Since the signing of the Paris climate agreement in 2015, the “pipeline” for new coal plant proposals in the Organisation for Economic Co-operation and Development (OECD) region has reached record lows.

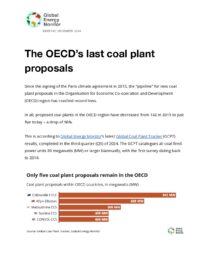

In all, proposed coal plants in the OECD region have decreased from 142 in 2015 to just five today – a drop of 96%.

This is according to Global Energy Monitor’s latest Global Coal Plant Tracker (GCPT) results, completed in the third quarter (Q3) of 2024. The GCPT catalogues all coal-fired power units 30 megawatts (MW) or larger biannually, with the first survey dating back to 2014.

Figure 1

The OECD is an intergovernmental organization with 38 member countries founded in 1961 to stimulate economic growth and global trade, comprising many of the wealthiest countries on the globe.

Of the thirteen OECD countries with coal plant proposals in 2015, all but Türkiye have since pledged to stop building new coal plants.

There are exceptions to the pledges for coal plants that significantly lessen or “abate” carbon dioxide emissions through the use of carbon capture and storage (CCS) technology. Four of the five remaining proposals include plans for CCS.

The drop in proposals puts the region well on its way to “no new coal,” defined as cancelling all unabated coal proposals not under construction.

The OECD and no new coal

Since 2015, proposed coal-fired capacity in the OECD has fallen from 142 coal proposals totaling 111 gigawatts (GW) to five proposals totaling 3 GW.

None of the five proposals have the necessary permits for construction, meaning it will likely be several years before construction begins – if they are built at all, as most of the proposals since 2015 in the OECD have been abandoned entirely.

Of the 111 GW proposed in 2015, 82% (91 GW) have since been shelved or cancelled, compared to 17% (19 GW) commissioned. The remaining 1% (1 GW) has been under construction since 2019, the last time a coal plant has broken ground in the OECD.

The 111 GW of proposals in 2015 were located across thirteen countries: Australia, Canada, Colombia, Germany, Greece, Israel, Italy, Japan, Poland, South Korea, Türkiye, UK, and the U.S.

Since 2015, twelve of the thirteen countries have pledged support for no new coal, whether as part of the international Powering Past Coal Alliance or through a domestic moratorium on new coal plant permits. The UK phased out coal power entirely this year.

“No new coal” commitments have been aided by the decreasing costs of competitive power sources, including gas and, increasingly, solar and wind power. Additionally, many countries have seen sustained opposition campaigns to new coal over pollution and high energy costs.

As the OECD turns away from new coal, coal power capacity in the region peaked in 2010 at 655 GW and has since declined by about one-third to 443 GW as countries shut down aging coal plants.

Figure 2

Türkiye resists no new coal

To date, the government of Türkiye has resisted calls for no new coal, despite repeated rollbacks in its coal plans.

Most of the country’s proposed coal plants have not materialized. Since 2015, over 70 GW of planned coal plant capacity in Türkiye has been called off compared to 6 GW commissioned, translating to a cancellation rate of 92% since 2015 – one of the highest cancellation rates in the world.

Figure 3

Coal plant proposals in Türkiye face a myriad of challenges, including strong public opposition over coal plant pollution and coal industry privatization, and domestic lignite coal that is low-quality and unreliable, leading many plants to use higher-cost imported coal instead.

In Q3 2024, the licenses for two coal plants – Karaburun and Kirazlıdere – were canceled due to irregularities in the environmental permitting process and the loss of interest in the investment by the plant sponsors. Another plant, Malkara, was shelved due to a lack of activity.

The developments have left Türkiye with one coal plant proposal – a remarkable development after being among the top ten countries with proposed coal-powered capacity for nearly a decade.

Despite the setbacks, Türkiye has not committed to ending new coal plant proposals. Its recently updated climate pledge, submitted during COP29, makes no mention of coal phaseout.

The country’s remaining proposal is a 688 MW two-unit expansion of the sizable Afşin-Elbistan power station complex in the city of Kahramanmaraş. Local residents have opposed the project, saying the increase in pollution in the densely-populated city will lead to thousands of premature deaths and cost billions of dollars.

Australia, Japan, the U.S. and “clean coal”

The remaining four coal plant proposals in the OECD are located in Australia, Japan, and the U.S.

While the governments of all three countries have recently pledged support for “no new coal”, they also support CCS to lessen or “abate” emissions from coal plants.

Abated coal plants are considered compatible with no new coal pledges if they meet Paris agreement-aligned definitions regarding “substantially lower” carbon emissions.

Critics argue CCS proposals are more expensive and polluting than cleaner electricity alternatives, often relying heavily on government subsidies in order to be economically viable. Only a handful of CCS coal plants have reached commercial operation, and none have achieved their target carbon capture rate.

The Japanese government signed on to a G7 agreement earlier this year to phase out unabated coal power by the mid-2030s and continues to promote a suite of “clean coal” technologies both domestically and abroad. The country’s proposal is a new coal gasification unit at J-Power’s Matsushima power station, dubbed GENESIS. The proposal is a veritable hodgepodge of “clean coal” tech, with plans to co-fire biomass, ammonia, and hydrogen, as well as utilize CCS.

The U.S. under President Biden also signed on to the G7 agreement and was one of twelve countries that joined the Powering Past Coal Alliance during COP28 in 2023. The country has two Department of Energy (DOE)-backed proposals with plans for CCS, as required under pending regulations for new coal power plants. While the future of both the coal pledges and regulations are uncertain given the recent re-election of Trump, to date the former president has been unable to turn the tide for coal, with more coal power capacity retired under Trump’s first term than either Obama or Biden, and no new coal plant built in a decade.

Australia’s Labor party, voted into power in 2022, recently joined a COP29 call for no new unabated coal. The country has not commissioned a new coal plant since 2012, with over 13 GW proposed coal-fired capacity cancelled since 2010. The country’s remaining coal proposal, the Collinsville (Shine Energy) power station, has been touted by its sponsors as a “high efficiency, low emissions” (HELE) coal project with plans to include CCS.

About the Global Coal Plant Tracker

The Global Coal Plant Tracker provides information on coal-fired power units from around the world generating 30 megawatts and above. The GCPT catalogues every operating coal-fired generating unit, every new unit proposed since 2010, and every unit retired since 2000.

About Global Energy Monitor

Global Energy Monitor (GEM) develops and shares information in support of the worldwide movement for clean energy. By studying the evolving international energy landscape and creating databases, reports, and interactive tools that enhance understanding, GEM seeks to build an open guide to the world’s energy system. Follow us at www.globalenergymonitor.org and on Twitter/X @GlobalEnergyMon.

Media Contact

Christine Shearer

Project Manager, Global Coal Plant Tracker