In a significant shift, China's rapid development of renewable energy is leading to a slowdown in coal power project approvals, according to a new report from the Centre for Research on Energy and Clean Air and Global Energy Monitor. While the number of new coal power permits has decreased, the existing pipeline of projects remains substantial, posing a potential challenge for China to meet its climate targets and energy transition ambitions.

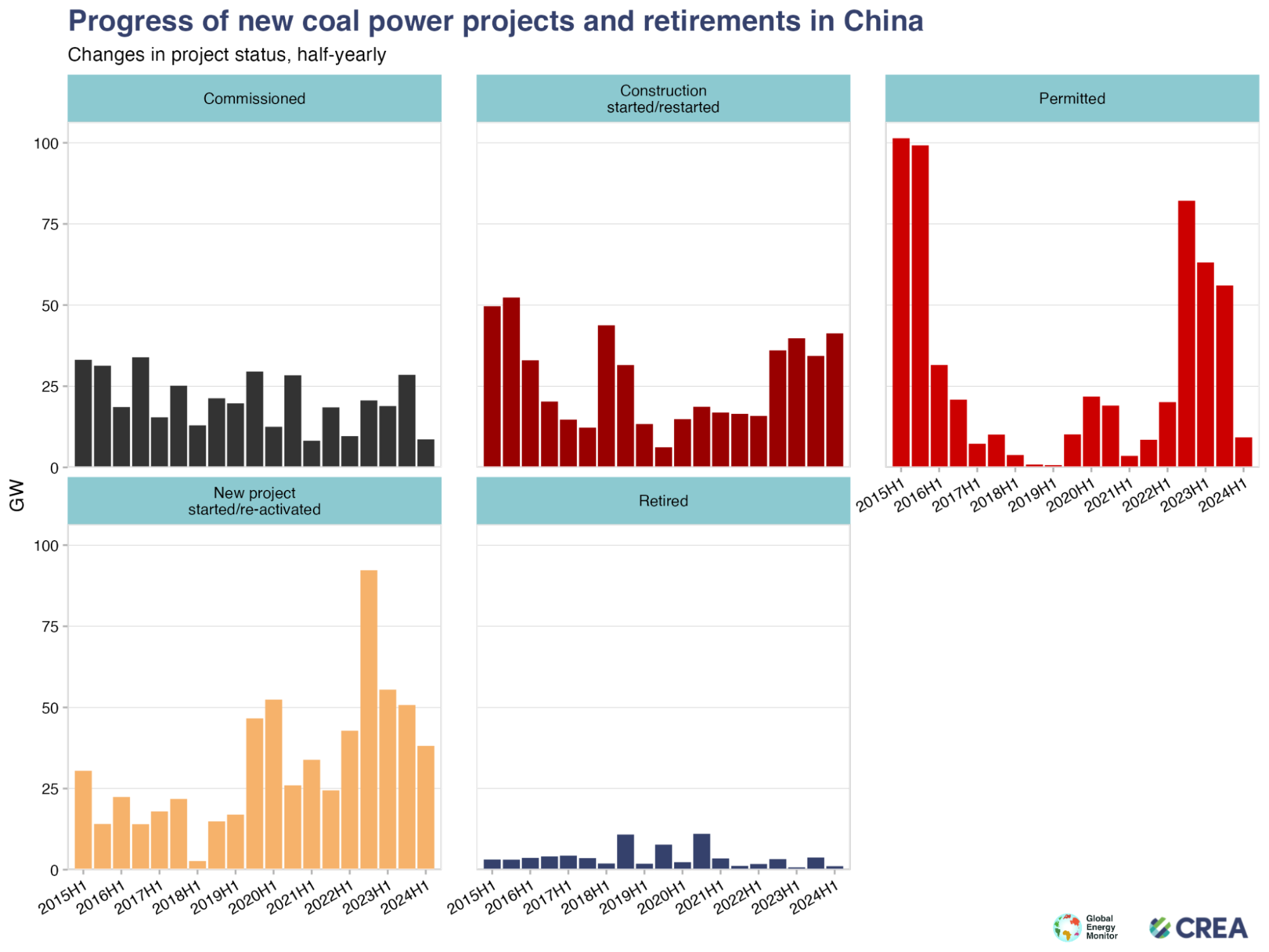

The report finds that in the first half of 2024, China reduced coal power permits by 83% compared to H1 2023, permitting only 9 gigawatts (GW) in H1 20241. Following the surge in coal power permits exceeding 100 GW annually in 2022 and 2023, the current decline in coal power activity is further reflected in the reduction of new and revived coal power proposals, totalling 37 GW in early 2024, down from 60 GW in early 2023.

Despite these encouraging signs, significant challenges persist. In the first half of 2024, construction began on over 41 GW of coal projects, nearly equaling the total that started construction during all of 2022 and constituting more than 90% of global new coal construction activities. Moreover, the government's goal of bringing 80 GW of coal-fired capacity online in 2024 indicates a potential increase in project completions in the latter half of the year, from 8 GW commissioned in H1 2024.

The slowdown in coal power permitting is largely due to the rapid development of clean energy, which is now being installed at levels sufficient to meet China's electricity demand growth. This shift has prompted the central government to revise its policy focus. While continuing to support clean energy development, the government is also prioritising carbon emission reductions to meet its climate and energy goals. By limiting new coal power projects and emphasising grid reforms, energy storage, and other clean solutions, China can set the stage for significant emission reductions.

However, this transition will require phasing down the existing massive coal power fleet and addressing the interests of coal power stakeholders. To meet long-term emission targets, China must also accelerate the retirement of existing coal plants and cancel previously permitted projects.

Given China's strategic shift towards reducing carbon emissions and the rapid development of clean energy, it is unlikely we will see another surge in coal power approvals in China similar to that of 2022-2023. Nevertheless, China's technical plans to reduce rather than eliminate carbon emissions from coal power and its continued insistence on coal as a baseload power source indicate that coal power will continue to play a significant role in the near-term energy landscape.

To mitigate the global climate crisis, China's upcoming Nationally Determined Contributions (NDCs) and 15th Five-Year Plan must include ambitious targets for both coal consumption reduction and renewable energy expansion.

Qi Qin, lead author of the report & China Analyst at CREA: “The development of clean energy enables the Chinese government to set more ambitious goals for reducing coal power generation and carbon emissions. China needs to stop allowing room for fossil fuel emissions to grow in its policies. Energy security should be achieved through clean energy and a more flexible, market-oriented power grid, rather than by burning coal.”

The steep drop in new coal plant permits is a hopeful sign that China’s massive solar and wind builds are dampening its coal ambitions. With clean power now capable of meeting the country’s electricity demand growth, China should cancel its remaining coal proposals and accelerate the retirement of its existing coal plants.

Christine Shearer, Research Analyst at Global Energy Monitor

1 The 9 GW figure for H1 2024 is based on the best available data at the time of publication of this report. As more comprehensive data becomes available, it is possible that the actual number of permits issued may be slightly higher. Nonetheless, the overall trend of a significant reduction in coal power permits remains clear.