Key points

- The vast majority of new oil and gas extraction projects in 2024 are located in the oceans: At least 8 billion barrels of oil equivalent (bboe) of resources were announced in new offshore discoveries, nearly 4 bboe of reserves were sanctioned for development offshore, and about 6.5 bboe began to be tapped as offshore projects started up, all marginal increases over 2023.

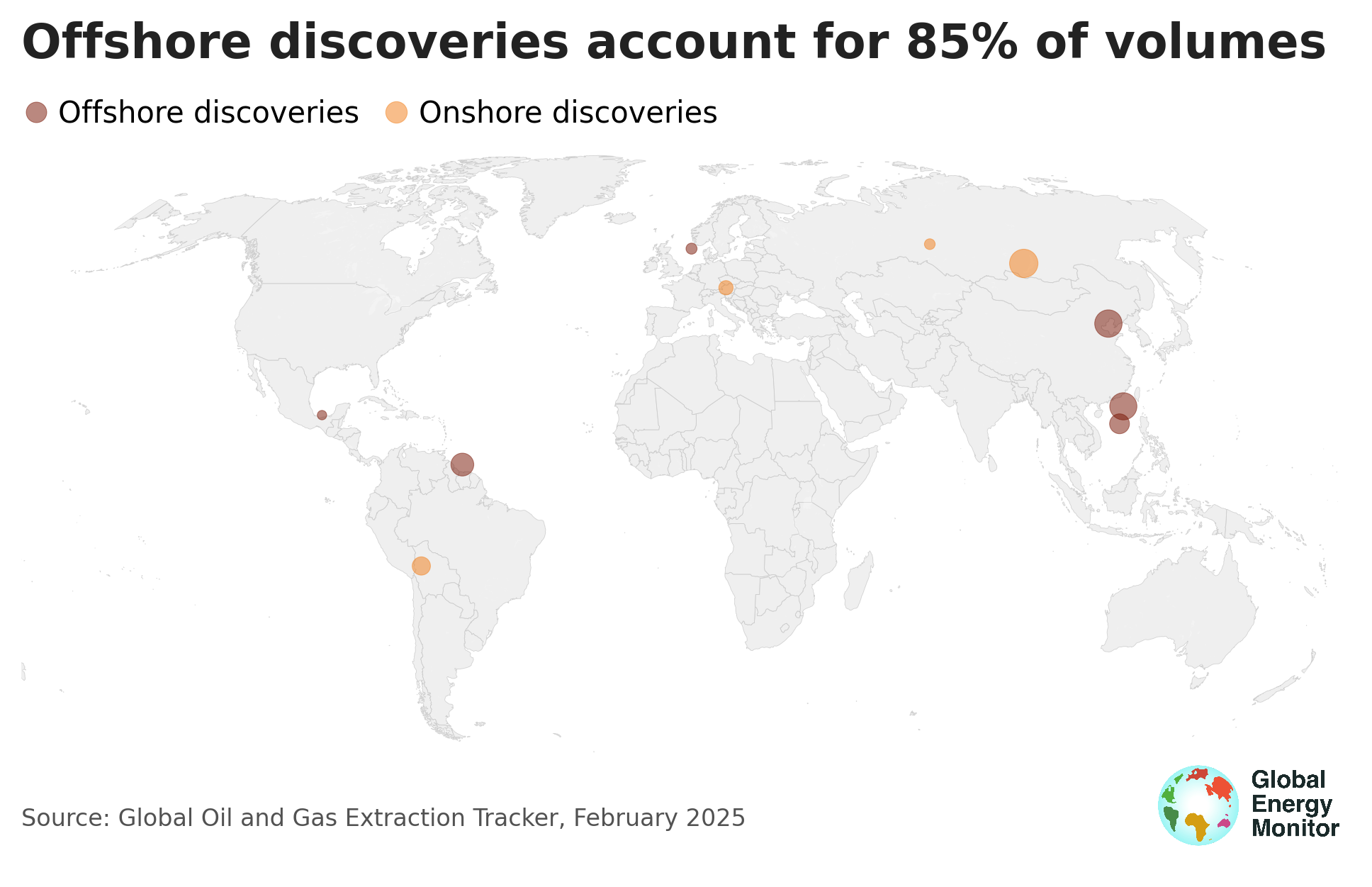

- 85% of new discoveries by volume were located in ten offshore fields.

- At least twelve projects reached a positive Final Investment Decision (FID) in 2024, all of which were offshore.

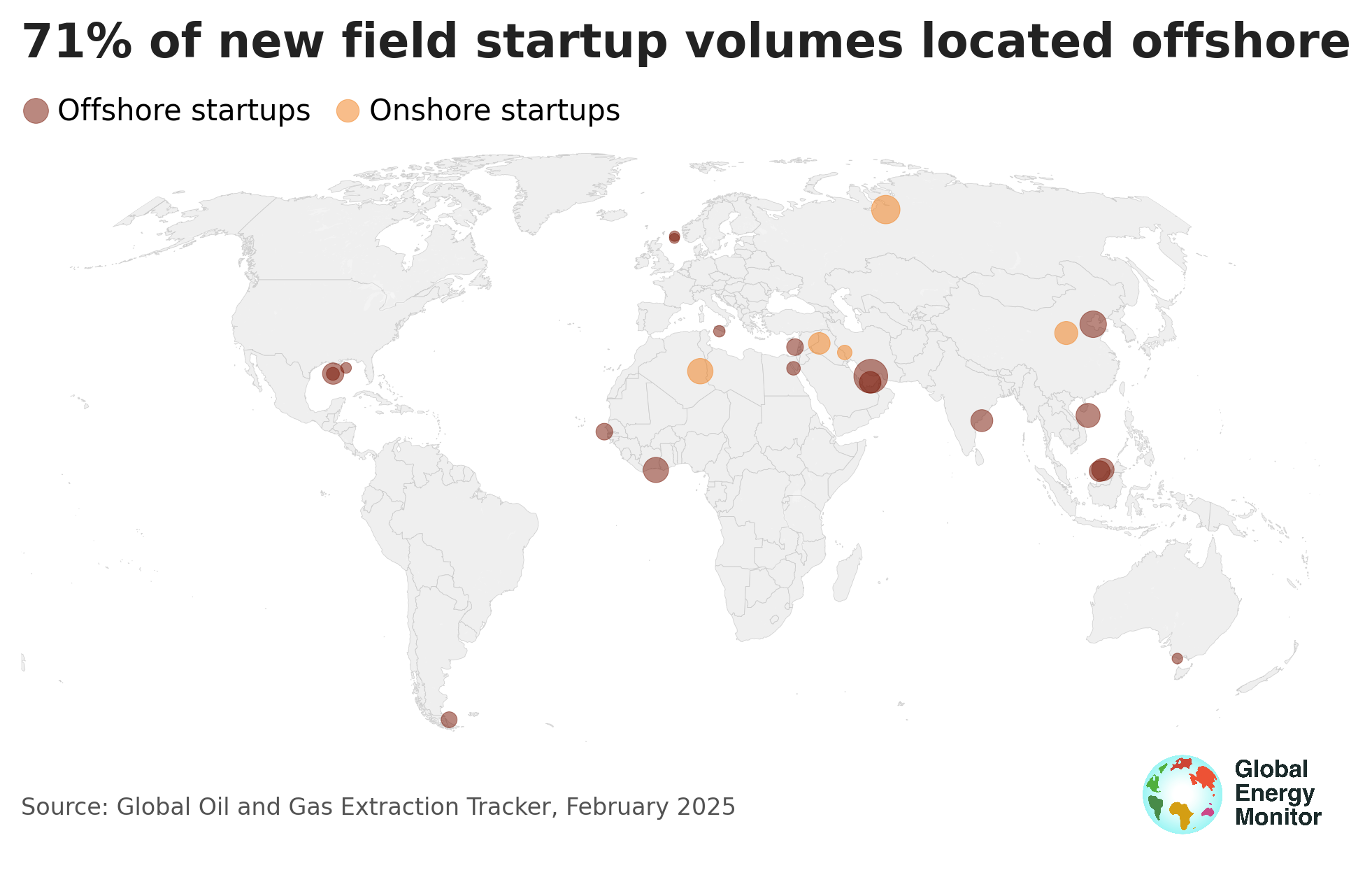

- 19 offshore projects produced first oil or gas in 2024, 71% of the total volume of field startups.

- Offshore oil and gas put oceans at risk throughout projects’ life cycles, jeopardizing marine biodiversity locally and the climate globally.

Global Energy Monitor’s Global Oil and Gas Extraction Tracker (GOGET) shows that the vast majority of new projects discovered, sanctioned, and started up in 2024 are located in the oceans. The industry continues to ignore warnings of the risk oil and gas extraction causes, leading to extreme climate impacts. Instead, companies and countries continue to push into uncharted waters. Not only do these projects harm the ecosystems they exist in and run the risk of environmental catastrophes, they run afoul of the scientific consensus that any new oil and gas field is incompatible with limiting warming to 1.5°C and break clear calls to protect the climate.

Ramping up offshore

Globally, on and offshore, at least 9 billion barrels of oil equivalent (bboe) of resources were announced in new discoveries, nearly 4 bboe of reserves were sanctioned for development, and about 6.5 bboe began to be tapped as projects started up. Discoveries, project approvals, and startups all have marginal increases in offshore volumes percentages compared to 2023. This is in line with longer term trends of the growth in prominence of offshore development.

Figure 1

Discoveries

Of these discoveries, 85%, in terms of expected hydrocarbon extraction, were located in ten offshore fields. Two of the largest of these projects were the Nokhatha and Mopane fields in Kuwait and Namibia, respectively. These giant discoveries were both the products of a renewed offshore focus from their respective countries and were welcomed by fossil fuel promoters as indications of potential expansions of oil and gas activity in these areas.

The Kuwait Petroleum Corporation (KPC), the owner of Nokhatha, through its subsidiary Kuwait Oil Company, made the “breakthrough” discovery as part of an offshore exploration campaign. Following Nokhatha’s announcement in 2024, the Julaiah field was discovered in January 2025, raising interest in the area.

Mopane follows significant discoveries in 2022 and 2023 (see Drilling Deeper), amidst the “Oil exploration boom Namibia.” Unlike Kuwait, Namibia has not yet produced any oil or gas. Following Galp’s discovery of Mopane in the Orange Basin, the area has been called “industry’s most exciting exploration frontier.”

Figure 2

Project approvals

At least twelve projects reached a positive Final Investment Decision (FID) in 2024, all of which were offshore. FID signifies the start of a project's development in GOGET, strongly indicating that the company actually intended to develop a project.

The Americas held significant activity in this regard. Exxon sanctioned the Whiptail development, targeting about 1 bboe of oil and gas, aiming to start production in 2027, and costing around US$12.7 billion. TotalEnergies announced FID of the GranMorgu development in Suriname in October 2024. Targeting the Sapakara and Krabdagu oil discoveries, the GranMorgu project is located right next to the maritime border with Guyana, drawing hopes from industry of replicating ExxonMobil’s successful exploration. In the United States, three projects targeting around 500 million boe (mmboe) were sanctioned, and in Trinidad and Tobago, another 300 mmboe project was sanctioned. Other projects were additionally sanctioned in Africa, Europe, and Western Asia.

Figure 3

Startups

Nineteen offshore projects produced first oil or gas in 2024. These projects represent 71% — 6.5 bboe — of the reserves started up in 2024. Significantly, China started up six offshore projects, the largest of which is China National Offshore Oil Corporation’s (CNOOC) Bozhong 19-6 (13-2) in the Bohai Sea, which commenced production in May 2024. This comes as CNOOC sets a 2025 production target of 5.6% higher than 2024 levels.

On average, this crop of projects took about fourteen years from discovery to first production, about the same time frame as onshore projects (fifteen years).

Figure 4

Putting oceans at risk

The risks from offshore drilling exist throughout the lifecycle of a project. A United Nations report recently called for, among other things, the halting of new offshore oil and gas projects until a series of safeguards and assessments is made. Such a directive was necessary, as those safeguards do not always occur. Research from the Center for International Environmental Law (CIEL) details how “offshore oil and gas activity threatens [the] two global commons on which all life on Earth depends: the oceans and the atmosphere.”

During the exploration process, noise pollution from seismic studies jeopardizes marine life, while exploratory well drilling can cause seabed disturbance and habitat loss and the introduction of toxins that threaten ecosystems. Additionally, the creation of exclusionary zones can prevent fisherfolk from accessing areas, harming their livelihoods.

During the production phase, offshore oil and gas production — like onshore production — has a huge climate footprint, but is historically underreported. Additionally, large-scale spills cause devastating impacts that have been well documented, while routine spills are an “often unreported or underreported” problem. As shown by SkyTruth, a vast portion of the oceans are impacted by oil and gas production.

Once companies have extracted all the value they can from a field, the true costs of decommissioning are shown. These potentially leaky wells can continue to harm ecosystems and the environment after a company leaves a site, especially when sites are abandoned.

Matching with trends

Historically, onshore oil and gas projects account for the majority of production. However, exploration and extraction companies are focusing offshore, with increased attention on unlocking new frontier areas via high-risk, higher-cost further offshore development.

In November 2024, the Financial Times declared, “Offshore oil is back” quoting a Rystad Energy analyst proclaiming “this comeback looks set to make the 2020s deepwater’s decade.” Reuters explained the industry's “love” of deepwater, stating, “all-new deepwater drilling is poised to hit a 12-year high next year.” The Gas Exporting Countries Forum (GECF) Gas Outlook outlines that many countries and companies are prioritizing offshore, and that “offshore natural gas production is forecast to grow at a faster rate than onshore gas production.”

BP, for example, reportedly “abandoned” its target to cut its oil output and instead announced a focus on new investments in the Gulf of Mexico to boost outputs. BP sanctioned the Kaskida development in July 2024. In February 2025, Equinor’s CEO similarly stated the company would be cutting its renewable investments substantially while increasing oil and gas production. Specifically, the CEO discussed the Norwegian company’s large offshore oil field.

GOGET data are directionally aligned with global trends shown in other datasets. GOGET data show offshore discoveries have been growing in share of global discoveries per year, accounting for about 60% in the 2010s and then around 73% so far in the 2020s.

Figure 5

The oil and gas industry's justifications

According to analysts, the costs of developing deepwater projects have halved in the past ten years. That fact, alongside new technological advances, has opened up the ocean for more production in reservoirs that were previously economically and geologically unreachable. Industry and analysts argue offshore projects have a lower carbon intensity than older projects, one even saying, “new projects are a lever to meet emission reduction goals, especially those focused on deepwater projects that continue to deliver on low emissions intensity and economic return.”

Emissions from extracting, processing, refining, methane, and transport combined, i.e. scopes one and two, account for about 20% and 15% of oil and gas lifecycle emissions, respectively, per the International Energy Agency. Combustion of oil and gas by end-use consumers accounts for 80% of oil and 85% of gas lifecycle emissions, so ignoring scope three is not accounting for the majority of climate impacts of projects, as shown in the cases of Rosebank and Jackdaw.

Local ecosystems and the global environment

While the impacts on local ecosystems, biodiversity, and economies must be addressed, as alluded to above, the environmental impact of these projects from associated greenhouse gas emissions is an additional problem. As discussed in Drilling Deeper, the science is clear that there can be no more oil and gas fields approved if the world is to limit warming to safe levels. This additional billion boe of oil and gas will only further risk climate catastrophe.

The peak of oil and gas demand is expected before 2030, but most of these projects would be just ramping up as the world’s oil and gas usage declines. Historical data show that projects often take longer than the timelines given by project promoters.

While some investment in oil and gas supply is needed in IEA scenarios, there is a significant discrepancy between what investment needs to be going toward clean energy and what is actually going towards fossil fuels. Bringing investments in line with scenarios designed to limit warming — stopping incompatible investment in fossil fuels and investing in wind and solar — could bridge the gap.

Conclusion

Offshore oil and gas appears to be having a heyday, but alternative futures are still possible. Expansions into uncharted waters are risky bets, financially, for ecosystems, and for the environment.

Accurate, accessible data is a necessity to best understand the trends, players, and systems enabling this growth. GOGET provides data on the locations, companies involved, production, and reserves for all of these fields and about 7,000 other projects.

About the Global Oil & Gas Extraction Tracker

GOGET is an information resource on gas oil extraction projects. The internal GOGET database is updated continuously throughout the year, and the annual release is published and distributed with a data download, summary tables, and unit wiki pages. The data are released under a creative commons license. Commercial datasets exist but are prohibitively expensive for many would-be users. Global Energy Monitor developed GOGET so that high-quality data on these projects is available to all.

Acknowledgments

Charts and maps were created by Scott Zimmerman and Stephen Osserman. Editing by Stefani Cox, David Hoffman, Hanna Fralikhina and Julie Joly. Alyssa Moore, Amalia Llano, Hanna Fralikhina, Julie Macuga, Mingxin Zhang, Norah Elmagraby, and Will Lomer contributed to the research underlying this report. Julie Joly provided invaluable guidance. Special thanks to Andreas Randøy (Greenpeace, Norway), Ashlee Barnes, Jasmine Wakefield (Uplift, UK), Daan Koopman, Elvira Sumalinog, Paul Rosane (Asset Impact) and Bruna Campos (CIEL) for data feedback. Maisie Bird and Jenny Martos have also contributed to GOGET.

Media Contact

Scott Zimmerman

Project Manager, Global Oil and Gas Extraction Tracker