upcoming closures are in close proximity to existing grid infrastructure, including substations and transmission lines — 96% of recently abandoned mines are less than 10 km from the grid, and 91% are within 10 km of a grid connection point, such as a substation.

- Job dividends: 259,700 permanent jobs could be created at coal-to-solar transition sites in manufacturing, wholesale trade and distribution, and professional services, and an additional 317,500 temporary and construction jobs, which is together more than the number of workers that the coal industry is expected to shed globally by 2035.

- China’s buildout: China has the most projects underway, with 90 operational coal mine-to-solar conversions, a capacity of 14 GW, and 46 more projects in planning, a capacity of 9 GW.

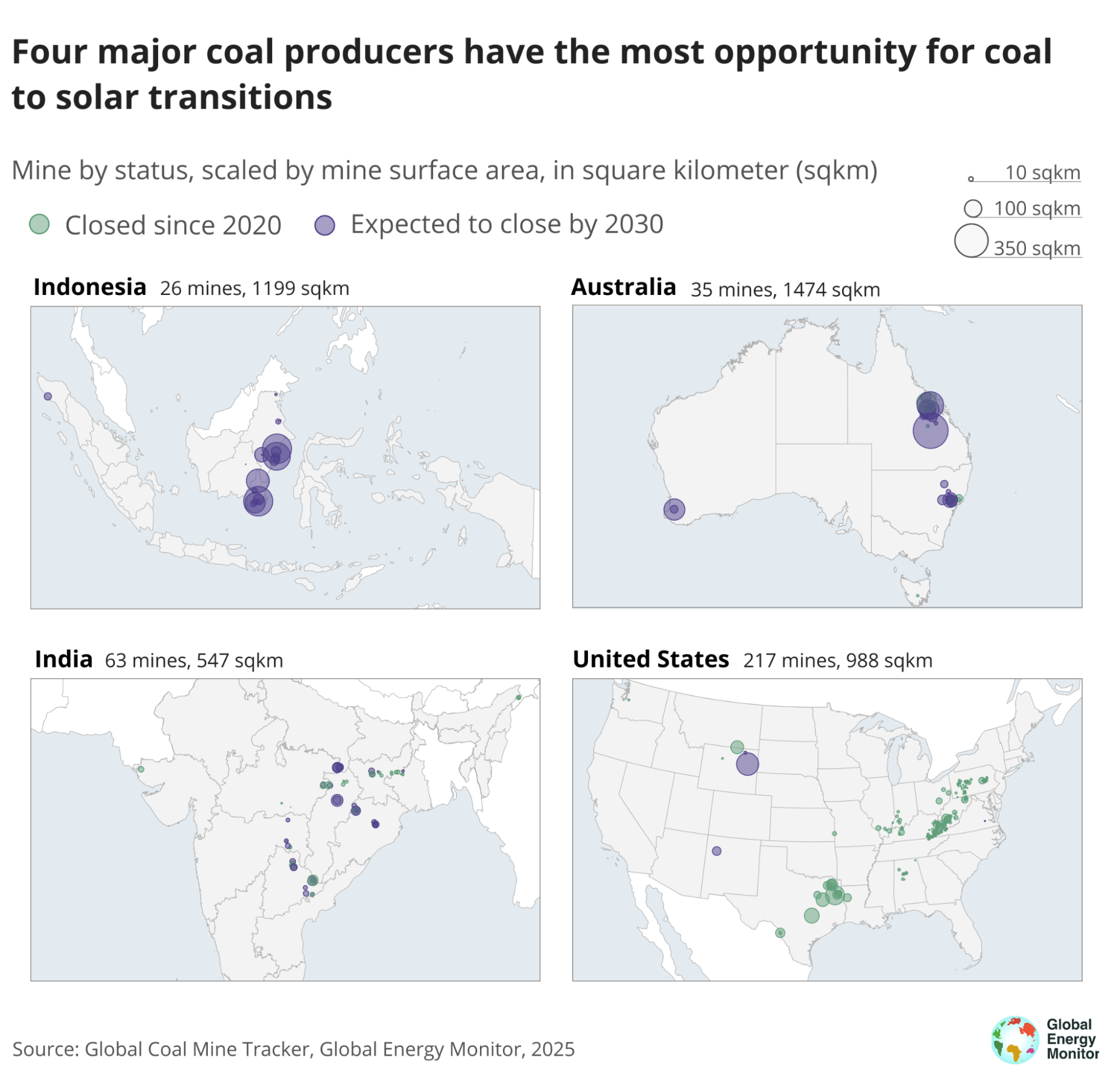

- Transitions that matter: The coal-to-solar transition is primed in both advanced and developing coal economies, including Australia, Indonesia, the United States, and India.

Figure 1

Coal’s dirty footprint

The coal industry remains a stubborn fixture in the global energy mix, even as it experiences a bust in its historic markets. With the industry’s decline has come a rash of mine closures in recent years — more than 700 underground and surface operations shuttered since 2020. With phaseouts in motion, government climate goals, and economic unviability, coal mine closures will keep mounting in the years ahead.

Today, 3,800 coal mines produce 95% of the world’s coal. With national commitments to phase out coal in 33 countries, the industry will leave behind hundreds of abandoned mines and eventually thousands once mega producers China and India chip away at the industry.

But when coal mines shutter, they leave behind large swaths of degraded and abandoned lands. The coal industry is land hungry in terms of the sheer acreage required to produce a megawatt of energy. Some surface mines are large enough to span an entire metropolitan area.

Figure 2 Source

While no agency publishes figures on the number of square kilometers (km²) eaten by coal mining, one team of academics at Vienna University used satellite imagery and machine learning to reported that the world has over 101,583 km² of mined out land and processing sites related to coal, copper, and gold, including open cuts, tailing dams, waste rock, waste ponds, and processing sites. These sites include long abandoned operations and sites ill-suited for repurposing. But coal contributed over half (52.5%) of all mineral fuels extracted in 2023, producing over 8 billion tonnes. The open pit mines alone are only part of the problem: The coal mine industry also disturbs the vicinity around mines for processing, transportation, sludge storage, and power.

After mining, cleanup or reclamation initiatives help restore these vast acreages to prior conditions. But the practice of reclamation and cleaning up the mess after mining is not a standard routine in much of the world. The United States passed federal reclamation laws in the 1970s, but those policies have lost their teeth over time, and today over 4,000 km² remain gouged out and unreclaimed. Under some state and national laws, mining companies are required to set aside funds to safely decommission sites once operations end. But as a global practice, this cleanup rarely happens. Without a profit motive to remediate, and weak government enforcement, many companies simply walk away — leaving behind unstable land and unmet obligations. As such, old mining sites have become prone to hazards and accidents, including in Indonesia, one of the largest coal producers, due to lack of enforcement for rehabilitation obligations.

Opportunity where coal once stood

Where coal once characterized local histories, solar now offers a chance to power the future. The utility-scale solar industry, the fastest growing energy technology in history, requires a large amount of real estate for PV farms. One of the oldest criticisms of solar is the land use requirements for ground-mounted installations. While many of those criticisms have proven overblown, there are nonetheless many legitimate examples of unjust and environmentally harmful land usage from deploying utility-scale solar infrastructure. The residents of Bianjiaqu, Shanxi in China, for instance, have alleged that a solar developer ignored citizen concerns during negotiations, damaged collectively-owned fertile land, and provided insufficient compensation. As solar developers provoke backlash in some corners of civil society, repurposing already-disturbed land, such as former coal mines, can help reduce or avoid conflict over land use.

GEM’s Global Coal Mine Tracker, a comprehensive dataset of coal mines, has identified 311 surface coal mines that have been idled and degraded since 2020. These abandoned mines sprawl over 2,089 km², an area nearly the size of Luxembourg. With repurposing, these coal-to-solar projects could site 103 GW of solar power capacity on derelict lands.

GEM’s analysts further identified 3,731 km² that may be abandoned by operators before the end of 2030, owing to reserve depletion and the reported life of the mine. If these operations close, they could site 185 GW of solar power capacity.

Over the course of the 2020s, some 446 coal mines and 5,820 km² of abandoned mine lands, in total, could be suitable for solar repurposing. With development, these projects could harbor nearly 300 GW of PV solar potential, equivalent to 15% of the globally installed solar capacity.

Figure 3

Figure 4

When coal mines are repurposed for solar, the results can range from small community arrays to large utility-scale projects. The size of the buildout influences the cost, complexity, and political landscape. Smaller projects (1–5 MW) can be quick wins, plugging into local distribution lines to power schools and neighborhoods, often with strong local support. They carry higher costs per megawatt and usually need creative financing such as bundling multiple sites into a single portfolio. But small projects have a considerably better chance of progressing in areas where big projects will never break ground. The mid-sized solar projects (5–50 MW) mix ambition with feasibility — big enough to attract corporate buyers and competitive investment but still small enough to tap into existing grid infrastructure without major upgrades. Mega projects over 100 MW often require transmission buildout, vast land preparation, and serious patience. But for coal communities looking to make an energy transition once and for all, these large utility-scale projects can radically transform communities into clean energy hubs.

The coal mines identified for repurposing between 2020 and 2030 offer a wide range of solar opportunities. About one-third of the 438 coal mine sites are suitable for community-scale solar projects, whereas the majority are capable of supporting larger, utility-scale solar developments. Nearly 70% possess land areas suitable for solar projects exceeding 50 MW and more than 200 coal mine sites are estimated to have a solar potential greater than 100 MW. Around 10% of the total potential coal mines are projected to have a solar capacity exceeding 1,000 MW. Coal mines with an estimated solar potential under 5 MW represent just 8% of the total, while those between 5 MW and 50 MW comprise about a quarter of the opportunities (24%).

In most cases, abandoned coal mines are adjacent to grid infrastructure, including transmission lines and substations. For recently closed mines, 96% are within 10 km of the grid and 91% are within 10 km of a grid connection, such as a substation. For operating mines expected to close before the end of 2030, 87% are within 10 km of the grid and 76% are within 10 km of a grid connection. These mines are so close to the grid that renewable developers have even investigated the locations for large-scale battery storage. Some sites have also been explored for green hydrogen production. The proximity to the grid can make these coal-to-solar projects more cost-competitive.

But converting steady, baseload coal power to variable solar power typically requires targeted upgrades in grid infrastructure. Solar power requires battery storage, grid-forming inverters, or synchronous condensers to maintain frequency and voltage support. As a result, technological upgrades are often needed to a grid built for fossil fuels, so that it can handle the fluctuations in solar generation. And even with infrastructure in place, many projects must complete new interconnection studies and permitting processes to ensure the system can reliably accept renewable power.

Figure 5

Where the ground is ready

The coal industry leaves behind an enormous area of untapped potential once production ends. During the height of the global Covid pandemic, in 2021, nearly 1,164 km² was abandoned, corresponding to an unrealized solar potential of 58 GW. But a second peak is projected in 2030, when over 700 km² of mine lands are expected to close based on mine-level forecasts, equivalent to an estimated solar potential of 36 GW.

Figure 6

Coal’s footprint has sunk deepest in the very places where clean energy remains an urgent need. The world’s largest coal producers — Australia, Indonesia, the United States, and India — hold some of the greatest potential for solar redevelopment on mine lands. But a total of 28 countries with recently abandoned surface coal mines are suitable for repurposing, representing a total potential solar capacity of 288 GW.

The opportunity to align reclamation with renewable energy buildout is evident in high-income countries and middle-income nations. In South Africa, for example, 20 identified coal mine sites could support nearly 13 GW of solar, twice as much as the country’s currently installed capacity, offering a way to accelerate the country’s clean energy goals while repurposing lands scarred by extraction. The sprawling German lignite mines could host over 4 GW of solar, which is a small share of the country’s total solar capacity, but a significant stride for a coal-dependent region.

In Australia alone, more than 1,470 km² of mine sites could support over 73 GW of solar capacity, roughly double the country’s entire current solar fleet. Indonesia’s coal mines offer space for nearly 60 GW of potential solar, 100 times more than the currently installed capacity, while the United States stands out not just for its capacity (49 GW) but for the sheer number of identified sites — 217 in total. In India, over 500 km² of mine lands could host more than 27 GW of solar, about 37% of currently installed capacity, offering a critical opportunity to advance clean energy targets while supporting reclamation in coal-heavy regions like Jharkhand and Chhattisgarh.

Figure 7

The establishment of clear regulatory frameworks for rehabilitating former coal mining sites is crucial to ensure an equitable transition. This is especially urgent in countries such as the United States, Canada, Russia, Germany, Serbia, Poland, the Czech Republic, the United Kingdom, and Slovenia, which have a large number of abandoned mines. In the United States, Texas, Kentucky, and West Virginia have already initiated several coal mine conversion projects, led by both governmental initiatives and private stakeholders (see Coal-to-solar in action).

Figure 8

But rehabilitation policy remains necessary in coal-heavy regions with forthcoming closures. Queensland and New South Wales in Australia, as well as East and South Kalimantan in Indonesia, are likely to have substantial land areas released from coal mining activities within the next five years, much of it suitable for solar development. Several of these regions have already initiated pioneering projects or implemented policies for repurposing these mines to solar energy at the subnational level (see Coal-to-solar in action).

Figure 9

Since sun exposure is clearly a prerequisite for successful solar installations, one key advantage of former surface mines is that they are largely cleared of tall vegetation and often sit on open plateaus.

But the installation of solar power capacity is only one measure of progress. Building solar on former coal mines creates jobs, makes abandoned lands safer, and tackles coal sector methane leaks that might otherwise linger for decades.

The work of the transition

The path to a just energy transition runs through the heart of coal country — 2.7 million coal miners are directly employed at the world’s operating coal mines. But these workers face the harsh prospect of job layoffs due to scheduled mine closures and a market shift toward cheaper wind and solar power generation, whether or not their home country has a coal phaseout policy in place. GEM’s previous research has found that the coal industry is expected to shed nearly half a million jobs in the mining sector by 2035, affecting on average 100 workers per day. The coal industry itself shoulders responsibility for the sector’s unpredictable future, yet GEM noted that most mines expected to close in the coming decades have no planning underway to extend the life of those operations or to manage a transition into a post-coal economy. In the United States, the coal mining sector employs fewer than 50,000 workers.

The clean up of degraded lands creates jobs in mining communities. Reclamation calls for the same brute machinery as mining, except workers undo the damage. Crews reset topsoil at old mine sites to cut down on contamination, bring back wildlife, and sometimes take on bigger civil works or community-building efforts.

Once cleanup is finished and solar installation begins, 1 MW of installed utility-scale solar, on average, creates 2.1 jobs, including permanent and temporary construction employment in advanced economies. The operations and maintenance at solar farms, including panel cleaning, inverter maintenance, and vegetation management, may require additional work, depending on site conditions, including inspecting water treatment systems or ground settling.

The boom in solar jobs continues to lead the energy sector, with about 500,000 new solar jobs created globally in 2023. In the short term, a rapid buildout of solar on existing and anticipated mine closures could provide 259,700 permanent jobs, and 317,500 temporary and construction jobs globally. While the number of permanent jobs is not nearly enough to offset mining job losses, especially in China and India, they can provide a “lifeline” to communities sorely in need of a just transition.

Addressing physical and emissions hazards

Turning old coal mines into solar farms goes beyond clean power or paychecks — it’s also a way to heal the land and address the emissions that coal left behind.

Bringing a coal mine back from ruin is no easy task. As with many derelict landscapes, clearing debris, scrap materials, or remnants of past industrial activity is required before work can safely begin. With deep surface mines, slopes are often unstable and prone to erosion and collapse. Pits can fill with toxic runoff and coal ash, and other industrial wastes can leach into nearby waterways. The mine's safety infrastructure in fencing, signage, and drainage can break or go missing with neglect. These sites become hazardous to the environment and to local communities left to live in the wreckage. The improper care of abandoned mines has led to dangerous conditions, including sinkholes under neighborhoods and parks in Pennsylvania, the evacuation of entire towns and villages in Shanxi, China, deadly roof cave-ins at mines illegally operated after closure in India, and ongoing water and agricultural pollution in South Africa.

Reclamation helps make the land safer for solar industry workers and surrounding communities. These restoration processes can stabilize unsettled ground, mitigate hazardous zones, and restore healthier soil layers. Adding solar infrastructure on top reinforces that process, keeping the land in productive use while reducing the risk of erosion and runoff pollution. Instead of abandoned scars on the landscape, these sites become managed, monitored spaces — cutting down on environmental hazards and offering a safer footprint for the communities around them. Within China, subsidence areas of some former coal mines, particularly in Shanxi and Inner Mongolia, have already been converted into large-scale solar farms under government-led pilot projects. These transitions are especially crucial as abandoned mines become more common with the rundown in the coal market and phaseout of coal.

Beyond the local environment, coal-to-solar projects can help tackle an imminent climate threat — methane emissions from abandoned seams. When a coal mine is closed, methane emissions from exposed coal seams and fractured rock can continue to leak for years unless operators take proactive mitigation measures. Slashing methane is one of the fastest, most effective ways to slow global warming in the short term. But one GEM analysis found that recently abandoned underground mines in the EU collectively emit nearly 200,000 tonnes of methane per year, equal to the emissions from the Nord Stream gas pipeline leak. The actual emission levels remain largely unchecked and unreported in many countries due to legal ambiguities over accountability for abandoned sites, incomplete information about the profiles of abandoned mines, and the absence of a comprehensive Monitoring, Reporting, and Verification (MRV) framework.

The methane emissions at abandoned surface operations are even more difficult to measure because they are diffuse with low concentrations. Yet proper reclamation procedures could reduce these long-term leaks. Installing a solar farm typically requires covering the site with soil, gravel, or other materials to stabilize the ground and prevent subsidence. This process acts as a physical barrier, reducing oxygen infiltration and sealing methane pathways, which slows or blocks the release of gas into the atmosphere.

What stands in the way

While the technical potential is high, the actual buildable area depends on legal and ecological factors. When mining happens in forested areas or sensitive ecosystems, for instance, legal requirements could require the developers or state to return the land to something close to its original condition. Building solar might not initially qualify, but if a solar project is seen as a public benefit or part of a clean energy strategy, then post-mining land use plans could be updated and amended to reflect those needs.

One common hurdle to building solar projects on former coal mines is identifying land owners. When coal operations close, companies often unload properties to junior firms or file for bankruptcy. The change in ownership makes it difficult to track control of land titles over time. If a coal company reclaims the land after mining, then solar development must still wait until the coal firm releases its bond and the rights return to whoever held it first, which may be another mining company, a landholding firm, or a longtime community landowner. That said, mine lands are frequently owned by a single entity, which means once the contiguous owner leases or sells, a project can proceed relatively quickly compared to greenfield development projects, which require acquiring large tracts of land under fractured property regimes and multiple owners.

But it is essential for states and developers to establish a transparent and equitable land rights return process. In India, the country with the fourth-largest potential for coal mine-to-solar transitions, many closed coal mines have remained idle for years due to the absence of clear policies governing closure and the return of land rights. In many instances, these abandoned mines, often not officially closed, are directly transferred to renewable energy or afforestation projects, bypassing the return of land to local communities. Addressing this issue is critical to prevent the replication of unjust land ownership regimes in the renewable energy sector.

GEM’s Global Coal Mine Tracker provides data on the last known coal owner and parent company at abandoned coal mines. The transfer of coal properties is one reason this analysis focuses on recent closures, rather than all abandoned mines over decades — there is less time for property transfers and easier paths to pinpoint the ownership chain.

Figure 10

Coal mines have complicated ownership structures, with a mix of corporate, government, and financial entities. But parent companies in the sector remain highly concentrated. Just ten owners are responsible for over half (57%) of the land area abandoned by coal mining since 2020.

Within some jurisdictions, permitting coal-to-solar projects may prove burdensome, since developers may need to simultaneously deal with mining authorities, environmental regulators, local zoning boards, and electric grid regulators. This patchwork can lead to a lengthy timeline to secure all permits and increase front-end legal and consulting costs. There might be uncertainty within some agencies about classifying a solar farm as an acceptable “post-mining land use,” for instance, which could require changes to the reclamation plan or special exceptions. On the other hand, in Germany’s lignite mining regions, government authorities have already simplified the process, recognizing the urgency of the energy transition.

But the biggest obstacle remains the associated capital costs with coal-to-solar transitions. Developing solar farms on abandoned surface mines typically costs more per megawatt than building on greenfield sites, largely due to the complex conditions left by mining activity. While the weighted cost for utility-scale solar, including on greenfield sites, runs near US$1.5 million per MW, projects on former mine lands often exceed these figures because of remediation needs such as fixing soil instability, uneven terrain, and infrastructure gaps.

Thanks to plummeting solar module prices and improvements in efficiency, utility-scale solar now has one of the lowest Levelized Cost of Energy (LCOE) of any generation source. The LCOE is a common metric that spreads a project’s total costs over its lifetime energy output, providing a dollar per megawatt hour ($/MWh) value. While building a solar farm on a coal mine could require a slightly higher LCOE compared to an ideal greenfield project, public subsidies and incentives (like tax credits in the U.S.) can create economics that outperform greenfield projects. If grid interconnection is efficient, for instance, and the land is cheap, those factors can neutralize the cost differential.

But creative financing may be needed to get these projects off the ground, including public incentives, green banks, or community investment. Given the “known unknowns” of former mining lands, some traditional financing mechanisms may prove more difficult to secure or come with higher interest rates and insurance costs. Some small-scale solar projects (1–20 MW) might not even attract large investors, since transaction costs are similar to large projects but with lower rates of return.

Despite the potential premium, solar development on mine lands remains a compelling strategy. These projects provide the potential to link reclamation with economic renewal in coal-affected regions. Redeveloping such sites supports local livelihoods and helps mitigate social and environmental harms. With appropriate siting on former strip mines, the development process can become more stable and efficient, helping to attract interest from solar developers.

Solar can take coal’s place, if challenges are addressed

Despite real challenges to coal repurposing, there are plenty of reclamation success stories. The work is underway among many of the world’s major global solar developers and state and national governments that have pursued coal-to-solar co-location projects. GEM has compiled preliminary data on at least 100 active coal-to-renewable transition projects globally (including 41 former coal mine sites), with additional projects being announced each month. Thirty-seven of these initiatives involve converting coal mines into solar energy facilities. GEM also maintains a more comprehensive dataset on China’s coal mine-to-solar transitions, as project names often reference their fossil fuel origins.

Figure 11

Back in 2021, the German power company RWE and Greece’s state-owned PPC launched Meton Energy, a joint-venture dedicated to installing 2,000 MW of solar electricity on Greece’s lignite fields. As of April 2025, nine projects totaling 940 megawatts peak in direct current (MWp/dc) have been sited on the footprint of the Amynteo opencast mine in Western Macedonia. Five projects have been completed and are generating power, with four more expected to be operational by the end of 2025. An additional 567 MW of solar will be commissioned in 2027 in Central Macedonia. These mine areas are within a short distance of existing transmission infrastructure, allowing for speedier deployment and evacuation of solar resources to populations throughout Greece.

China, the world’s largest producer and consumer of coal, is also making large investments in coal-to-solar transitions. Shanxi, the coal-producing region located on the Loess Plateau with abundant solar resources and vast areas of land, has a robust pipeline of solar projects that are to be built on mine subsidence land. In 2024, the provincial government announced that three projects totaling 5,000 MW will be installed in the city of Datong’s subsidence zones. The projects will be online in 2026 and 2027. These projects are in addition to the existing 1,000 MW of solar operating on approximately 200 km² of former coal mine land. Meanwhile, wind, solar, and storage projects totaling 6,000 MW will be delivered to customers in Beijing, Tianjin, and Hebei provinces via the Datong-Tianjin ultra-high voltage power line, and Yangquan City has installed 950 MW of solar across 4,570 km² of subsidence land.

Inner Mongolia’s 14th Five-Year Plan on Renewable Energy established a target of 5,000 MW of solar installed on former coalfields in Erdos, Tongliao, Wuhai, Alxa, Bayannur, Baotou, and other areas with stable geological conditions and acceptable access conditions. Inner Mongolia is already home to China’s largest operating mine-to-solar project, the 3 GW Inner Mongolia-Shandong Power Export Ordos Mined-Out Area (China Energy Investment) solar farm.

Figure 12

Solar is only the beginning

While solar panels often lead redevelopment on old mine lands, many projects are stacking uses, combining power generation with storage, grazing, and ecological repair. Renewable energy developers in Australia, for instance, have begun to reimagine underground mining operations. The New England Renewable Energy Zone (REZ), in New South Wales, for instance, has garnered interest from investors due to its potential for pumped hydropower storage and its existing transmission lines connected to population centers in Upper Hunter, Queensland, and New South Wales’ eastern coast. This storage complements the generation capacity planned in the South West Renewable Energy Zone , which is located in southern NSW and is ripe for wind and solar development. With an initial target of 2,500 MW of wind and solar capacity in the South West REZ, expressions of interest from developers included proposals for 34,000 MW in generation and storage projects. These projects will leverage existing and in-development transmission capacity to evacuate power. Together, both REZs are expected to create an estimated 10,000 jobs across construction and operations and spur over US$17 billion in private investments.

These projects have turned remnants of the fossil era into storage tools for the energy transition. Some sites have been converted for pumped hydropower or compressed air energy storage, using mine shafts and voids to hold and release power on demand. India’s Ministry of Coal, for instance, is assessing over 20 abandoned mines for potential pumped storage development, consulting with stakeholders about business models. Likewise, in Australia, a collaboration with Glencore to establish energy storage infrastructure in Queensland, capable of storing 2 GWh of energy, would be sufficient to power around 120,000 households. The industry has also tapped geothermal heat from flooded tunnels for low-carbon heating and cooling. In the UK, the government is exploring geothermal potential in over 100 flooded coal mines, utilizing naturally heated water for heat pumps, with successful applications at the Gateshead Mine. One US$2 million study is assessing the feasibility of using geothermal heat from mine water to provide heating for over 100,000 homes in the West of England. There are reportedly early stage projects exploring gravity-based storage, underground hydrogen reserves, and battery installations within mine spaces. In some cases, mines have been considered infrastructure for energy-efficient data centers or for carbon sequestration. Together, these efforts show how the infrastructure of extraction can be reworked to serve the next generation of energy systems.

Just as underground mines are being reimagined for storage and clean energy, former surface mines also offer potential far beyond solar panels. In areas with suitable geology, surface mines may also be candidates for pumped hydro storage, using reshaped pits as reservoirs. Others are being considered for agrivoltaics, combining solar development with grazing or crop production, or as sites for native habitat restoration alongside energy generation. China has built the world’s largest sites of floatovoltaics, where floating PV is built on a collapsed coal mine that was filled with water — a 70 MW array covering 63 hectares of a former pit lake.

One of the most successful examples of agriculture on reclaimed mine lands comes from replanting native grasses, wildflowers, and pollinator meadows, bringing life back to mined landscapes. In the U.S., the Appalachian Botanical Company has been cultivating lavender on approximately 50 acres of reclaimed coal mine land in Boone County, West Virginia. Lavender, well-suited to dry, rocky soils, flourishes on this reclaimed ground. The company also keeps bees on site, producing honey while boosting pollinator habitats. Meanwhile, in the U.K., projects like the Dearne Valley Green Heart and the National Coal Mining Museum have turned former colliery grounds into thriving meadows. Together, these efforts help revive the land and create jobs for local residents, including those facing employment barriers.

Conclusion: The promise of renewal

The legacy of coal is written into the land — open pits, buried seams, and abandoned sites that still shape local economies and environments. But that legacy does not have to define the future. Whether in Queensland’s sprawling fly-in-fly-out open pits to the rolling spoil piles of Kalimantan, these sites hold more than the memory of extraction; they hold space for renewal. Repurposing mine lands for solar development offers a rare chance to bring together land restoration, local job creation, and clean energy deployment in a single strategy.

The coal-to-solar opportunity is not theoretical. The world’s largest coal-producing regions hold the greatest potential for solar development on disturbed lands, in those places where grid connections often already exist, where skilled labor forces stand ready, and where reclamation is urgently needed. But realizing this potential will take deliberate action. The transformation will require policy frameworks that prioritize renewable development on mine lands, investment strategies that recognize the value of linking reclamation with clean energy, and community engagement that puts local jobs and local voices at the center of the work. But with the right choices, the same ground that powered the industrial age can help power the climate solutions we now urgently need.

About the Global Coal Mine Tracker

The Global Coal Mine Tracker is a worldwide dataset of coal mines and proposed projects. The tracker provides asset-level details on ownership structure, development stage and status, coal type, capacity, production, workforce size, reserves and resources, methane emissions, geolocation, and over 30 other categories.

The most recent release of this data in May 2025 includes operating mines producing 1 million tonnes per annum (mtpa) or more, with smaller mines included at discretion. The tracker also includes proposed coal mines and mine expansions with various designed capacities.

About the Global Solar Power Tracker

The Global Solar Power Tracker is a worldwide dataset of utility-scale solar photovoltaic (PV) and solar thermal facilities. It covers all operating solar farm phases with capacities of 1 megawatt (MW) or more and all announced, pre-construction, construction, and shelved projects with capacities greater than 20 MW.

The most recent release of this data was in February 2025.

Media Contact

Ryan Driskell Tate

Associate Director