Key points

- High-quality iron ore reserves, abundant renewable electricity, and a skilled workforce make Brazil a prime candidate to lead Latin America’s green steel transition.

- Brazil’s well-developed and rapidly growing renewable energy sector will be instrumental in the large-scale green hydrogen production required to ramp up steelmaking via the low-emissions hydrogen-direct reduced iron (DRI) route. Brazil ranks among the world’s top ten nations in operating hydropower, bioenergy, and utility-scale wind and solar capacity, as well as within the top three for prospective utility-scale solar and wind capacity.

- Despite efforts to partially decarbonize the Brazilian steel industry through the use of biochar in blast furnaces (BFs) and scrap in electric arc furnaces (EAFs), two-thirds of Brazil’s operating steel capacity continues to rely on emissions-intensive, coal-based blast furnace-basic oxygen furnace (BF-BOF) technology.

- Lower-emissions EAF and DRI technology are less prevalent in Brazil than in most other large steelmaking countries. EAFs account for less than one-quarter of Brazil’s steelmaking capacity, and DRI capacity is limited to a single plant not currently operating.

- More than half of the coal-based BFs at Brazil’s largest steel plants are relatively new or recently relined and are thus capable of operating well into the 2030s without significant interventions to switch technologies. Advance company planning, government policy, financial incentives, and international cooperation will be crucial in supporting green alternatives.

Brazil is well-positioned to become a global green iron and steel leader, thanks to its established industrial infrastructure, high quality iron ore reserves, a skilled workforce with steelmaking expertise, and unparalleled renewable energy resources. Moreover, a July 2024 report from Global Efficiency Intelligence estimates that Brazil has the capacity to produce green steel at a lower price than other leading steelmaking nations. The key to seeing this possibility become a reality is strategic policy setting and sectoral alignment with the country’s net zero targets. Hosting COP30 in 2025 could be the tipping point that propels Brazil into a future as the leader on green steel.

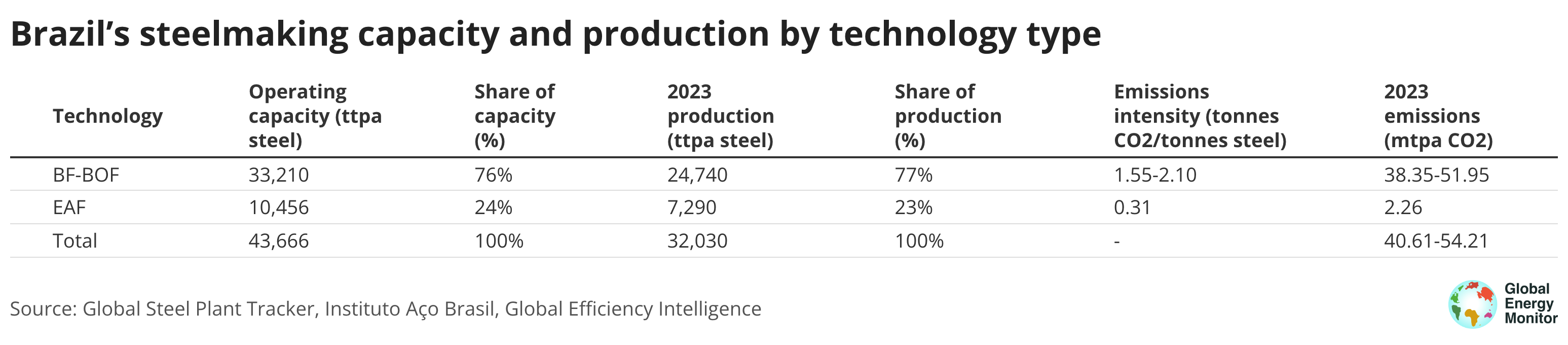

Brazil’s steel industry currently relies heavily on emissions-intensive blast-furnace-basic oxygen furnace technology, with 76% of operating steel capacity using BF-BOF and just 24% using the lower-emissions electric arc furnace alternative. The World Economic Forum estimates that emissions from Brazil’s steel industry could rise nearly a third by 2050 without proactive moves to boost demand and supply of green iron and steel. However, the country could take advantage of its many strengths to embark on a low-emissions overhaul.

To bring Brazil in line with global efforts to limit global warming to 1.5°C will require a concerted effort from both government and industry. Brazil’s president, Luiz Inácio Lula da Silva, has articulated the importance of including domestically produced green steel in national energy transition plans, and Brazil’s New Industry Plan, launched in 2024, sets a goal of reducing industrial CO2 emissions by 30% per unit of value added by 2033. With the right combination of private initiatives and government incentives, Brazil could transform its heavy industry sector into a model for Latin America and the world.

Overview of Brazil’s iron and steel industry

With 44 million tonnes of operating steel capacity across 21 steel plants, Brazil ranks as the ninth largest producer globally and first in Latin America.

Roughly three-quarters of Brazil’s current iron and steelmaking capacity relies on older, more emissions-intensive BF-BOF technology, which also tends to be operated at higher rates than the lower-emissions EAF technologies, leading to an even higher share of annual production using BF-BOF (Table 1).

Brazil is also a top producer and exporter of iron ore, surpassed only by Australia. Iron ore is an important component in iron and steelmaking, and Brazil boasts some of the highest quality iron ore anywhere on earth, with iron content ranging from 60% to 67%. High-quality ore is especially critical for the lower-emissions green hydrogen-based DRI production method.

Another distinctive feature of Brazil’s steel industry is its significant use of biochar, which has been adopted by several companies as a replacement for coal in blast furnaces, potentially resulting in reduced greenhouse gas emissions.

Technologies for decarbonizing Brazil’s iron and steel industry

The most common and widely-proven path to decarbonizing the steel industry is the replacement of emissions-intensive, coal-based BF-BOF technology with lower-emissions EAF technology, including both scrap- and direct reduced iron-fed EAFs. Emerging low-emissions technologies that may be even more effective in the Brazilian context include molten oxide hydrolysis and DRI production using green hydrogen, both of which require large amounts of electricity and could take full advantage of Brazil’s exceptional renewable energy potential.

BF-BOF retirements and conversions

Currently, Brazil’s seven largest steel plants (Table 2) use the BF-BOF steelmaking route, employing coal rather than biochar as their primary reducing agent.

Collectively, the plants on this list account for 87% of Brazil’s operating blast furnace capacity, and 72% of Brazil’s total steelmaking capacity. Prospects for imminent conversion or retirement at most of these plants do not look promising, given that more than half of the blast furnaces at Brazil’s largest steel plants have been relined or started up within the past one to eight years (Table 2). Typically, blast furnaces need to be relined every 17 years, meaning that most of Brazil’s fleet of BFs still have an anticipated remaining lifespan of one to two decades without intervention.

The relining process is expensive, costing approximately 25% to 50% of a new BF. This cost could help drive interventions by creating an economic incentive for steelmakers to switch to less emissions- and electricity-intensive EAF technology. Another incentive for transitioning away from BFs is that the Brazilian steel industry is entirely reliant on coke made from imported coal, with no domestic production of metallurgical coal. The cost of relining or investments in new BF furnaces is dwarfed by their operating costs, so investments in green steel will only take place if companies consider their operation cost competitive in comparison to BFs.

Nonetheless, companies need to begin implementing transition plans now, with an eye to replacing blast furnaces with lower-emissions alternatives at the earliest possible date.

Benefits and pitfalls of biochar in blast furnaces

To date, Brazil’s efforts to decarbonize its national steel industry have focused primarily on the use of biochar as a replacement for coal in blast furnaces. As of 2021, roughly 11% of Brazilian steel production was based on charcoal derived from biomass, making Brazil the largest producer of biochar-based steel globally. Seven Brazilian iron and steel plants in the states of Minas Gerais, Maranhão, and Pará have converted their operations to run at least partially on biochar sourced from company-planted eucalyptus forests (Table 3). Brazilian steelmaker Gerdau, with 250,000 hectares of managed forest, is the world’s largest producer of plant-based charcoal.

Some sources estimate that Brazil’s use of biochar in replacing coal has reduced the sector’s emissions intensity from BF-BOF processes by approximately 0.4 tCO2e per tonne of crude steel. However, estimates of carbon emissions reduction from biochar vary widely, depending on the amount and source of biochar used and at which stage in the process it gets used.

Some of the biochar used in Brazilian plants has been certified by reputable organizations such as SGS-Société Générale de Surveillance, FSC-Forest Stewardship Council, and CDP-Carbon Disclosure Project). SGS has certified three of Brazil’s smaller iron and steel producers — Aço Verde do Brasil, Aperam, and Vetorial — as carbon neutral due to their use of biochar, and emissions intensity measurements at other Brazilian steelmakers using biochar are generally lower than at companies using coal in their blast furnaces.

From an emissions perspective, if charcoal is assumed to be carbon neutral, the overall CO2 intensity of Brazil’s BF-BOF steel production ranks lowest among the major steel-producing countries, at 1.55 tonnes of CO2 per tonne of crude steel, well below the 2.0 tonnes of CO2 per tonne crude steel global average. However, Brazil’s BOF-BF carbon intensity figure rises to 2.10 tonnes CO2 per tonne crude steel if charcoal is not considered to be carbon neutral.

Assessments of biochar’s carbon neutrality are complex and often controversial. While biochar may reduce direct emissions from iron and steel production, some biochar sources may create significant upstream emissions impacts from deforestation and processing, negating or even exceeding the amount of emissions saved in the steelmaking process.

Despite serious efforts within Brazil to assess and certify the sustainability of forest farming for biochar production, there is also a risk that Brazil's trade partners may not accept charcoal as carbon-neutral in the future — for example, as the EU increases scrutiny of biomass sustainability and imposes more stringent supply chain reporting and/or disclosure obligations.

Ultimately, the amount of coking coal that can be substituted with biochar in a blast furnace is limited — partial coal replacement still equals coal dependence.

Transitioning to EAFs

To fully transition away from coal-based steelmaking and decarbonize the steel industry, Brazil will need to replace BF-BOF technology with lower-emissions EAF technology. Steel produced through recycling in EAF units will achieve the lowest emissions-intensity of all EAF production methods, but direct reduced iron-fed EAFs will also play an important role in filling the gap left by limited scrap supplies.

Scrap-based EAF expansion

EAFs currently account for only about 24% of Brazilian steelmaking capacity, and the number of Brazilian companies planning to add new EAFs in the foreseeable future is limited. Gerdau, Brazil’s leading scrap-based steelmaker and Latin America’s largest scrap recycler, owns several operating EAF plants around the country, accounting for 32% of the country’s EAF capacity and 8% of its total operating steel capacity. In early 2024, Gerdau reported an emissions intensity of 0.86 tonnes CO₂e per tonne of steel produced, reflecting heavy use of scrap (approximately 73%) in its EAF operations, along with biochar as a reducing agent in its BF-BOF facilities. Gerdau has signaled its intention to expand operations at its Maracanaú plant in Brazil’s Northeast region, but details on technology and capacity remain unclear. Two other companies (ArcelorMittal and Simec) have EAF units in development with a total capacity of 1,700 ttpa.

Limited and volatile scrap supply will likely constrain Brazil’s expansion of scrap-based EAF steel production. Global scrap supply in general is forecast to lag behind demand, although Brazil in 2023 became a net scrap exporter due to a variety of factors, including a slump in domestic steel sales prompted by competition from China.

Domestic green iron production

Given the limitations of scrap-based EAF production, hydrogen-based direct reduced iron production (H2-DRI) will play an important role in decarbonizing the steel industry. Hydrogen-based DRI fed to an EAF can fully replace BF-BOF steelmaking as a lower-emissions production process, but Brazil currently has no operating DRI plants. Obstacles to developing a Brazilian DRI industry have included the significant capital expense of developing these projects and the challenge of competing with low-cost Chinese steel imports.

Affordable financing instruments and international development support could bridge this gap, and given Brazil’s access to top quality iron ore and renewable energy for green hydrogen production, the country has strong potential to operate H2-DRI units locally and export DRI in its cooled form called hot-briquetted iron (HBI) as value-added products, rather than exporting iron ore pellets. This approach would be beneficial to Brazil’s economy and strategically advantageous for global industrial decarbonization, allowing regions like Europe that have more existing EAFs and steelmaking capacity to manufacture steel from Brazilian green iron rather than building out their own DRI and importing the ore.

In September 2023, Brazilian iron giant Vale announced plans to create an HBI production hub at the Port of Açu, initially using Brazilian fossil gas rather than hydrogen in the DRI production process. Iron production using fossil-based DRI has a lower emissions intensity than that of blast furnace technology, but the emissions do not reach the decarbonization potential of hydrogen-based DRI. Thus, Brazil’s green steel transition should aim for green hydrogen-based DRI, but plants like the Vale project that begin with fossil gas-based DRI and commit to converting to green hydrogen in the future could function as a stepping stone towards green steel. Vale has also announced an initiative in conjunction with H2 Green Steel to study the potential development of low-carbon industrial steel hubs in Brazil revolving around green hydrogen and HBI production.

Green hydrogen

To support lower-emissions DRI production, Brazil will need to build out its green hydrogen capacity. Production of green hydrogen demands huge amounts of renewable energy, a sector where Brazil has already established global leadership. Brazil generated 93% of its electricity from renewables in 2023, and has the cleanest energy mix among the G20 countries. In 2022, Brazil also attracted more new investment in renewables (US$25 billion) than any country except the U.S. and China.

According to data from GEM’s Global Integrated Power Tracker, Brazil ranks second globally in operating hydropower and bioenergy capacity, seventh globally in operating utility-scale wind capacity, and ninth in operating utility-scale solar capacity. Future prospects for wind and solar are even more impressive. GEM data show that Brazil has 180 GW of utility-scale wind farms in announced, pre-construction, or construction status, placing the country third globally behind China and Australia. Brazil’s 139 GW of prospective utility-scale solar farms ranks second globally, trailing only China.

Brazil’s Ministry of Mines and Energy estimates that the country has the potential to become a green hydrogen powerhouse, generating an estimated 1.8 gigatonnes of low-carbon hydrogen annually at a lower cost than any other nation. The development of a robust Brazilian green hydrogen industry could in turn lure companies to build new iron and steel mills in Brazil to take advantage of the country’s unique combination of green hydrogen, high-quality iron ore, and 24/7 clean power.

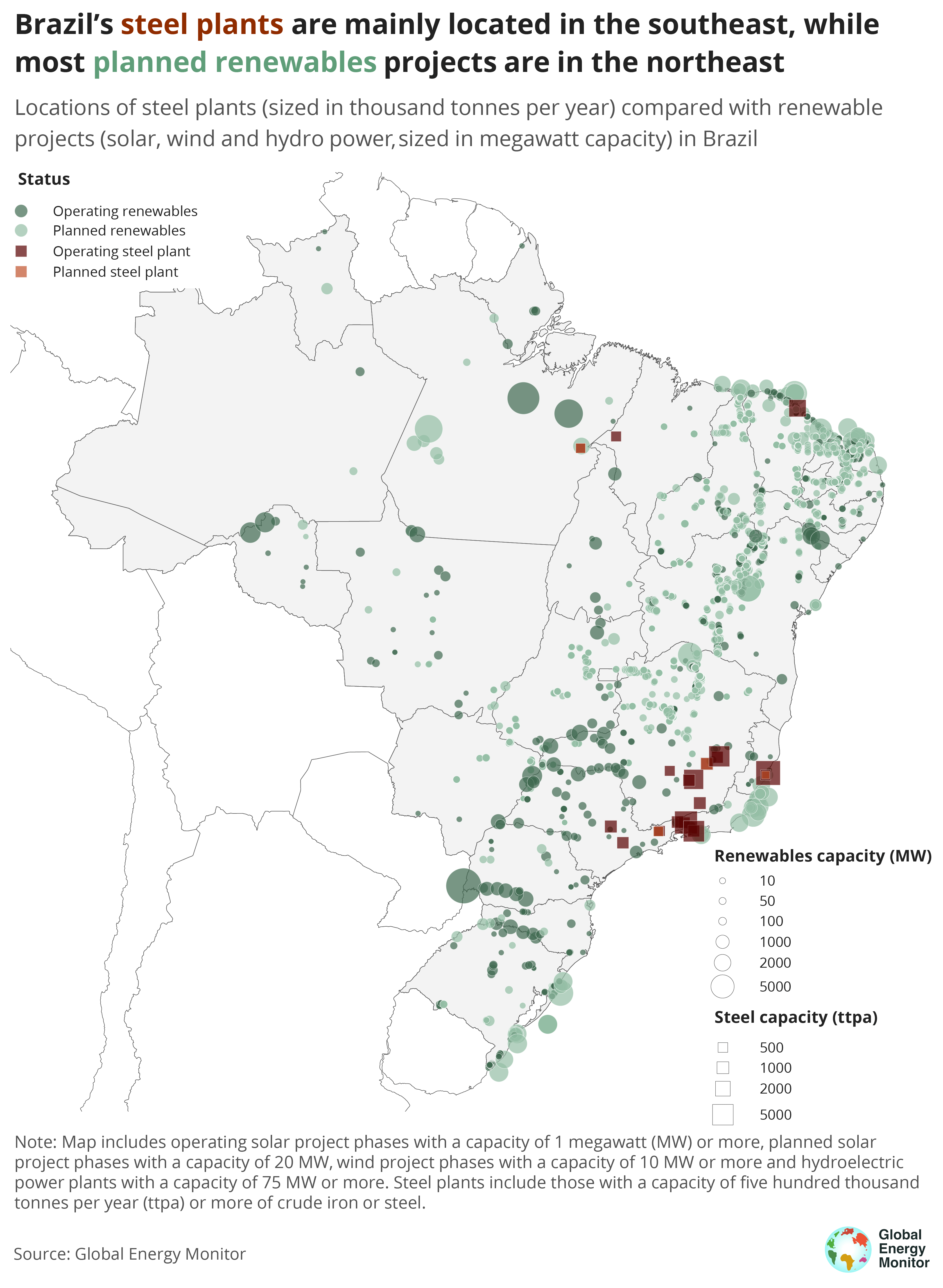

Brazil launched a national hydrogen program in 2021, and in August 2024 President Lula signed into law a legal framework for low-carbon hydrogen production. Brazil’s Northeast is especially fertile ground for green hydrogen, given the region’s exceptional wind and solar potential. Multiple projects are already under development in Northeastern states such as Piauí and Rio Grande do Norte, and in Ceará, where private enterprises have signed dozens of MOUs with the state government. Companies have also launched pilot green hydrogen projects in the steel-producing states of Brazil’s Southeast, including Minas Gerais, Espírito Santo, and Rio de Janeiro. Some developers plan to obtain electricity for their green hydrogen initiatives via purpose-built, captive wind and solar projects or direct partnerships with local energy producers, while others will take advantage of the national grid, which can deliver renewable electricity from states with greater wind and solar capacity to support hydrogen production at industrial facilities elsewhere in Brazil. In April 2024, the Brazilian government awarded contracts for nearly 4500 km of new transmission lines and substations to bolster nationwide renewable electricity distribution.

Molten oxide electrolysis

Developed by the American company Boston Metal, molten oxide electrolysis (MOE) is a novel technology that uses electric current to directly separate oxygen from iron ore. If it can be developed on an industrial scale, MOE could lead to decarbonized steel production that eliminates the need for hydrogen. Boston Metal expects to achieve the first commercial production of MOE-based green iron in the next couple of years, and the company inaugurated a plant in Minas Gerais state in March 2024, with the goal of starting MOE production in Brazil in coming years. While MOE production eliminates the need for hydrogen, one of the challenges of the process is the need for a constant, reliable source of electricity. However, Brazil is well-positioned to produce green steel using MOE, thanks to its versatile mix of renewable electricity resources.

COP30 and Brazil’s green steel transition

Brazil has a golden opportunity to define itself as a green steel champion on the global stage when it hosts COP30 in November 2025. Government and industry should act now to define ambitious industrial decarbonization policies that take advantage of Brazil’s tremendous potential.

Brazil’s two largest steelmakers, Gerdau and ArcelorMittal, have stated their intentions to become carbon neutral by 2050. However, the Brazilian government needs to provide more guidance and support to advance the green steel transition across the entire sector. Brazil’s October 2023 NDC update failed to establish specific mitigation measures or net zero emissions targets for the steel industry. Moreover, despite President Lula’s occasional favorable mentions of green steel, the industrialization action plan unveiled in January 2024 did not directly address the steel sector.

Global pressure from hosting COP30 may finally drive this change. In May and June 2024, the Brazilian government convened a series of workshops aimed at defining industry-specific decarbonization targets, including for the steel sector. The government aims to unveil a National Industrial Decarbonization Strategy by November 2024, to be integrated with the National Climate Change Plan and the Nova Indústria Brasil program.

The United Nations Industrial Development Organization (UNIDO) also recently announced a partnership with Brazil to help the country develop “Industry, Cement and Steel Sectoral Mitigation Plans,” while the UK and Brazilian governments joined forces to launch Brazil’s “Industrial Decarbonization Hub.” Both initiatives aim to develop an industrial decarbonization policy in Brazil by COP30. However, details of the policy goals remain vague, and the success of these initiatives requires follow-through from the Brazilian government.