Evaluating progress toward 2030 iron and steel decarbonization goals

Pedal to the Metal is an annual survey of the current and developing global iron and steel plant fleet. The report examines the status of the iron and steel sector compared to global decarbonization roadmaps and corporate and country level net zero pledges.

This year’s analysis draws from GEM’s Global Iron and Steel Tracker (GIST) — formerly the Global Steel Plant Tracker and Global Blast Furnace Tracker — and the Global Iron Ore Mines Tracker (GIOMT). Together, these tools provide detailed, asset-level data on over 1,200 plants and nearly 900 iron ore mines worldwide.

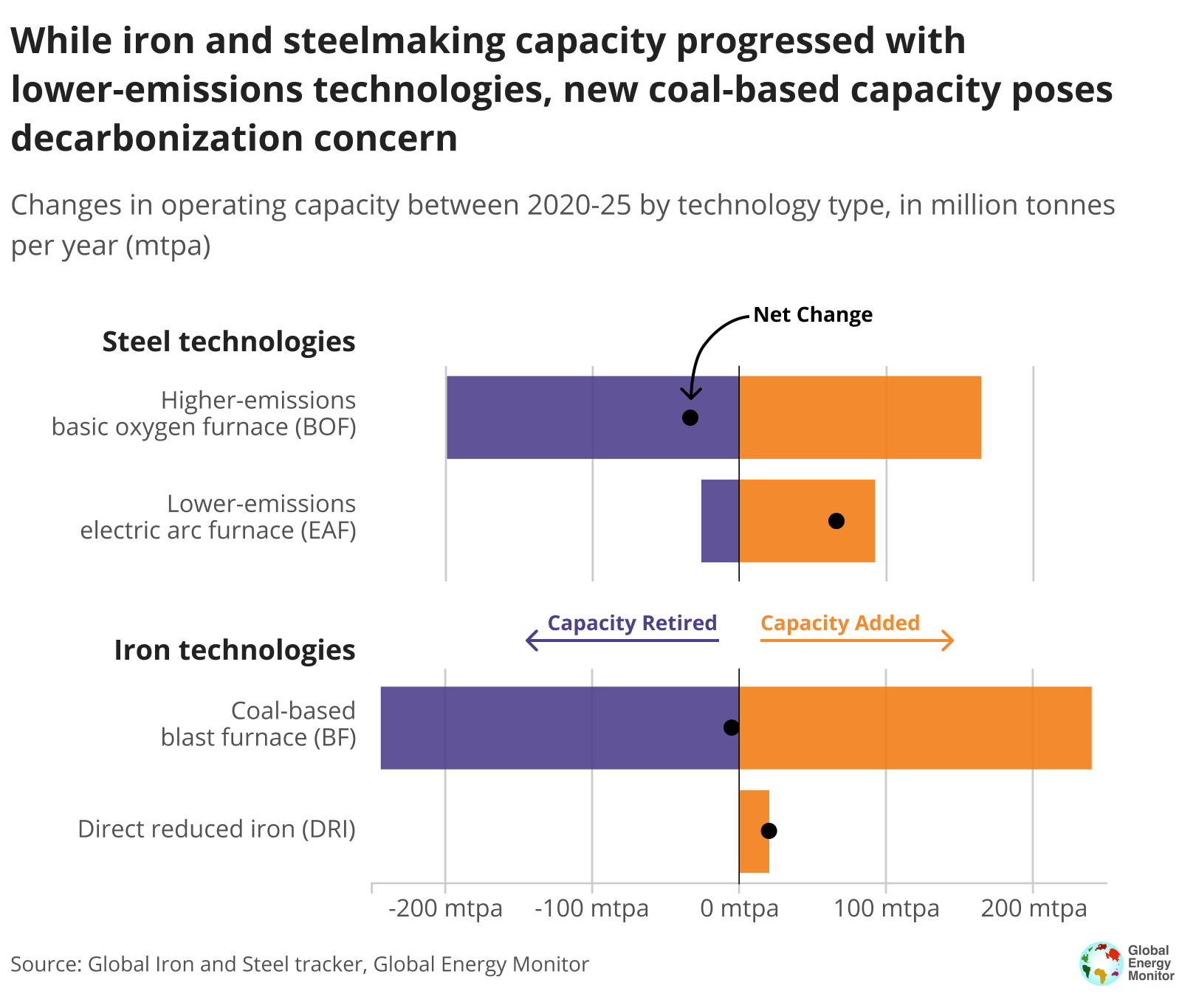

Cleaner technologies are rising, but coal still dominates

Electric arc furnace (EAF) capacity has grown nearly 11% since 2020, with another 24% increase projected by 2030. Half of all steelmaking capacity under development plans to use EAF technology, much of it integrated with direct reduced iron (DRI) — a process that uses gas, rather than coal, to produce iron before it’s melted into steel in an EAF.

DRI also represents a growing share of new ironmaking capacity, rising to 42% of developments, compared to just 10% of current operating capacity.

If current developments and retirements proceed, the global fleet could reach 36% EAF steelmaking by 2030, just shy of the IEA’s 37% target — a key benchmark for greening one of the world’s most polluting industries. Whether that milestone is met will depend largely on India’s direction.

India’s choices will shape the future of steel

India’s choices will be decisive in determining whether the global steel sector reaches 37% electric arc furnace (EAF) production by 2030 as the country now dominates global steel development plans.

India has overtaken China as the top developer of new steel capacity and now accounts for 57% of all coal-based BOF capacity under development. Its total steel development pipeline stands at 352 mtpa, more than a third of the global total — yet only 8% of these projects have entered construction. By contrast, China has already begun construction on 46% of its development pipeline.

Much of India’s steel buildout remains concentrated in coal-based technologies. The country also has significant coal-based rotary kiln DRI capacity — much of it at smaller plants not tracked in GEM’s dataset — further compounding its emissions profile. Despite growing international and domestic awareness of the need for clean steel, India has yet to translate that urgency into concrete action.

This gap between ambition and execution presents a turning point. India’s buildout of new coal-based capacity risks locking in decades of emissions — but with much of this capacity still in early planning stages, there’s an opportunity to pivot toward lower-emissions pathways.

India is now the bellwether of global steel decarbonisation. If the country does not increase its plans for green steel production, the entire sector will miss an important milestone. So goes India, so goes the world.

Astrid Grigsby-Schulte, Project Manager of the Global Iron and Steel Tracker at Global Energy Monitor

Cleaner steel plans advance, but construction lags behind

While India’s trajectory looms large, the broader picture shows that global plans for cleaner steelmaking are growing — even if implementation is still lagging.

Many upcoming projects include integrated direct reduced iron (DRI) and electric arc furnace (EAF) production. DRI now accounts for 42% of ironmaking developments — a notable rise from earlier in the decade. Even so, DRI development has fallen behind global decarbonization goals.

While EAF-based capacity now makes up 50% of all projects in development, less than a third of that is under construction. Meanwhile, 46% of steel projects that have broken ground are still BOF-based, showing that emissions-heavy infrastructure is still advancing.

Australia and Brazil have a green ironmaking opportunity

While much of the global spotlight is on India, other countries also hold outsized influence in shaping the trajectory of clean steel — particularly upstream in the supply chain.

GEM’s Global Iron Ore Mines Tracker (GIOMT), launched in 2024, maps nearly 900 iron ore mines and underscores how Australia and Brazil are uniquely positioned to shape the future of green ironmaking due to their large iron ore reserves and renewable energy potential. Both countries have large reserves of high-grade iron ore and significant renewable energy potential — key ingredients for green DRI-EAF steelmaking.

But neither country has yet emerged as a leader in green ironmaking. Despite their production advantages, both lag in deploying cleaner technologies like DRI — leaving untapped potential to drive a global shift.

With falling demand from China and growing international momentum for cleaner steel, these countries face both a challenge and an opportunity: align mining and industrial development with the decarbonization of steel, or risk losing competitive ground.

The pipeline for cleaner steel has never been stronger, with record-high levels of EAF and DRI capacity in development. But unless those projects are built, and built with low-carbon inputs, the industry risks missing its moment.

Cleaner technology is no longer theoretical — it’s available. The coming years will determine whether the steel sector seizes that momentum, or lets it slip.