Key Points

- Unmatched industrial growth and heavy reliance on coal: Driven by its National Steel Policy, India's growth plans position it as the country with the largest steelmaking capacity under development, surpassing even China. This growth reinforces India’s status as the second-largest steel-producing economy, with the emissions-intensive blast furnace-basic oxygen furnace continuing to be the dominant production route for the foreseeable future.

- India faces a rocky and uncertain path towards net zero: The unique presence of coal-based rotary kilns for direct reduced iron production, along with the limited availability of other gasses as transitional fuels creates significant challenges for the shift towards green hydrogen-based direct reduced iron production. India’s current approach largely involves integrating decarbonization strategies once the capacity is built, rather than transitioning away from coal-based production to green steelmaking.

- Young blast furnaces risk carbon lock-in and stranded assets: India’s young fleet of blast furnaces, combined with ongoing investments in emissions-intensive blast furnace technology, poses a long-term risk of elevated emissions from the steel industry, as these furnaces have longer lifespans and are challenging to decarbonize. Additionally, it places the country at a stranded assets risk of US$124–187 billion from new steel capacity, given India’s commitment to achieving net-zero emissions by 2070.

Setting the right goals for India's steel industry

In September 2024, India’s Ministry of Steel published a roadmap and action plan for greening the nation’s steel sector in an effort to support the national goal of reducing emissions by 45% from 2005 levels across the economy by 2030. The report discusses steps to promote the adoption of green steel in both the public and private sectors through procurement targets; certification ecosystems; emissions disclosures by end-users; tax incentives; and higher environmental, social, and governance (ESG) ratings for green steel consumers. It also focuses on energy efficiency improvements, the adoption of the best available technologies (BATs) for reduced emissions, the implementation of waste heat recovery measures, and other efficiency improvement strategies. However, the report does not lay out a roadmap for reducing India’s heavy reliance on coal-based blast furnace-basic oxygen furnace (BF-BOF) production or plans to phase these units out eventually.

Instead, the National Steel Policy focuses on expanding domestic steelmaking capacity, which is dominated by coal-based production. The strategy appears to focus on decarbonization once the capacity is developed, rather than planning for it from the start. This “build now, decarbonize later” approach misses the opportunity to develop steel capacity using low-emissions technologies, which could make India a leader in green steel capacity, save on decarbonization efforts later, and reduce current and future stranded asset risk in the industry.

While India’s short-term solutions to reduce emissions without significant modifications to the existing production may lower emissions intensities, India will need to make the grand switch away from coal to fully decarbonize the industry and sustain its production in the long run. India must expand its narrow focus from merely developing large steel capacities to developing green steel capacities, thereby establishing itself as a leader in green steel.

A heavy and growing reliance on coal-based BF-BOF production

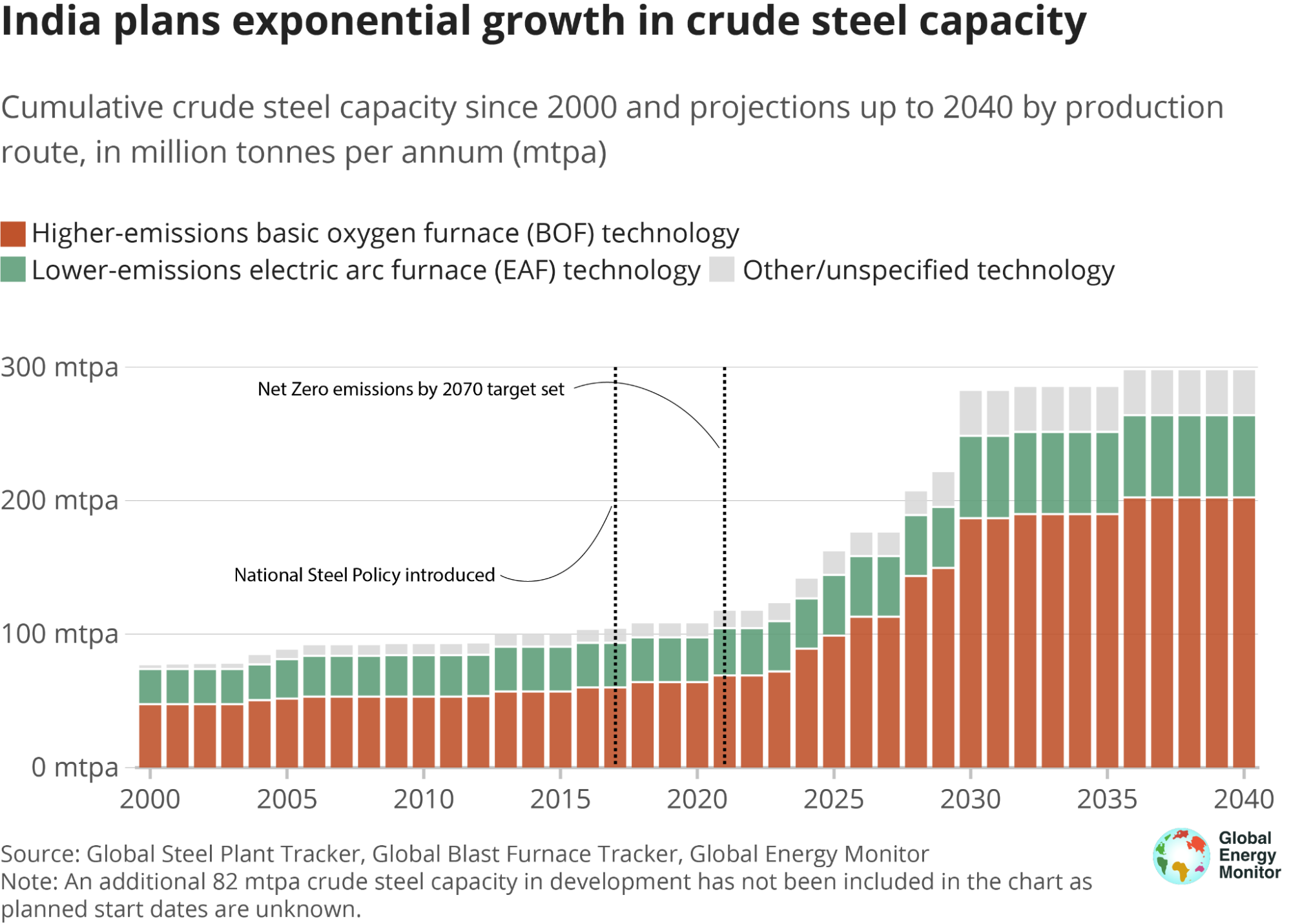

India boasts the world’s second-largest operating steelmaking capacity after China and has planned to double its capacity by 2030. India’s steel industry will face immense pressure to increase production based on the country’s growth trajectory, with India on track to become the third-largest national economy by 2032. As a result, the annual steel demand within the country is expected to grow from 136 million tonnes in 2024 to 221–275 million tonnes by 2034, with a global steel demand rise of 1.2% in 2025.In 2017, when imminent pressure on the steel sector became apparent, India announced its National Steel Policy to facilitate faster growth and development of its steel industry. This plan set an aggressive goal of increasing the crude steel capacity from 125 million tonnes per annum (mtpa) to 300 mtpa by 2030. The crude steel capacity in the country had already reached 161 mtpa in FY2023 and continues to grow exponentially, with projections showing that it may triple by 2040 from 2017 levels (Figure 1). As a result of these growth plans, India has the most steelmaking capacity in development of any country, even China.

Over 87% of India’s operating ironmaking capacity and 90% of that in development is dependent on coal, making India one of the most emissions-intensive steel sectors globally. The steel industry in India currently accounts for over 240 million tonnes of CO2 emissions annually, about 12% of the country’s total carbon emissions, and that number is expected to double by 2030. The average emissions intensity of crude steel production in India is the highest in the world at 2.55 tonnes of CO2 per tonne of crude steel (tCO2/tcs), 38% higher than the global average of 1.85 tCO2/tcs. India’s high emissions intensity stems largely from its reliance on coal-based production routes.

Figure 1

With India’s commitment to net zero by 2070, its reliance on coal-based steel production puts the country at the greatest global risk for stranded assets from new steel capacity, with an estimated US$124–187 billion from BF-BOF capacity in development. This is in addition to the risk from operating BF-BOF capacity.

With over 86% of India’s planned basic oxygen furnace (BOF) capacity not yet in the construction phase, there emerges an opportunity for India to shift its strategy. Transitioning to green steel production technologies now can help the country avoid the risk of stranded assets when these coal-dependent plants are rendered obsolete by future decarbonization policies and market shifts. Transitioning early would enable India to meet both global and domestic sustainability goals while securing a competitive advantage in the emerging green steel market.

Figure 2

The 2024 update of Global Energy Monitor’s Global Steel Plant Tracker (GSPT) tracks around 123 mtpa of operating crude steel capacity in India. Over 59% of this capacity is based on the emissions-intensive BF-BOF production route. Electricity-based electric arc furnaces (EAF) and induction furnaces (IF) constitute only 30% and 9% of the operating capacity, respectively. Additionally, the average capacity utilization of emissions-intensive technologies is higher in the country. For instance, the average capacity utilization for BOF was 84%, while that for EAF was only 74%.1 As a result, the share of overall annual steel production from BOF is even higher than the capacity share, at 65% of the total steel produced in the country.

Figure 3

The emissions intensity associated with BF-BOF production in India is 3.83 tCO2/tcs2, one of the highest globally. For example, in China, the global leader in steelmaking, the BF-BOF emissions intensity is 1.84 tCO2/tcs, and in Japan, the third-largest steelmaker following China and India, the intensity is 2.12 tCO2/tcs. The high emissions intensity is driven by the operation of old and inefficient BF-BOF plants, high electricity grid emissions, and poor quality domestic iron ore and coal. Only 12% of India’s iron ore is classified as high-grade, while 38% and 31% are classified as medium- and low-grade iron ores, which means the iron ore requires additional processing, leading to greater emissions. Domestic coking coal is high in ash content (approximately 18–49%), which makes the coal less efficient and leads to higher emissions, meaning that it has to be washed and then blended with high-quality coking coal before use in coke ovens.

Around 90% of India’s metallurgical coal demand is currently met through imports, positioning India as one of the largest markets for foreign coal suppliers. Major Indian steel producers have begun expanding their investments in international coal mines to secure supply for their increasing production needs. For instance, the Steel Authority of India (SAIL) and JSW Steel have announced investments in coal mines in Mozambique and Australia, respectively. India is also trying to increase domestic sourcing of coal to reduce reliance on imports. One of the main objectives set in the National Steel Policy 2017 was to increase domestic coking coal availability enough to reduce reliance on imports from 85% to 65% by 2030. However, this approach prolongs the dependence on coal-based production instead of accelerating the shift to greener alternatives.

Around 258 mtpa of steel capacity is in various stages of development in India, with BOF constituting 69% and EAF only 13%. This means that India’s operating steel capacity, which is already dominated by coal-based BF-BOF, will become further entrenched in this higher-emissions technology if action is not taken. With the current emissions intensity, the additional BF-BOF capacity could add another 680 million tonnes of CO2e to India’s steel sector emissions. India’s commitment to reach a net-zero emissions target by 2070 makes investments in new BF-BOF infrastructure increasingly riskier. Steel companies and financiers would benefit from caution while investing in BF-BOF, as these are expensive technologies with long operational lifetimes of fifteen to 25 years and limited options for mitigating emissions.

Younger fleet of blast furnaces poses a bigger challenge in decarbonization

Over 75 mtpa (72%) of operating blast furnace (BF) capacity was developed in the last two decades and over 43 mtpa is estimated to be due for relining before 2030. This relatively young fleet of BFs increases the risk of fossil lock-ins and poses a challenge to transitioning India’s BF fleet, as many of these units may still be recovering initial investment costs. This hinders the decarbonization of the steel sector and threatens the fulfillment of climate targets.

Figure 4

On the other hand, around 11% of the operating BF capacity in India is over 40 years old. Older BFs are characterized by operational inefficiency, reliance on outdated energy-intensive technologies, and limited capacity to integrate low-carbon strategies, leading to higher emissions intensities. Older units also face increased maintenance costs and safety risks for workers. Thus, the oldest BFs should be prioritized for replacement with green technologies, as those will offer the greatest cost savings in transitioning.

Figure 5

India's direct reduced iron production is dominated by coal-based technologies

India is the world's largest DRI producer, accounting for over 22% of operating capacity and nearly 20% of developing capacity globally. DRI constitutes 24% of India’s installed iron capacity and 22% of that in development.3 The widespread adoption of coal as the reducing agent in the DRI production process is especially unique to India, with around 80% of India’s DRI using coal-based rotary kilns. Of the DRI capacity tracked by GSPT, over 54% uses coal as the reducing agent, while 35% and 11% of the capacity uses fossil gas and waste recovery gas, respectively. Furthermore, around half of DRI production in India uses domestic high-ash coal, which results in higher emissions, but lower costs than imported coal.

India needs to focus on transitioning coal-based rotary kilns to cleaner DRI production methods, which will also require accelerating hydrogen development. While gas-based DRI production is more efficient than coal-based production, gas is unlikely to serve as a mitigation strategy for DRIs due to its limited availability and price volatility in India, in addition to the stranded asset risk associated with fossil-based production. Gas-based DRI operators in India are increasingly seeking to substitute fossil gas partially or fully with alternate gasses like coke oven gas, Corex gas or biogas, owing to the inconsistent availability of fossil gas. On the other hand, a company in Namibia is building the first industrial-scale hydrogen-based rotary kiln DRI steel plant, which could provide promising options for decarbonizing India’s rotary kiln fleet. India should be exploring these and other proven hydrogen-capable DRI technologies to prepare for its green steel transition.

While India develops hydrogen-capable DRI capacity, it should also focus on scaling up hydrogen production. The National Green Hydrogen Mission, launched by the Ministry of New and Renewable Energy to promote the production and use of green hydrogen, aims to have 5 million tonnes of green hydrogen capacity by 2030. The mission has allotted 30% of its pilot project budget to the steel sector, an outlay of ₹455 crore up to 2029–30. About 58 kg of hydrogen is required to produce one tonne of DRI, which brings the hydrogen demand to 885 thousand tonnes per annum (ttpa) for the operating shaft furnaces and 844 ttpa for the shaft furnaces in development. Switching rotary kilns from coal to hydrogen would further increase this demand.

Over recent years, several pilot projects for green hydrogen-based steel production have been announced in India, including initiatives by Matrix Gas and Renewables in Raipur, JSW Steel at its Vijayanagar plant, and Jindal Steel & Power Limited at its Angul facility. Despite these efforts, green hydrogen is unlikely to become the primary fuel for steelmaking in India before 2050 due to the current high cost of production and lack of expertise and ecosystem for production. In the meantime, India will need to rely on the use of imported hydrogen or alternate gasses, improved material and energy efficiencies, and renewable energy integration for decarbonizing its DRI production.

India should direct stimulus toward its secondary production sector

Scrap

GSPT tracks an operating EAF capacity of 37 mtpa and an IF capacity of 11 mtpa, the latter constituting nearly 61% of the global IF capacity.4 EAFs and IFs utilize scrap in addition to pig iron and DRI. Scrap-based production remains low in India, constituting only 21% of total steel production. Scrap input ranges between 40–80% in EAFs and 10–20% in IFs. The overall supply of steel scrap in India is around 31–37 million tonnes, about one-fifth of which is imported. Rising global restrictions on steel scrap exports are expected to decrease scrap supply to India further, challenging the scrap availability for the development of additional secondary production capacity.

Strategic investments and aggressive implementation of the 2019 Steel Scrap Policy, among other initiatives, such as the 2021 Motor Vehicles (Registration and Functions of Vehicles Scrapping Facility) Rules are crucial to meeting the 2030 scrap demand projected at 70–80 million tonnes and to advancing India’s steel decarbonization efforts. While strengthening domestic infrastructure to increase scrap supply is inevitable, India’s scrap availability is unlikely to reach levels comparable to those of further developed countries anytime soon. India will need to continue looking outside for stable sources of scrap.

Renewable Energy

India’s steel sector accounts for around 20% of the country’s industrial energy use. The steel sector's total electricity demand is projected to grow at an average annual rate of 8.7%, from 94.3 terawatt hour (TWh) in 2021–22 to 183.8 TWh by 2030–31. Though EAF and IF production routes rely on electricity, much of it is generated in thermal power plants, contributing to India’s high grid CO2 emissions factors. Currently, 85% of the energy input into the steel sector comes from coal.

For deep decarbonization of the steel sector, switching energy dependence from thermal power plants to renewable sources of energy is crucial. India has already made decent progress on renewable energy installations and has an aspiring goal of 50 GW per year of new installations over the next five years. The Ministry of Steel has an ambitious renewable energy penetration target of 43% by 2030 from the current level of 7.2%, which is expected to reduce the average emissions intensity of crude steel production in India by 8%.

India will see significant energy demand to switch from coal-based production to green steelmaking technologies. A commercial-scale hydrogen DRI-based steel plant capable of producing 1 mtpa would require a 350 MW electrolyzer facility to supply the necessary hydrogen. Switching to renewable electricity for hydrogen generation and EAF-based crude steel production has the potential to reduce emissions by up to 88% compared to using conventional grid electricity. India has 45 GW of planned renewables-based hydrogen projects, but over 80% are still in the concept stage. It remains to be seen how much of this planned capacity will ultimately be realized and available to meet the needs of the steel sector.

Energy Efficiency

India has also been paying attention to increasing the overall energy efficiency of the sector. With energy constituting 20–40% of steel manufacturing cost, the implementation of effective energy efficiency measures is vital for the steel sector. A Perform, Achieve and Trade (PAT) scheme introduced in 2012 to incentivize steel producers to reduce their energy consumption has been instrumental in driving energy efficiency in the industry and achieved a total energy savings of 6.137 million tonnes of oil equivalent (Mtoe) by 2022. The average CO2 emissions intensity of the Indian steel industry has decreased from 3.1 tCO2/tcs in 2005 to approximately 2.55 tCO2/tcs by 2022, primarily driven by the implementation of energy efficiency measures. While further emissions reductions may be possible from energy efficiency measures, these will be marginal. Ultimately, decarbonizing India’s iron and steel sector will require a full transition to green steelmaking technologies.

1Average capacity utilization values were calculated using reported production in 2022 from fifteen BOF, 19 BF, fifteen EAF, and thirteen DRI plants.

2This includes scope 1 (direct, process emissions), scope 2 (indirect, power-related emissions), and upstream emissions.

3GEM’s Global Steel Plant Tracker provides details on 33 mtpa of operating DRI capacity in India. However, the installed capacity is much higher at 60.5 mtpa in FY24. Much of this capacity is small and medium rotary kilns with individual capacities less than 0.15 mtpa, which get excluded from the tracker, as GSPT has a capacity threshold of 0.5 mtpa and above. Given the small and dispersed nature of these units, most decarbonization initiatives do not address them.

4The actual operating IF capacity is much higher, at around 68.8 mtpa spread across micro, small and medium enterprises, with little control over the quality of steel produced and lower capacity utilization rates.