Fossil-powered capacity dropped below half of the electricity mix in the BRICS group for the first time in 2024. However, the expansion of the BRICS group in early 2025 includes relative newcomers to the energy transition, many of which risk staying dependent on fossil fuels. These new BRICS members have ten times as much carbon-intensive capacity under construction as wind and utility-scale solar. Chinese state-owned enterprises play a crucial role in this power sector buildout, backing nearly two-thirds of power projects underway across the new bloc members, including the overwhelming share of their coal (88%) and hydropower (93%).

Key points

- Fossil-powered capacity dropped below half of the total mix in the BRICS group for the first time in 2024

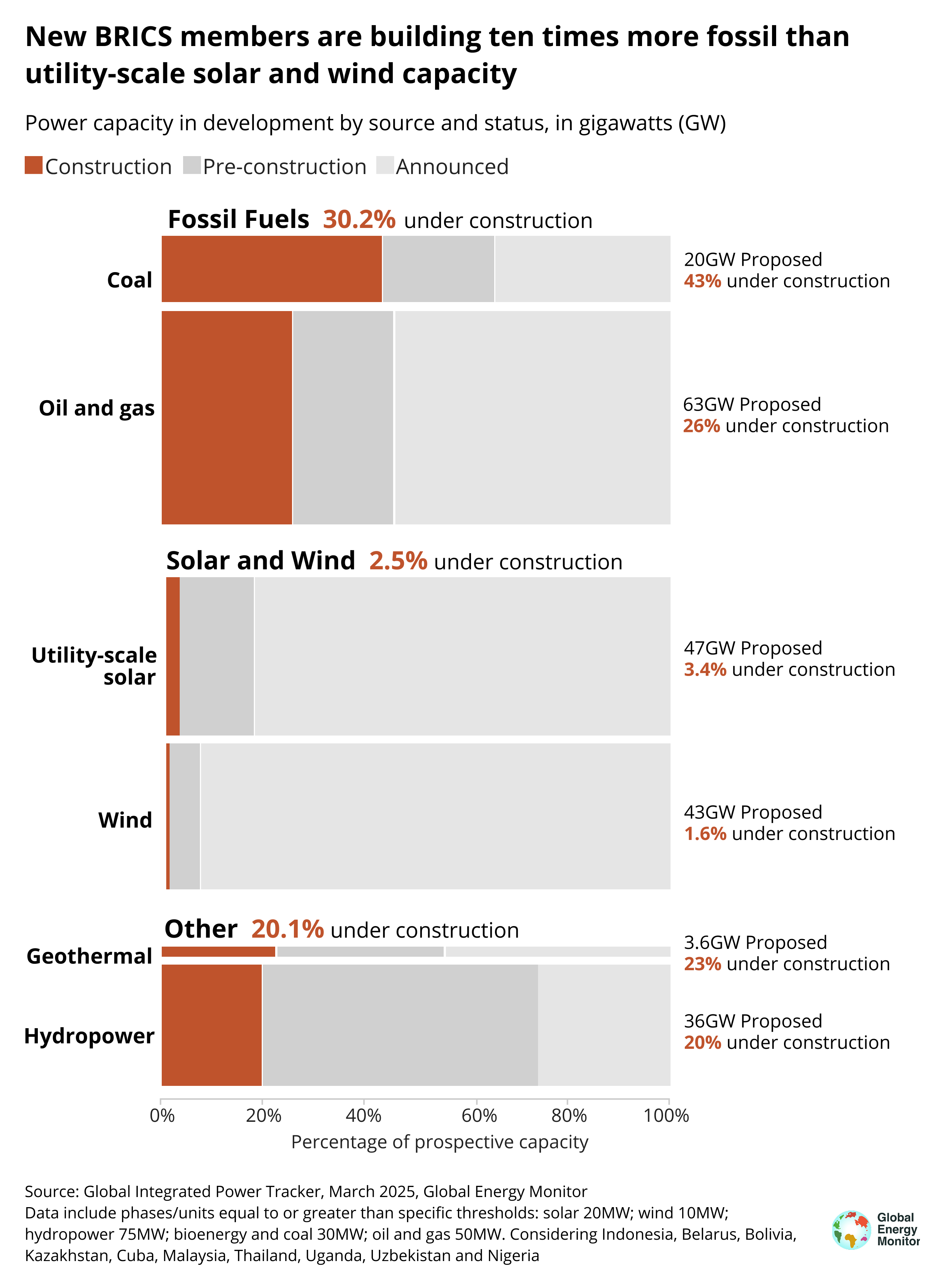

- New BRICS members are building over ten times as much coal, oil, and gas capacity (25 gigawatts (GW)) as wind and utility-scale solar (2.3 GW).

- Over 97% of wind and utility-scale solar capacity among new BRICS members is in the early stages of project development, compared to 30% of fossil projects. Hydropower and geothermal projects see higher construction rates but still fall short of those for coal, oil, and gas.

- Chinese state-owned enterprises (SOEs) have backed over 60% of the total power capacity under construction in new BRICS member geographies and over 90% of hydropower under construction. Despite past pledges to end support of overseas coal projects, Chinese finance and construction still backs 7.7 GW of new coal, virtually all of which is found in Indonesia.

Fossil share of total power capacity in the BRICS fell below half in 2024

The BRICS crossed an inflection point in 2024: fossil fuels no longer account for the majority of their total power capacity. The milestone came on the back of unprecedented renewable energy growth in China, India, and Brazil, mostly from solar and wind technologies. South Africa fell short of the record solar capacity additions seen in 2023 but still saw solar and wind additions surpass 800 megawatts (MW) of new coal-fired capacity from the long-delayed Kusile power station. Russia remained largely static and still anchored in fossil generation.

Members of the bloc joining in 2024 saw capacity additions similarly tilted towards non-fossil additions. Egypt solidified its second-place ranking in Africa for renewable capacity, with 1 gigawatts (GW) of solar and wind capacity added in 2024. The United Arab Emirates led the Middle East region's solar capacity additions in 2024. Ethiopia cemented hydropower's primacy as additional turbines of the Grand Ethiopian Renaissance hydroelectric plant became operational last year.

Figure 1

New BRICS members are building over ten times as much fossil capacity as wind and utility-scale solar

Alongside the progress of several major BRICS countries in renewables uptake, the recent expansion of the group includes newcomers to the energy transition, many of which could get locked into fossil fuel use. Brazil kicked off this year’s rotating presidency of the BRICS group of nations by announcing Indonesia’s accession to full membership along with nine additional countries obtaining partner status, including Belarus, Bolivia, Kazakhstan, Cuba, Malaysia, Thailand, Uganda, Uzbekistan, and Nigeria.1 The BRICS expansion brings major coal- and gas-producing and consuming nations into the group. Indonesia and Kazakhstan are among the world’s top ten coal producers and exporters, with power sectors reliant on coal for over 60% of electricity generation, and Malaysia, Thailand, and Uzbekistan have sizable domestic coal mining activities and growing imports. According to Global Energy Monitor (GEM) data, the expansion of the BRICS group means that 94% of global construction and pre-construction coal plant capacity is now held within BRICS. The addition of new members to the bloc increases the BRICS share of global operating coal plant capacity by 6% and boosts the BRICS share of the global coal development pipeline by 3%.

All but one of the new BRICS members are oil and gas producers,2 with each of the four largest producers (Nigeria, Kazakhstan, Indonesia, and Malaysia) planning further development of new and existing fields. These new members all use oil and gas for power generation, and GEM data show seven of the ten new members have new oil and gas plant capacity in development, totalling 63 GW of capacity. These new members increase the BRICS share of oil and gas plant capacity in development by 26% to total 40% of the global amount.

Despite the general dominance of fossil fuels among the expanded BRICS group, most members have signaled a willingness to transition away from fossil fuel energy sources. Currently, eight out of the ten new members have declared some form of net-zero emissions target in the 2050–2070 time frame, and all five of the new members that use coal for power have publicized some form of coal plant phaseout date (see accompanying GEM Wiki page for a compilation of net-zero pledges and phase out announcements). These targets, in their various forms, would all involve a wholesale transition away from fossil power to non-fossil sources — comprising large shares of wind and solar power.

But there is distance between intentions and actions within the power sector transition. GEM’s Global Integrated Power Tracker shows that although all new members of the BRICS group have 139 GW of non-fossil power capacity in development, including solar, wind, hydropower, geothermal, and nuclear, just 7%, or 10 GW, of this total is under construction. By comparison, new fossil capacity sees a much higher rate of construction among the newest BRICS members, with 44% of coal plants and 26% of oil and gas plants in the construction phase.

Although the total figure for fossil capacity in development is lower than for non-fossil, the higher rate of construction implies that more than twice as much coal, oil, and gas capacity is currently getting built in new BRICS member geographies (25 GW vs. 10 GW). More concerning still are the markedly low levels of wind and utility-scale solar capacity in the construction phase — two cornerstone technologies of the energy transition. According to GEM data, nine of the ten new BRICS members have less than 0.3 GW of wind or utility-scale solar capacity under construction. Contrasting these members with China, India, and Brazil — frontrunners in wind and solar capacity with record 2024 deployment — new BRICS members need a major ramp up in renewables construction activities to shift the fossil dominance.

Figure 2

Chinese state-owned enterprises drive power sector expansion in new BRICS countries

Chinese state-owned enterprises (SOE) have widespread involvement in the financing and construction of BRICS power projects overseas. The new BRICS members have a total of 35 GW of power capacity under construction across energy technologies: coal, oil and gas, hydropower, solar, wind, and geothermal, and GEM’s comprehensive analysis of these under-construction projects indicates that just under two-thirds (62%) of this total capacity under construction involves Chinese SOEs, either as providers of engineering, procurement, and construction services (EPC) and/or as financiers. This share of Chinese involvement is even greater in hydropower and coal power projects, at 93% and 88%, respectively.

China’s reach is part of larger trends: The country’s outward direct investments climbed 10% in 2024, with annual cleantech investment double that of either the U.S. or EU. China's outbound investment program under the Belt and Road Initiative (BRI) saw its highest-ever level of investment and construction contract value in 2024. Notably, all new BRICS members are part of the BRI and have seen the effects of the venture’s consistent energy-sector focus, an average of over one-third of all BRI engagement in the last decade.

By far, the largest share of China’s outward investments in the energy sector to date is toward fossil projects. Indonesia was the largest single recipient of investment under BRI in 2024, and almost all of that investment was directed to the energy sector. In recent years, Chinese-origin finance has been instrumental in the growth of captive coal plants, particularly for metal ore refining, with Chinese-led captive coal capacity tripling since 2019. Further capacity additions are planned in Indonesia, with 8.6 GW of coal plants currently under construction, 88% of which include beneficial ownership from Chinese SOEs. Chinese SOEs are also involved in developing 6.5 GW of oil and gas power capacity across seven plants in new BRICS member geographies, with the largest plants in Uzbekistan and Nigeria.

Chinese involvement is even more extensive in hydropower projects, especially those under construction in new BRICS member geographies. Virtually all of Indonesia's under-construction hydropower capacity3 involves Chinese firms for EPC purposes, including a subsidiary of the state-owned China Energy Engineering Corporation (CEEC) working on the Upper Cisokan plant, Indonesia's first pumped storage facility. In Malaysia, a subsidiary of CECC is also undertaking the main civil works for the 1.3 GW Baleh hydroelectric plant, with three further recently commissioned projects by Chinese SOEs (Bakun-PowerChina, Murum-Three Gorges, and Perak-CEEC). China Southern Power Grid is developing the Pskem pumped storage plant in Uzbekistan, and has signed agreements for three additional hydroelectric projects, all due for completion by 2030. Nigeria’s 3 GW under-construction Mambilla hydropower project is 85% financed by China Exim Bank, which is also financing the planned 360 MW Gurara II hydropower project and the recently commissioned 700 MW Zungeru and 130 MW Kandadji projects. Sinohydro Corporation is the lead contractor for the 1 GW Makurdi hydropower project in Nigeria. With financing from China Exim Bank, Sinohydro Corporation also financed the recently commissioned 600 MW Karuma hydropower project in Uganda, with a further three announced hydropower projects also receiving Chinese backing. The Laos Pak Beng hydropower project will export all power to Thailand and is 51% owned by China Datang Overseas. And in Bolivia, the Rositas 600 MW hydropower project received support from China Exim bank and a consortium of Chinese construction SOEs.

A combination of factors likely contributed to China’s SOEs favouring large power projects overseas in recent years, including coal and hydroelectric developers seeking new opportunities due to slackening domestic demand, and direct instruction for policy banks to support BRI-type lending abroad. Following the criticism of some overseas energy projects for environmental failures, outward investment policy advocated for a green shift, notably the 2021 announcement to cease building new coal plants abroad and instead step up investment in renewable energy. The continued backing of captive coal plants and mining projects abroad in the years since attests to apparent loopholes in the moratorium. Nonetheless, China has redoubled commitments to greener investments abroad, refocusing on smaller, sustainable projects, and has recapitalized policy banks.

Meanwhile, China’s increasingly renewables-focused SOEs and industry-leading private firms are seeking to expand their global footprint, with outbound capital flows into solar, wind, batteries, and new energy vehicles at historically unprecedented levels. These trends are apparent in GEM data, with several new BRICS members showing significant projects in early-stage development, most notably in Uzbekistan, with all under-construction solar and wind farms involving Chinese SOEs. Indonesia and Malaysia have solar projects in early stages of development totalling over 3 GW each, again with Chinese SOEs leading EPC roles. Chinese firms also lead construction of Kazakhstan's largest wind farm and a project to provide 2 GW of solar capacity to Cuba.

Several namesake BRICS nations have seen record deployment of wind and solar in recent years, and new members stand to gain from cultivating ties with the bloc to secure investment, know-how, and low-cost supply in these critical technologies. Other BRICS countries not yet seeing this uptick should heed the broader positive experiences of energy transition in the Global South, where the acceleration of solar and wind's share of electricity generation has far outpaced historical precedents.

Figure 3

1 The official website of the Brazilian Presidency currently lists Saudi Arabia as a full member, though Riyadh has not officially accepted the invitation, so Saudi Arabia is excluded here.

2 Uganda will commence oil production in 2026–2027.

3 Mentarang-PowerChina, Upper Cisokan-CEEC, Batang Toru-PowerChina, Kerinci Merangin-Hydget Power.

About the Global Integrated Power Tracker

The Global Integrated Power Tracker (GIPT) is a free-to-use Creative Commons database of over 142,000 power units globally, that draws from GEM trackers for coal, gas, oil, hydropower, utility-scale solar, wind, nuclear, bioenergy, and geothermal, as well as energy ownership. Footnoted wiki pages accompany all power facilities included in the GIPT, updated biannually. For more information on the data collection process that underpins GEM’s power sector trackers, please refer to the Global Integrated Power Tracker methodology page.

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape and creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Follow us at www.globalenergymonitor.org and on Twitter/X @GlobalEnergyMon, and Bluesky @globalenergymon.bsky.social.

Media Contact

James Norman

Research Analyst, Global Energy Monitor